Good Morning!

Markets threw another tantrum this week, but hey, that’s why you’ve got us. While everyone else is doomscrolling tech stocks and panicking over the Fed’s coin-flip rate decision, we’re over here doing what we do best: cutting through the noise and trading what actually matters.

AI darlings are slipping, Bitcoin lost its grip on $100K, and macro data is still stuck in government-shutdown purgatory. Translation? The tourists are nervous. The pros are positioning. And as usual, we’re early.

This issue breaks down what’s really driving the volatility, what Sherlock’s seeing on BTC, and where the next clean setups are hiding.

If you want to stay ahead of the herd, keep reading.

👉 Read on, because the next setup’s already loading.

Market Rundown

Futures are slipping again after Thursday’s sharp selloff - the worst day for stocks in over a month. Tech took the brunt of it, with Nvidia, Broadcom, and Oracle dragging the Nasdaq lower as investors rethink stretched AI valuations.

Uncertainty around the Fed isn’t helping. With the shutdown freezing key economic data, traders are flying half-blind heading into December’s meeting, and rate-cut odds have dropped to a coin flip.

Applied Materials added pressure after warning that China’s spending on chip equipment will fall next year due to U.S. export rules. Meanwhile, early state-level data shows jobless claims edged down, but not enough to shift the Fed’s stance.

Bitcoin joined the risk-off move, breaking below $100K as flows from big institutions and ETFs slowed.

Bottom line: tech fragility + rate uncertainty + missing data = choppy markets ahead.

🌡 TradingLab’s Headline Roundup

📈 Investing & Strategies

Is MP Materials Stock the Next Nvidia?

Is Netflix a Buy After the 10-for-1 Stock Split?

🏛 Stock Markets

Disney Stock Falls Nearly 8% as Revenue Misses Estimate. Blame Good Ol’ TV

S&P 500 Sheds 1.7% as Traders Get Anxious Over Pent-Up Economic Data

Gold Soars Above $4,200 After Trump Ends Longest Shutdown in US History

SoftBank Stock Tanks 10% on News Tech Investor Dumped Entire $5.8B Nvidia Stake

₿ Crypto

Bitcoin Spot ETFs See $869M Outflow, Second-Largest on Record

Nearly 25% of Adults With Internet Access in Asia Might Own Crypto, Report Says

Chrome Web Store’s No. 4 crypto wallet can steal user seed phrases

What’s Driving Bitcoin’s Dip Below $100,000?

💥⚡ Sherlock’s BTC Re-Long Plan (And Why This Pullback Isn’t What You Think)The Play

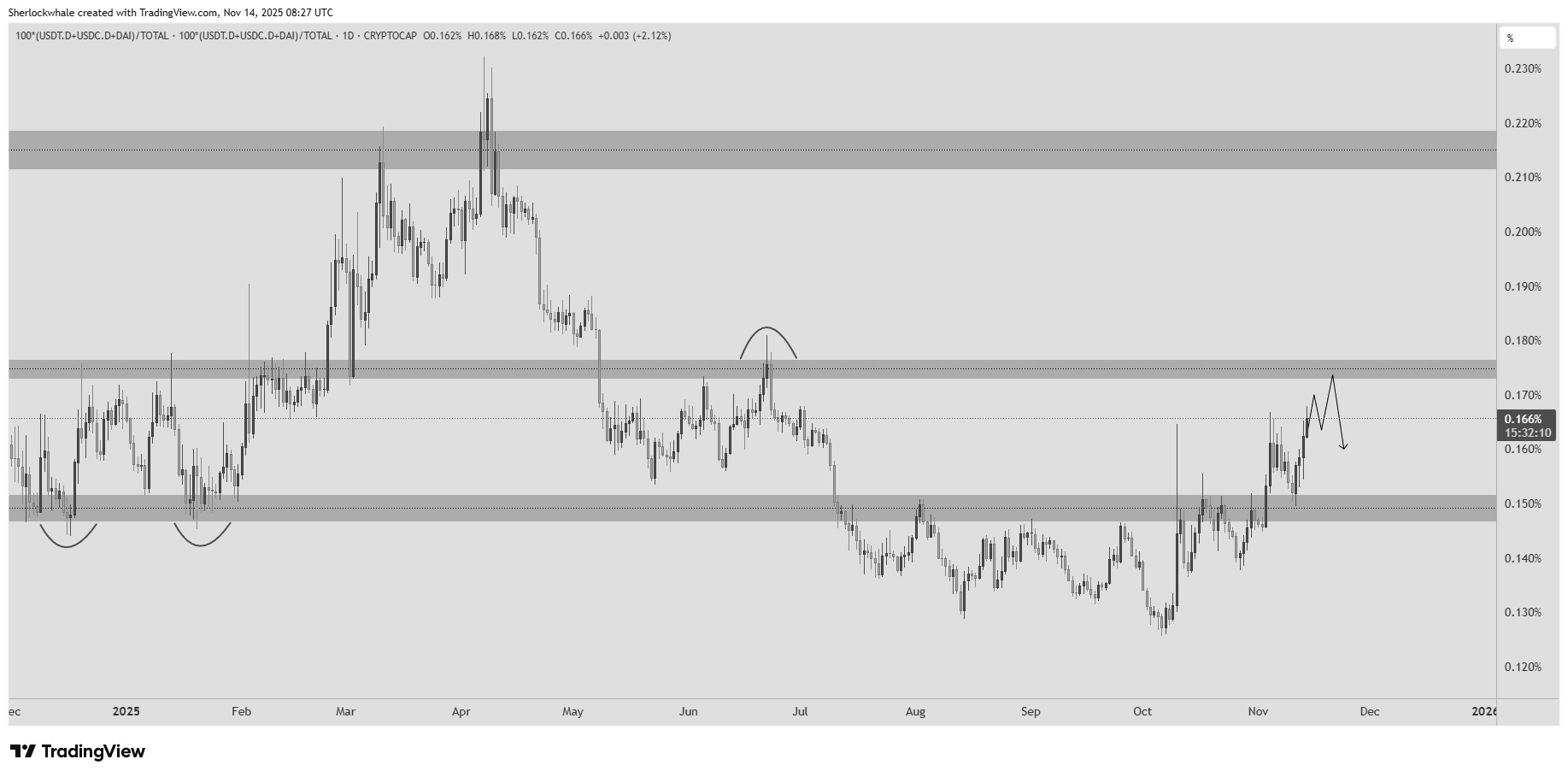

Sherlock didn’t flinch. He got stopped out at $96K, shrugged, and immediately went back to reading the real signal: stablecoin dominance.

Here’s the setup he’s stalking next:

Previous Long: Stopped at $96K

New Entry Zone: BTC around $92K

Trigger: Stablecoin-dominance index climbing into 3.7%–4% resistance

Invalidation: Daily close below yesterday’s low

No revenge trades. No panic flips. Just precision.

The Catalyst

Everyone wants to blame “market sentiment” when price drops, but the truth is far less mystical:

Rate-cut odds for December collapsed.

94% → 62% → now under 50%

Tech stocks bled.

BTC, which behaves like a tech stock with an identity crisis, followed.

That’s it. No conspiracy.

Layer in delayed economic data and radio silence from Fed officials, and you get a market that’s jumpy, confused, and selling first / thinking later.

Sherlock’s stablecoin-dominance read cuts through the noise: liquidity is defensive, but still respecting structure. Which means opportunity, not doom.

Our Take

This move isn’t bearish.

It’s a setup wearing a dip’s clothing.

The SFP thesis is still alive, stablecoin dominance is mapping out the next inflection point, and BTC’s next high-probability long is lining up exactly where Sherlock wants it: around $92K.

We wait. We strike. We don’t chase.

But here’s the part you need to hear…

You’re reading this after the community already got the breakdown.

They saw Sherlock’s chart, the levels, the thesis, hours before this hit your inbox.

If you’re tired of reacting late, tired of trading yesterday's setups, and tired of watching our members catch moves while you catch up…

Stay ahead, stay informed, and most importantly, stay profitable.

‘til next time,

TradingLab