Good Morning!

This week, the Dow Jones soared past 40,000, fueled by cooling inflation. Bitcoin also broke out of its slump, rallying on positive inflation data. Curious what that means for our Bitcoin short? Keep reading.

Besides Reynard’s short update, we have a breakdown of Czar’s AUDJPY trade.

Let’s get into it 👇

🌡 Market Temperature Check

Stock markets are in record territory, with the DJI breaking above 40,000 for the first time. The S&P and Dow also soared as markets celebrated cooling inflation, as displayed in Wednesday’s CPI report.

Bitcoin also had a huge rally, breaking out of its local downtrend based on the inflation data, giving investors more confidence in the medium term. We’ll share what that means for the Bitcoin short we mentioned in the last edition below. 👇️

Here are the latest headlines.

👾 Bitcoin Short Update

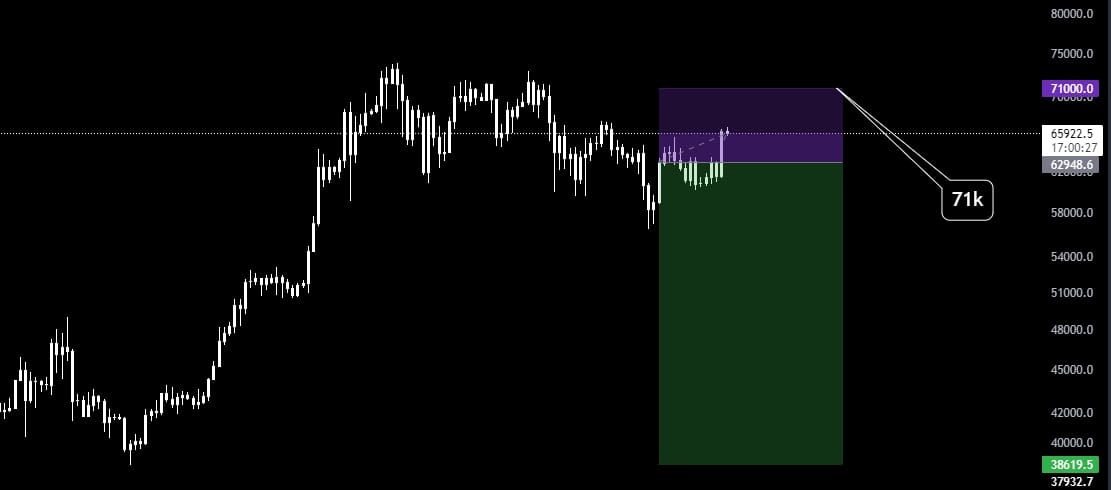

Last edition, we shared a setup from our very own Reynard and his swing short. The intraday short got stopped out, but Reynard isn't backing down. He's still holding strong on his longer-term short position. Let’s break it down.

Swing Short Update

So, the intraday short didn’t quite pan out as planned. It got stopped out, but no sweat – that's part of the game. Reynard had a hunch there'd be a jump to around $64k on Wednesday, but he didn’t anticipate the massive rally. Why the surge? The latest data showed US inflation dropping to 3.4%, sparking a BTC pump that hit higher than expected.

Adjusting the Strategy

Reynard’s moving the stop loss up to $71k. Despite this adjustment, the risk-reward (RR) on his trade remains solid. If you're one of those high-risk traders (and we know many of you love going all in), consider trimming your position by 50-75% to keep liquidation at bay while maintaining the stop loss as advised. His target? $38k!

Join Our Trading Community:

Feeling the market pulse is crucial, but doing it with a network of keen-eyed traders in TradingLab can turn insights into profits. If Reynard’s analysis resonates with you, imagine getting real-time updates like these firsthand.

Join our community where the action is fresh, the strategies are sharp, and the returns are significant.

💴 Forex Catalyst

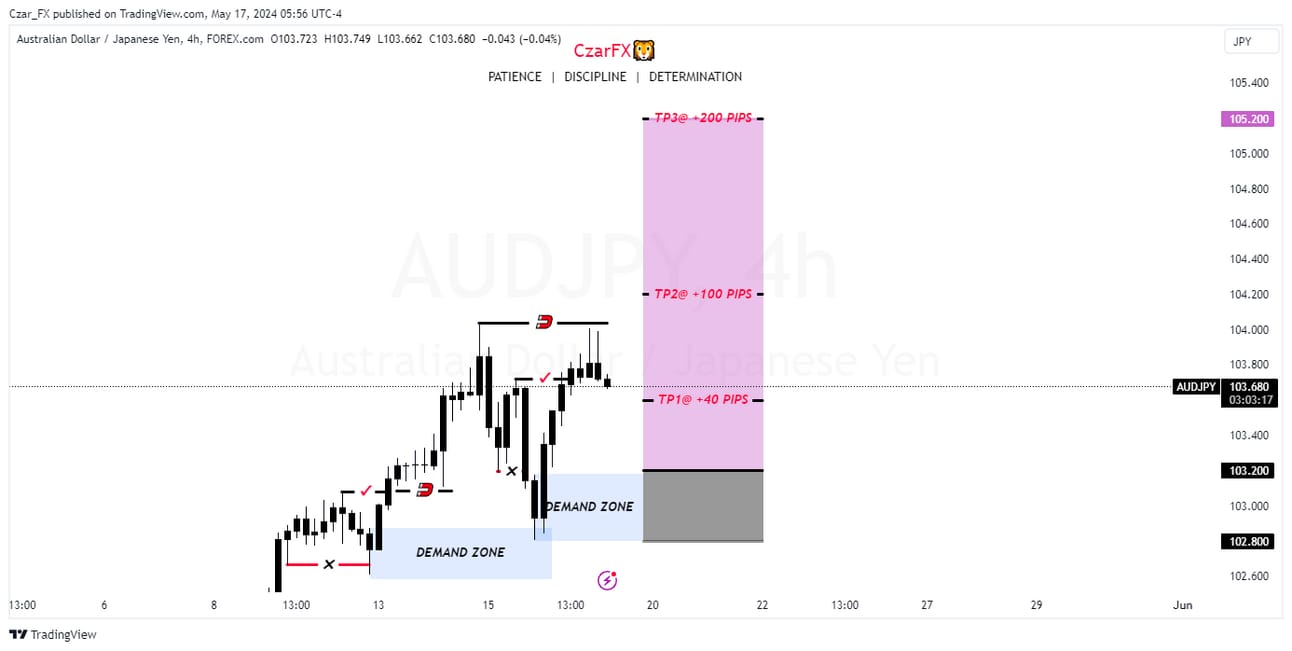

The Play

AUDJPY Trade Breakdown

Entry: 103.200

Stop Loss: 102.800

Take Profit 1: 103.600

Take Profit 2: 104.200

Take Profit 3: 105.200

Risk: 0.30%

The Catalyst

The Australian dollar has recently surged to a four-month high, with the New Zealand dollar also seeing significant gains. This boost is largely attributed to slowing US inflation and changing expectations around local interest rates.

On the other hand, the Japanese yen has weakened following a 0.5% contraction in Q1 growth. The drop in economic growth, coupled with falling real wages and cooling inflation in Tokyo, has dampened the likelihood of the Bank of Japan (BoJ) raising its relatively low interest rates anytime soon.

This delay is a negative factor for the JPY, making the AUDJPY pair an attractive trade.

Our Take

Why are we bullish on AUDJPY? Simple. The Australian dollar is riding high on positive momentum. Meanwhile, the Japanese yen is suffering from a slew of negative economic indicators that are likely to keep interest rates low for the foreseeable future. This divergence creates a ripe opportunity for profit.

Czar’s strategy here is spot on. By entering at 103.200, we position ourselves to benefit from the continuing strength of the AUD against the JPY, with a controlled risk of just 0.30%. The multiple take profit levels (103.600, 104.200, 105.200) allow for flexibility and incremental gains as the trade progresses.

✍ TL;DR

Stock Market at Record Highs: The Dow Jones Industrial Average surpassed 40,000, with the S&P and Dow also hitting new peaks, driven by cooling inflation.

Bitcoin Rally: Bitcoin broke out of its local downtrend on positive inflation data, impacting our Bitcoin short strategy.

Reynard’s Swing Short Update:

Intraday short got stopped out due to an unexpected BTC rally.

Reynard’s new stop loss is set at $71k, with a target of $38k.

Advice to high-risk traders: Trim positions by 50-75% to manage risk.

AUDJPY Trade Breakdown:

Entry: 103.200

Stop Loss: 102.800

Take Profit Levels: 103.600, 104.200, 105.200

Risk: 0.30%

Rationale: Bullish on AUD due to strong momentum and bearish on JPY due to weak economic indicators and low interest rates.

Stay ahead, stay informed, and most importantly, stay profitable.

‘til next time,

TradingLab