Good Morning!

Later today, Jerome Powell takes the stage at Jackson Hole for his highly anticipated speech—the one the markets have been buzzing about all week.

Yesterday saw some big stock moves: tech stocks took a hit, while names like Peloton and Zoom enjoyed solid gains.

Let’s get into it 👇

More than 300 million people use AI, but less than 0.03% use it to build investing strategies. And you are probably one of them.

It’s high time we change that. And you have nothing to lose – not even a single $$

Rated at 9.8/10, this masterclass will teach how you to:

Do market trend analysis & projections with AI in seconds

Solve complex problems, research 10x faster & make your simpler & easier

Generate intensive financial reports with AI in less than 5 minutes

Build AI assistants & custom bots in minutes

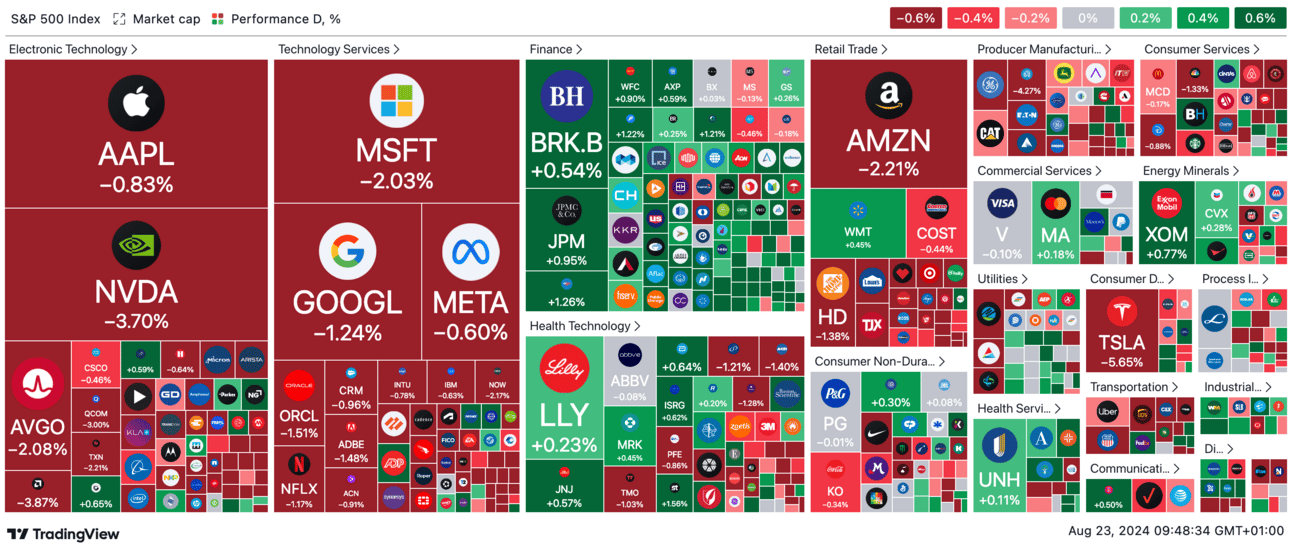

🌡 Market Temperature Check

Quick Links

📰 What’s Moving Markets?

Tech Takes a Hit: Markets Get Jittery Ahead of Powell’s Speech

Thursday wasn’t a good day for tech stocks, with the Nasdaq dropping nearly 1.7% and dragging the broader market down with it. The S&P 500 slipped by 0.9% while the Dow dipped 0.5%. The tech sector, which had been riding high since early August, led the slide, with Nvidia taking a particularly hard hit.

What’s Going On? Investors are getting a bit twitchy ahead of Fed Chair Jerome Powell’s speech on Friday. Tech stocks, which have been the market’s MVPs lately, are especially vulnerable to any whiff of bad news on the interest rate front.

Every year, Jackson Hole hosts a gathering of central bankers from around the world.

What’s Powell Going to Say?

All eyes are on Powell’s speech at Jackson Hole this Friday, and everyone’s got their predictions. The market seems convinced that the Fed will start cutting rates in September and keep going through 2025. But there’s always a chance that Powell could surprise us.

Here’s the Deal: The Fed’s July meeting minutes showed that most members are leaning toward a rate cut in September. Powell’s speech, scheduled for 10 a.m. ET, is expected to focus more on the Fed’s long-term thinking rather than dropping any bombshells.

Why You Should Care: If Powell strays from the script and hints at a less aggressive rate-cutting plan, it could spook the markets. Tech and other interest rate-sensitive sectors are the most likely to feel the heat if that happens.

Bitcoin Bounces: Crypto Catches a Break

On the crypto front, Bitcoin finally caught a break, rallying over 3% to push past the $61,000 mark. This bounce comes on the heels of the Fed’s July meeting minutes, which hinted at a potential rate cut in September.

Why It Matters: Cryptos like Bitcoin love low interest rates. Cheaper borrowing costs mean more investment in speculative assets. The latest spike in Bitcoin’s price is a direct reaction to the Fed’s dovish signals.

Looking Ahead: If the Fed stays on the path to rate cuts, Bitcoin could keep climbing. But just like with tech stocks, any unexpected news from Powell could quickly turn things around.

In short, while the market is hoping for a Fed-friendly outcome, nothing is set in stone. As Powell steps up to the mic, it’s worth keeping an eye on how things play out.

‘til next time,

TradingLab