Good Morning!

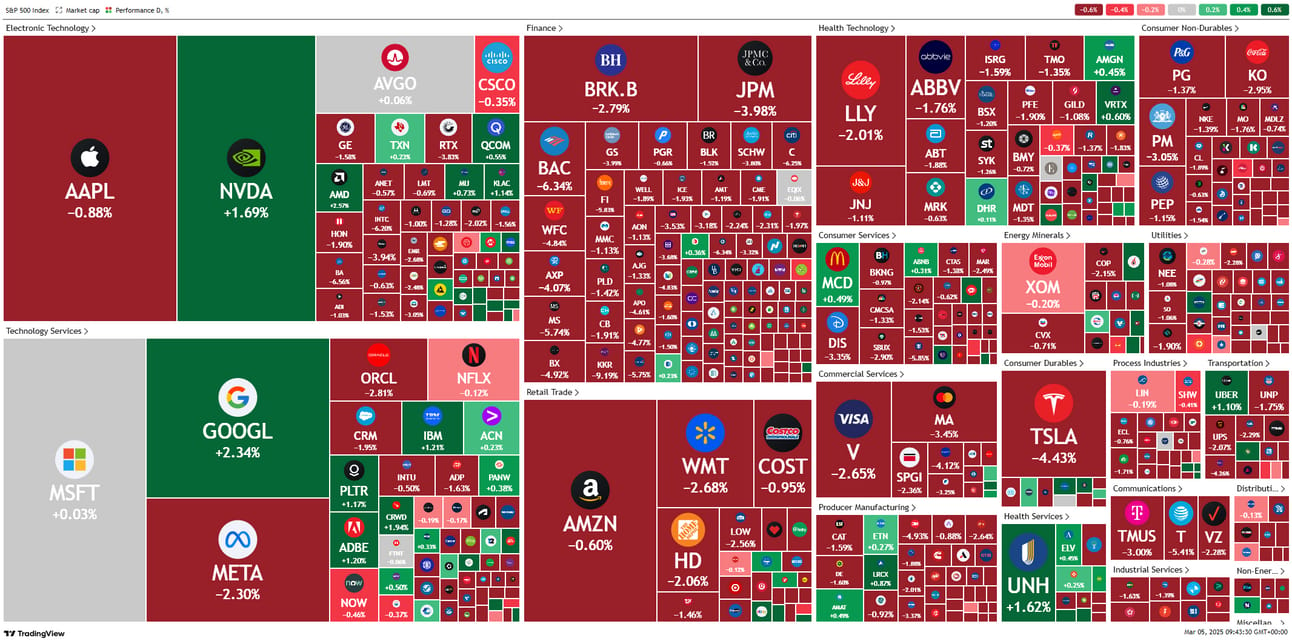

Tesla is tanking, Nvidia’s in the gutter, and Trump’s tariffs are throwing the markets into a frenzy. But while the weak hands panic, the smart money is making moves.

🔥 Tech stocks are on a knife’s edge—buy the dip or run for cover?

🔥 Bitcoin’s whipsawing as traders digest Trump’s crypto strategy.

🔥 The Euro’s surging while the dollar takes a hit—forex traders, pay attention.

Recession-resistant trades? Tariff-proof strategies? We’ve got you covered. Dive in and get ahead of the chaos.

Let’s get into it 👇

🌡 TradingLab’s Headline Roundup

Stock Markets

5th March, 2025

Tesla Stock Drops as China Sales Plummet 50% in February.

Nasdaq Briefly Dives into Correction but Tech Lovers Jump to Buy the Dip

Stoxx Europe 600 Hits All-Time High as US Peer S&P 500 Slides 5% from Record

Nvidia Stock Sheds 9% to Languish Near Six-Month Low. Should You Buy the Dip?

Trump Tariffs Hit Markets: Here's What Smart Traders Should Consider with my Recession-Resistant Trades

Crypto

Bitcoin Wipes Crypto Reserve Gains as Traders React to Looming Tariff Wars

Commodities/Forex

Euro Blasts Off to 4-Month High Above $1.06 as Traders Digest Tariff Hikes

Dollar Index Plummets 1% as Trump’s Duties Send Forex Markets Scrambling

Tariffs Surge — This Tech Disruptor Moves Faster Than Global Shifts

Consumer electronics may have dodged the tariff bullet, but one smart home disruptor isn’t waiting for luck.

They’ve strategically secured production outside China, staying ahead of the global manufacturing shift.

That’s exactly how this company has hit 200% year-over-year growth while expanding into over 120 major retail locations.

Their smart shade technology is reshaping home automation, protected by patents and backed by powerful retail partnerships.

Smart investors spot the pattern: companies that turn global challenges into strategic wins often deliver the biggest returns.

At just $1.90 per share, you’re looking at a company that’s not just prepared for supply chain shifts — it’s already capitalizing on them.

Past performance is not indicative of future results. Email may contain forward-looking statements. See US Offering for details. Informational purposes only.

Upcoming Earnings

📅 Wednesday, 6th March

Abercrombie & Fitch (ANF)

Victoria's Secret (VSCO)

📅 Thursday, 7th March

BJ's Wholesale (BJ)

Macy's (M)

Broadcom (AVGO)

Costco Wholesale (COST)

Gap (GAP)

Smith & Wesson Brands (SWBI)

📅 Friday, 8th March

No Notable Earnings

📈 What’s Moving Markets Today?

🔥 Futures Rebound: Tariff Tantrum Eases

Markets are catching a break this morning after yesterday’s tariff-induced bloodbath. U.S. stock futures are bouncing back as traders digest signals from Commerce Secretary Howard Lutnick that President Trump might be willing to "meet in the middle" on his latest round of tariffs on Canada and Mexico.

📌 Key Moves:

📈 Dow Futures: Up 0.6% (+248 points)

📊 S&P 500 Futures: Up 0.7% (+39 points)

💻 Nasdaq Futures: Up 0.8% (+168 points)

This comes after Tuesday’s brutal session, where:

The S&P 500 sank 1.2%

The Dow tumbled 1.5%

The Nasdaq barely held above correction territory

Trump’s trade war is shaking up everything from automakers (GM down 4.6%, Ford off 2.9%) to inflation expectations. Investors are watching closely to see if a compromise is really coming.

🏛️ Trump’s Power Play: A "Primetime" Flex

Never one to shy away from the spotlight, Trump took the stage for a 100-minute address to Congress last night, boasting about his policy "wins" and brushing off the market turmoil from his aggressive tariff moves.

📌 Takeaways from the Speech:

🇺🇸 "America is back!" Trump is doubling down on his protectionist stance

💰 More tariffs, more pain: 25% levies on Mexican imports and non-energy Canadian goods

🔥 China hit harder: U.S. doubled tariffs on Chinese imports to 20%

🚀 Elon Musk’s new gig?! Trump highlighted the Musk-led "Department of Government Efficiency"—because of course, Musk is now in charge of streamlining D.C.

Trump admits these policies will cause "disturbance" but insists "we’re OK with that." Investors? Not so much.

📉 Tariff Talk Hits the Economy

If you think the tariffs are just market noise, think again. Data is already showing signs that the economy is feeling the heat:

📌 Recent Weak Spots:

📉 U.S. Services PMI: Expected to decline after recent business uncertainty

🏗️ Homebuilding: Data suggests a weak January

🛍️ Consumer Spending: Retail numbers are softer than expected

📦 Trade Deficit: The goods gap widened—not exactly the goal of Trump’s policies

With inflation concerns rising, all eyes are on upcoming ISM data to see if this tariff drama is a temporary blip or a longer-term headache.

🤑 Bitcoin Rallies as Risk Appetite Returns

Guess what’s back? Bitcoin. After a wild week where it briefly dipped below $80,000, the crypto king is on the rise again.

📌 Key Factors Behind the Rebound:

🏦 Trump’s Crypto Reserve: Five cryptos, including Bitcoin, are now part of a planned "strategic reserve"

🔥 Risk Appetite Rebounding: As tariffs cool down, traders are willing to buy risk assets again

📈 Bargain Hunting: Big dips always bring in the dip-buyers

Crypto’s volatility remains off the charts, but for now, Bitcoin is back in business.

🛢️ Oil Slips, But Gold Stays Strong

Oil prices dipped to five-month lows as major producers signaled an output hike in April. Meanwhile, gold is still flirting with record highs as investors hedge against economic uncertainty.

📌 Market Moves:

🛢️ Oil: Prices slipping as supply concerns grow

✨ Gold: Safe-haven demand keeps prices firm

When in doubt, investors always flock to gold—and with tariff uncertainty lingering, that trend isn’t changing anytime soon.

🎢 The Takeaway: Volatility Is Here to Stay

If today’s market action tells us anything, it’s that we’re in for a ride. Between trade wars, economic uncertainty, and Trump’s unpredictability, volatility is the name of the game.

✔️ Futures are bouncing back, but the tariff saga isn’t over

✔️ Trump’s doubling down, and markets are reacting

✔️ Economic data is showing early signs of stress

✔️ Bitcoin is rebounding, but oil is slipping

Strap in, folks—this week isn’t done surprising us yet.

Stay ahead, stay informed, and most importantly, stay profitable.

‘til next time,

TradingLab