Good Morning!

🌡 TradingLab’s Headline Roundup

Markets are treading water into today’s January CPI, with Dow futures off ~0.2% and S&P/Nasdaq futures down ~0.1% as traders steady themselves after Thursday’s tech-led rout.

The damage was sharp: Nasdaq Composite $NDAQ ( ▲ 0.57% ) bore the brunt of fresh AI disruption jitters, while the S&P 500 $SPY ( ▲ 0.72% ) and Dow Jones Industrial Average $DJI ( ▲ 0.47% ) managed modest gains.

Earnings kept tech in focus. Arista Networks $ANET ( ▼ 3.24% ) reiterated margin guidance despite higher memory costs, and Applied Materials $AMAT ( ▲ 1.5% ) leaned into an upbeat AI-driven outlook. Pinterest $PINS ( ▲ 5.96% ) lagged on soft Q1 revenue guidance amid tougher competition.

Macro is the hinge. CPI is expected to cool slightly, but January has a habit of running hot - a firm print likely reinforces “higher for longer,” while a softer read could reignite rate-cut chatter.

Elsewhere, gold is up ~1% on safe-haven demand, while Brent ~$67 and WTI ~$63 are steady but tracking a weekly dip.

For now, it’s cautious positioning - nobody wants to be offsides when the inflation number hits.

🏛 Stock Markets

Nasdaq Claws Back Losses as Bargain Hunters Buy Battered Tech Shares

Alphabet Stock Bounces Off Double Bottom After 15% Slide. Time to Buy?

Amazon Stock on Cusp of Bear Market After 9 Red Days in a Row. What’s Next?

₿ Crypto

Bitcoin Prices Float Near $68,500 After Weekend Pump Fades Fast

Bitcoin ETFs hold billions despite price crash, but resilience masks harsh reality

Peter Thiel's Founders Fund dumps every ETHZilla share

🔓 FREE PREVIEW: These alerts are delayed. Upgrade to access them in real-time and join my trading community.

The Play

Belovy wasted no time kicking off the week.

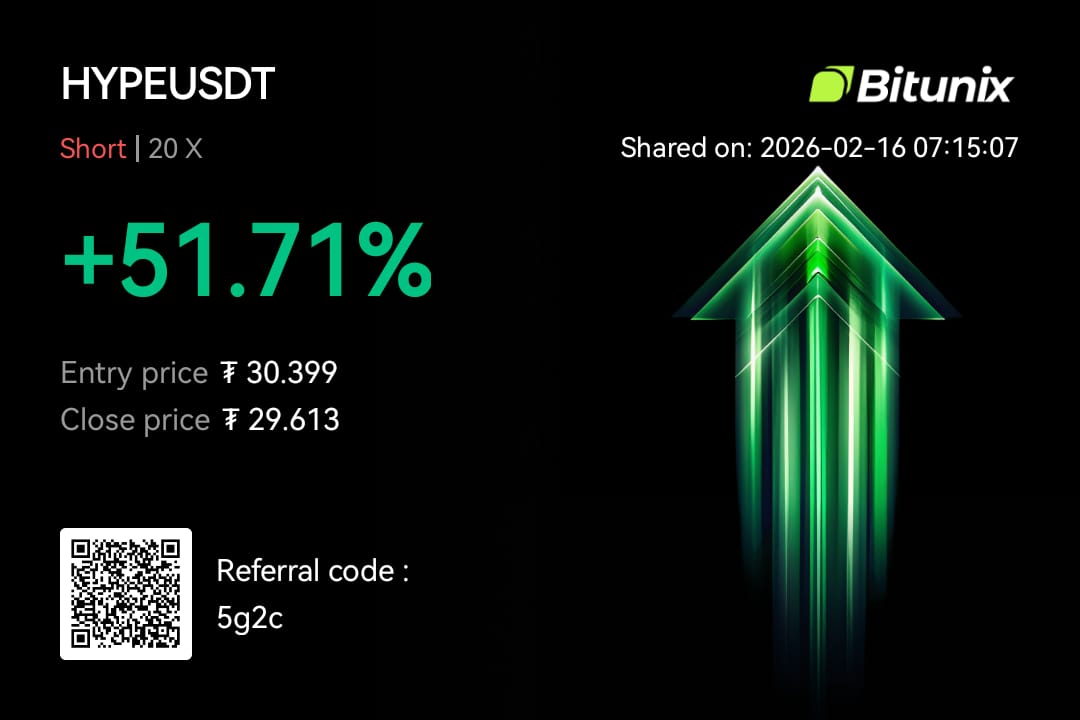

HYPE - SHORT (20x cross)

Entries: 35 – 30.40 (CMP)

Stop: Daily candle close above 37.20

Targets:

✅ T1: 29.70 (HIT)

🎯 T2: 28.90

🎯 T3: 27.40

🎯 T4: 25.70

🎯 T5: 23.90

🎯 T6: Runners

Position sizing was clean and controlled - 1% allocated for entries (split 0.5% / 0.5%), 2% reserved for DCA if needed.

Within hours? Target 1 tagged. Stops moved to entry. Risk = neutralized. Hunters now playing with house money.

The Catalyst

HYPE had been running hot - momentum stretched, funding overheated, and leverage stacking aggressively on the long side. Classic late-stage euphoria setup.

Add in broader market hesitation and rotation out of high-beta alts, and the risk/reward flipped hard. When liquidity thins and everyone’s leaning one way, you don’t follow the crowd - you fade it.

Belovy spotted exhaustion while most were still tweeting rocket emojis.

Our Take

This wasn’t a “hope it dumps” trade. It was structure, positioning, and timing.

Parabolic moves + crowded longs + macro uncertainty = asymmetric short setup. With clearly defined invalidation above 37.20, the downside ladder offered multiple high-probability take-profit zones.

Now that T1 is secured and stops are at entry, this becomes a pressure trade. If momentum accelerates, the lower targets open fast - and 20x leverage does what 20x leverage does.

The difference? You either saw it live in the community… or you’re reading about it after the fact.

We drop setups like this daily. Real entries. Real risk plans. Real execution. While the timeline argues, we’re already in and scaling out.

If you’re tired of watching screenshots after the move, you know what to do.

Join the room. Catch the next one live.

Because the only thing worse than a losing trade…

is missing a 50% leveraged move you could’ve been in.

👉 Inside TradingLab, you get these trades in real time. entries, exits, updates, and profit protection included.

If you’re serious about catching moves like this before they rip, you know where to be.

Stay ahead, stay informed, and most importantly, stay profitable.

‘til next time,

TradingLab