Good Morning!

Tesla’s 8.4% nosedive, the Nasdaq Composite's 2% shakeup, and Bitcoin’s slide to $56k are just the tip of the iceberg. Dive in for the gritty details and find out why small-cap stocks are suddenly the belle of the ball.

And for you crypto warriors, Sherlock’s got the latest on Ethereum’s precarious dance near $3100. With potential ETFs on the horizon, the stakes have never been higher.

Let’s get into it 👇

🌡 Market Temperature Check

📰 What’s Happening Today?

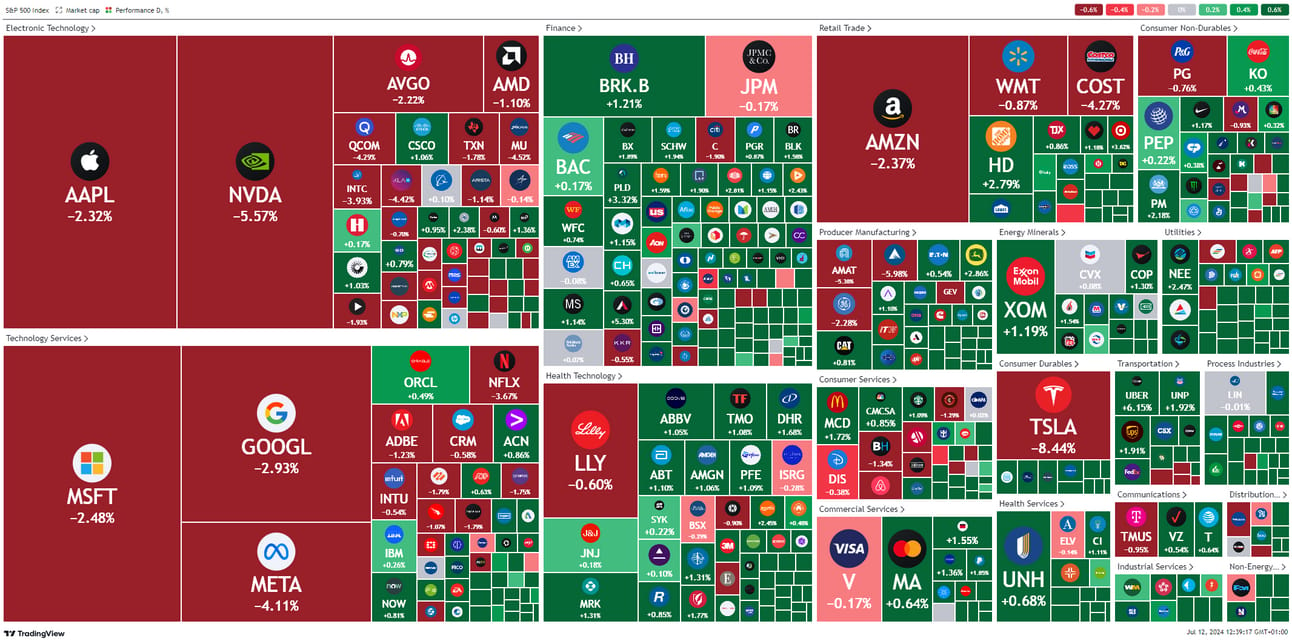

The Tech Sector is Taking a Beating

Thursday was a rough day for tech stocks as the Nasdaq Composite took a 2% nosedive. The latest inflation data showing signs of easing prompted investors to pull out of the tech-heavy Magnificent Seven and dive into small-cap stocks instead. The result? A jaw-dropping $600 billion loss – the biggest single-day wipeout since February 2022.

Nvidia (NVDA) led the fall with a 5.6% drop.

Meta (META) wasn't far behind, sliding 4.1%.

Tesla (TSLA) took the hardest hit, plummeting 8.4% after delays in its robotaxi project.

But it wasn't all doom and gloom. Small-cap stocks surged, with the Russell 2000 index jumping 3.6% for its best day since November. This shift in investor sentiment marked a clear move away from tech giants.

Inflation Data and Interest Rate Rumblings

Despite the cooling inflation data suggesting a slowdown in the U.S. economy, it wasn't enough to keep tech stocks afloat. The CPI announcement revealed easing price pressures, which led to a dip in Treasury yields and ramped up expectations for future interest rate cuts.

The odds of a rate cut in September shot up to about 93% according to the CME FedWatch Tool.

Yet, most believe the Fed will hold rates steady at their next meeting.

This brewing anticipation for lower interest rates had investors locking in profits from their high-flying tech stocks, nudging the Nasdaq further down. Nasdaq futures dipped slightly by 0.04%, while Dow and S&P 500 futures ticked up just a bit.

Global Ripples and Investor Pivots

The tech selloff in the U.S. echoed across global markets, hitting Asian and European tech-heavy indices hard. Losses in Nasdaq 100 Futures on Friday hinted at more pain to come for technology stocks.

Wall Street saw a sharp drop as investors shifted to more economically sensitive sectors.

These sectors are expected to benefit from better growth prospects as interest rates potentially fall this year.

The sharp downturn in the tech-heavy Nasdaq and the ensuing investor shift underscore the market's fluid nature and how macroeconomic factors shape trading strategies. As we move forward, keeping an eye on inflation trends and Fed moves will be crucial for navigating these turbulent times.

📈 What I’m Trading

Headline and Play

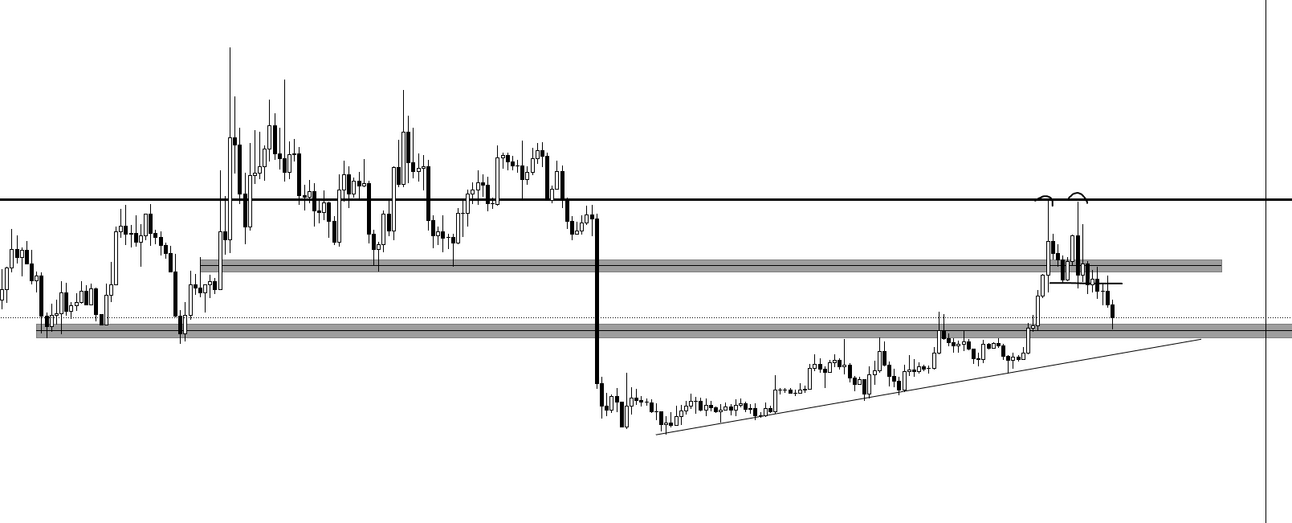

Time to spill the tea on what’s brewing in the crypto market, specifically around our old friend, Ethereum ($ETH). Our analyst, Sherlock, has been crunching numbers and reading the charts. And what’s he found? Let’s just say it’s a mix of caution and optimism.

The current chart for $ETH isn’t exactly giving us warm fuzzies. Sherlock points out that $ETH is dancing dangerously close to a major support level. If it doesn’t rally to at least the $3100 mark soon, we might be in for a dip below $3000 again. This isn’t just idle speculation; the chart’s painting a pretty clear picture.

The Big But...

Before you start panic selling, here’s the kicker. There’s a major catalyst on the horizon that could flip this whole scenario on its head. Ethereum ETFs are about to hit the market, and the inflow projections are staggering. According to Tom Dunleavy from MV Global, these ETFs could pull in up to $10 billion in new investments in the coming months. That’s the kind of influx that could push $ETH to new all-time highs by the end of the year.

Why This Matters

If you remember the impact Bitcoin ETFs had, you’ll know this isn’t just hype. Bitcoin ETFs pulled in around $15 billion, significantly boosting BTC’s price. Dunleavy predicts Ethereum will see between $5 billion to $10 billion in new inflows. Eight spot Ether ETFs are waiting for the final green light from U.S. regulators and could start trading as soon as this month. Once they’re live, we could witness a significant price surge, just like we did with Bitcoin ETFs.

The Bottom Line

This is a classic case of high risk, high reward. $ETH is on a knife-edge, and while it’s flirting with support levels that could lead to a drop, the incoming ETF inflows are a potential game-changer.

Sherlock’s advice? Keep a close eye on the $3100 level. If we break above it, we could be in for a bullish ride. But remember, the crypto market loves to keep us on our toes, so stay sharp and trade smart.

If you’re not already part of our TradingLab community, now’s the time to join. We’re breaking down the latest trends, sharing exclusive insights, and helping each other navigate these choppy waters. Don’t miss out – join us today and be part of the conversation!

✍ TL;DR

Market Update:

Tech Stock Selloff:

Nasdaq Composite dropped 2%.

Major tech stocks (Tesla, Nvidia, Meta) saw significant losses.

Tesla fell 8.4% due to robotaxi delays.

Magnificent Seven stocks lost $600 billion in a single day.

Investor Shift:

Small-cap stocks surged, with the Russell 2000 index up 3.6%.

Cooling inflation data prompted expectations of future interest rate cuts.

Global tech-heavy indices also experienced losses.

Ethereum Update:

ETH Price Analysis:

ETH is close to a major support level around $3100.

Risk of dipping below $3000 if it doesn't rally soon.

Potential Catalyst:

Upcoming Ethereum ETFs could attract up to $10 billion in new investments.

Positive impact similar to Bitcoin ETFs, which previously pulled in $15 billion.

Outlook:

High risk, high reward scenario.

Break above $3100 could signal a bullish trend.

Stay ahead, stay informed, and most importantly, stay profitable.

‘til next time,

TradingLab