Good Morning!

US Stocks just pulled off their best five-day run since November, thanks to cooler than expected inflation data, and tech stocks are surging.

Meanwhile, Starbucks took the markets by surprise, firing their CEO and catapulting the stock up by 25%

Finally, Sherlock is in a great position on BTC, already in profit with more expected. If you missed this Bitcoin entry, you might want to jump into our Discord.

Let’s get into it 👇

🌡 Market Temperature Check

📈 US stocks continue to rally

Wall Street lit up in green on Tuesday as stocks soared, driven by cooler-than-expected inflation data. Tech stocks were the star performers, with the Nasdaq Composite jumping 2.4% and the S&P 500 climbing 1.7%. Meanwhile, the Dow Jones inched up 1%. This marked the best five-day run since November for these indexes, thanks to a streak of wins.

Eyes are now on the July CPI report due Wednesday to see if the trend continues.

☕ Starbucks Stock Whips Up Record 25% Increase

Starbucks shocked the market on Tuesday by ousting CEO Laxman Narasimhan and appointing Chipotle’s Brian Niccol as his successor, effective September 9. The unexpected leadership change sent Starbucks stock skyrocketing, with shares jumping 25% in a single day. So what went wrong?

🌯 Chipotle stock falls as CEO Brian Niccol leaves

Things we’re so positive for Chipotle, their stock took a hit on Tuesday, dropping as much as 10% after the company announced that CEO Brian Niccol would step down on August 31 to lead Starbucks. The stock eventually closed down 7% for the day. Niccol, who became CEO in March 2018, oversaw a remarkable 770% rise in Chipotle's stock during his time in charge.

🥇 Gold price nears month high ahead of US inflation data

Gold prices surged on Monday as traders anticipated key US economic data, hoping for signs that might lead the Fed to ease monetary policy next month. The market is currently pricing in a 49% chance of a 50 basis point rate cut in September.

📈 What I’m Trading

The Play

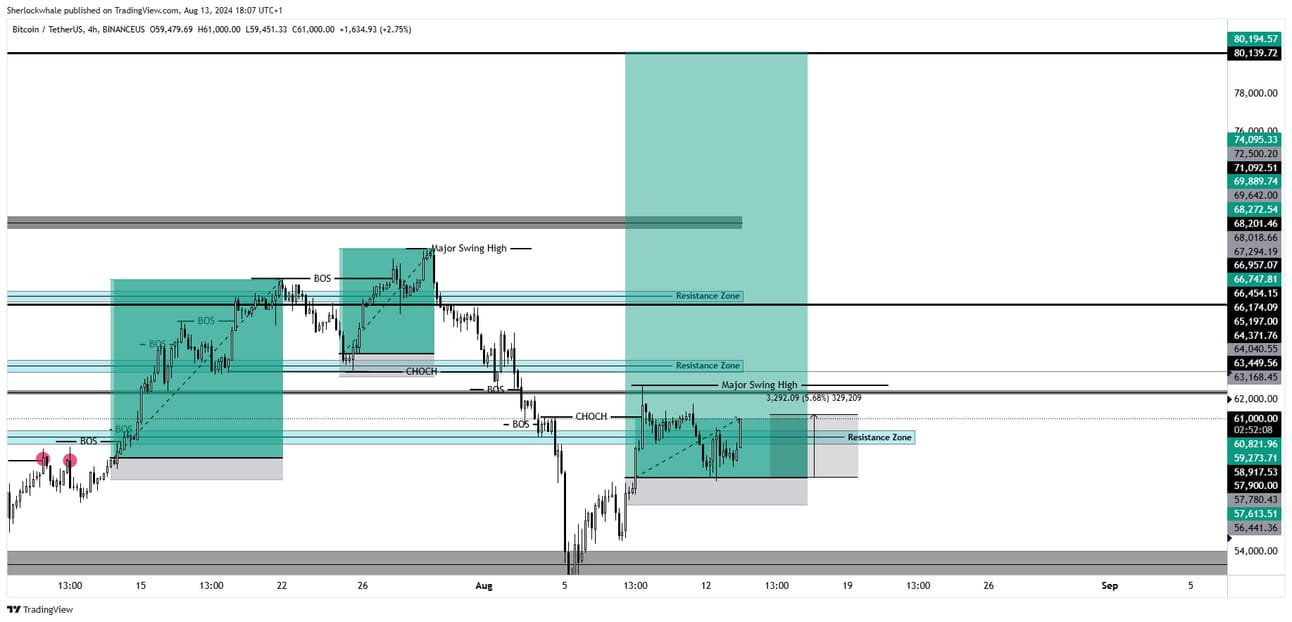

Sherlock is back with another great move, this time with a swing long on Bitcoin that’s already paying off big time. Here’s the rundown:

Entry Range: $57,900 - $56,225 - $53,500

Stoploss: 1D Close Below $52,200

Targets: $62,000 - $64,000 - $67,000 - $70,000 - $80,000

Current Status: 5.7% Up From Entry! First TP hit at $61,200

After last week’s market turmoil, where Bitcoin witnessed a flash crash, Sherlock was able to catch the bounce off the mid-term EMA and saw a rejection from the monthly VWAP, the perfect setup in his eyes.

The first target has been smashed, and he’s now eyeing higher levels. With the yearly VWAP in play, he’s confident this could push to $80K if wider market conditions allow.

What’s next?

The market is on edge with everyone watching the upcoming US CPI numbers like hawks. QCP Capital summed it up perfectly in their latest broadcast: the Fed’s next move hinges on these inflation figures, and with odds split between a 50 or 25 bps rate cut, volatility is guaranteed. This kind of uncertainty is Bitcoin’s playground.

Our Take

Bitcoin looks strong, it has managed to shake off the bears after hitting a major support zone.

The chart shows a clear bounce from a multi-timeframe EMA support. With the momentum building, breaking past yearly VWAP opens the door to $70K and beyond.

If you missed this Bitcoin entry, what are you waiting for?

Our analysts like Sherlock are dropping entries like this regularly in our Discord.

‘til next time,

TradingLab