Good Morning!

Markets are messy, and we love it that way. Between Trump’s latest tariff flip-flop, a $5.5B faceplant from Nvidia, and Powell prepping his next verbal yoga session, Wall Street is doing its best impression of a soap opera right now.

Here’s what’s up today:

Nvidia’s AI dreams hit a regulatory wall (and a multi-billion dollar invoice)

Trump’s trade tantrums are back, and they’re confusing everyone, including the EU

Powell’s up to bat, and the Fed put might be back on the table

Retail earnings, China GDP, and more fuel for the fire

Let’s get into it 👇

🌡 TradingLab’s Headline Roundup

Stock Markets

9th April, 2025

🚨 Nvidia Stock Slumps Over 6% as US Chip Restrictions Could Add $5.5 Billion in Charges

Canada Inflation Cools to 2.3% in March

OpenAI Plans to Build X-Like Social Platform Amid Ongoing Rift With Musk: Report

The Price of Peace: Why Diversification is Difficult, but Necessary

Crypto

Bitcoin Slips With XRP, ADA as Nvidia's Massive $5.5B Charge Sours Investor Sentiment

Coinbase Urges Australia to Vote for Crypto Progress in May

Bitcoin bulls ‘coming back’ as key metric on Binance flips to neutral

Dogecoin Whales Accumulate, SOL Hints at Consolidation as Market Takes a Breather

Forex/Commodities

Sterling Rises for Seventh Day in a Row as UK Inflation Cools to 2.6% in March

Gold Takes Off to Fresh Record Near $3,300, Logs 25% Year-to-Date Gains

Japan seeks full removal of US tariffs ahead of trade talks

Upcoming Earnings

via LevelFields

📅 FRI.

No major earnings scheduled

📈 What’s Moving Markets Today?

🔥 Futures Tank as Tariff Tensions Return

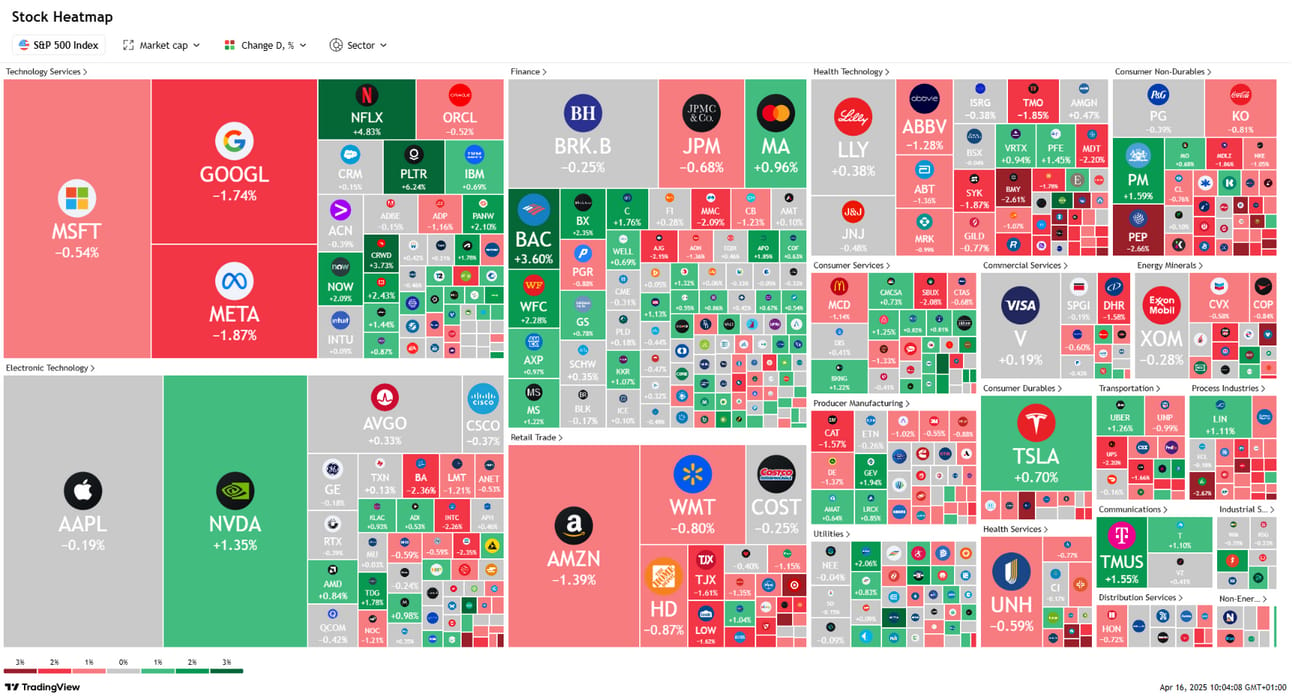

Wall Street woke up cranky. Futures are down across the board as traders digest Trump’s latest tariff drama and a fresh crackdown on AI chip exports to China. The Dow, S&P 500, and Nasdaq futures are all taking a hit this morning.

📌 Key Points:

Dow Futures: Down 0.7%, that’s -282 points, for those counting.

S&P 500 Futures: Off by 1.3%, a pretty solid drop.

Nasdaq Futures: Getting hammered, down 2%, tech is not loving this.

Trump’s tariff whiplash continues: he teased concessions earlier this week, then the U.S. told the EU some tariffs are staying anyway. Mixed signals, anyone?

Bank of America and Citigroup showed strong trading revenue, but warned of uncertainty due to “the Trump factor.”

⚠️ Nvidia Takes a $5.5 Billion Hit

Yikes. Just when Nvidia was riding the AI boom, the U.S. Commerce Department drops a new hammer: updated export restrictions that ban its crucial H20 AI chip from China. That’s a $5.5B slap straight to the balance sheet.

📌 Breakdown:

The H20 was Nvidia’s last legal route to the Chinese market, thanks to earlier Biden-era restrictions.

New licensing rules now target Nvidia’s H20, AMD’s MI308, and similar high-performance chips.

Other names getting caught in the crossfire? AMD (AMD), Broadcom (AVGO), Super Micro (SMCI), Intel (INTC), and TSMC.

Nvidia’s shares are dropping premarket, and the AI narrative might be facing its first real reality check.

🧾 Earnings & Retail Sales: All Eyes on the Consumer

Earnings season marches on, but the real curiosity is whether retail sales held up before Trump’s tariff mic drop. Analysts at ING suggest March numbers could be artificially high as consumers rushed to buy before prices spike.

📌 Watchlist:

Pre-market earnings from Abbott Labs (ABT), Prologis (PLD), and U.S. Bancorp (USB)

ASML (ASML) dropped over 5% in Europe after warning about tariffs clouding visibility through 2026. That’s a big red flag for the chip supply chain.

The March retail sales report is coming in hot, and could reveal whether consumers were genuinely strong, or just panic-buying before tariff hikes.

🧠 Powell Takes the Mic

Later today, Fed Chair Jerome Powell gets to play economic therapist at the Economic Club of Chicago. With markets rattled by tariffs and a tech wreck, Powell’s tone could be the deciding factor for how the rest of the week plays out.

📌 What to Expect:

Powell speaks at 1:30 PM ET — set your alerts.

Investors want clarity on rate cuts, but Powell has been in “wait and see” mode.

Fed Governor Waller thinks the tariff impact will be “transitory” (famous last words?), but warned it’s still a major macro shock.

If Powell sounds hawkish, brace yourself. If he drops a Fed put hint? The market might just throw a party.

🐉 China’s Economy: Strong Start, But...

China’s Q1 GDP came in at +5.4% YoY, topping expectations. Looks great… until you zoom in. Quarter-over-quarter growth actually missed, signaling that the tariff war might already be biting.

📌 The Numbers:

+5.4% YoY vs. 5.2% forecast

+1.2% QoQ, below the 1.4% expectation and slowing from Q4’s 1.6%

Beijing’s stimulus measures are clearly working… but how long can they offset the growing trade pressure?

🎢 The Takeaway: Choppy Waters Ahead

Between the Nvidia news, Trump's tariff ping-pong, and a data-heavy week, investors are caught in a crossfire of macro headwinds and AI hiccups. If you're looking for clarity, don't. You're more likely to find it in a Magic 8-Ball than in Powell's carefully-scripted remarks today.

Play it smart. Stay nimble. And maybe keep some gold on the side. 🏆

Let me know if you want a graphic summary or this turned into an email blast format!

Stay ahead, stay informed, and most importantly, stay profitable.

‘til next time,

TradingLab