Together with:

Good Morning!

Markets are serving up drama this morning, and I’m here for it. Nvidia just pulled an impressive disappearing act—shedding $274 billion in market value overnight. Bitcoin, meanwhile, is on a downward spiral, dipping below $80K as risk appetite dries up. And if that wasn’t enough, President Trump is stirring the pot with fresh tariff threats aimed at Mexico, Canada, and the EU.

Oh, and Dell? They’re diving headfirst into AI servers but somehow still managed to spook investors with a margin squeeze.

Let’s get into it 👇

🌡 TradingLab’s Headline Roundup

Stock Markets

21st February, 2025

Nasdaq Composite Plunges as Markets Digest Tariff Hikes, Nvidia Sheds 8%

Nvidia Does It Again—Bumper Quarter and Bold Guidance Show Demand Isn’t Going Anywhere

TD Bank Earnings Slide Due to Remediation Costs, Rise in Credit-Loss Provisions

Crypto

Bitcoin Slumps to $82,000 as Crypto Market Takes $1 Trillion Hit to Valuation

Uniswap partners with Robinhood, MoonPay, Transak to turn crypto into cash

Bitcoin's Wild Ride: Unpacking the Latest Crypto Crash

$SOL Dips, Ecosystem Activity Declines, and Major Hacks Impact the Network

Commodities/Forex

US Dollar Up for Third Straight Day as FX Traders Brace for Tariff Onslaught

Gold Extends Slide to $2,890—Can US Inflation Data Reignite Upside Swing?

Euro Takes a Beating to $1.0450 After Trump Floats 25% Tariffs on EU Goods

Upcoming Earnings

📅 Friday, 28th February

Pearson (PSO)

FuboTV (FUBO)

🌡 Disrupting a Trillion Dollar Market

Isn't it time we build houses like everything else? BOXABL thinks assembly line automation can lead to building homes faster, at a higher quality, for a lower cost. Protected by 53 patent filings, BOXABL has raised over $170M since 2020 from over 40,000 investors.

They believe BOXABL has the potential to disrupt a massive and outdated trillion dollar building construction market.

*from our partners. Please see full disclosures below

📈 What’s Moving Markets Today?

🔥 Futures Edge Up: Markets Steady Before Key Data

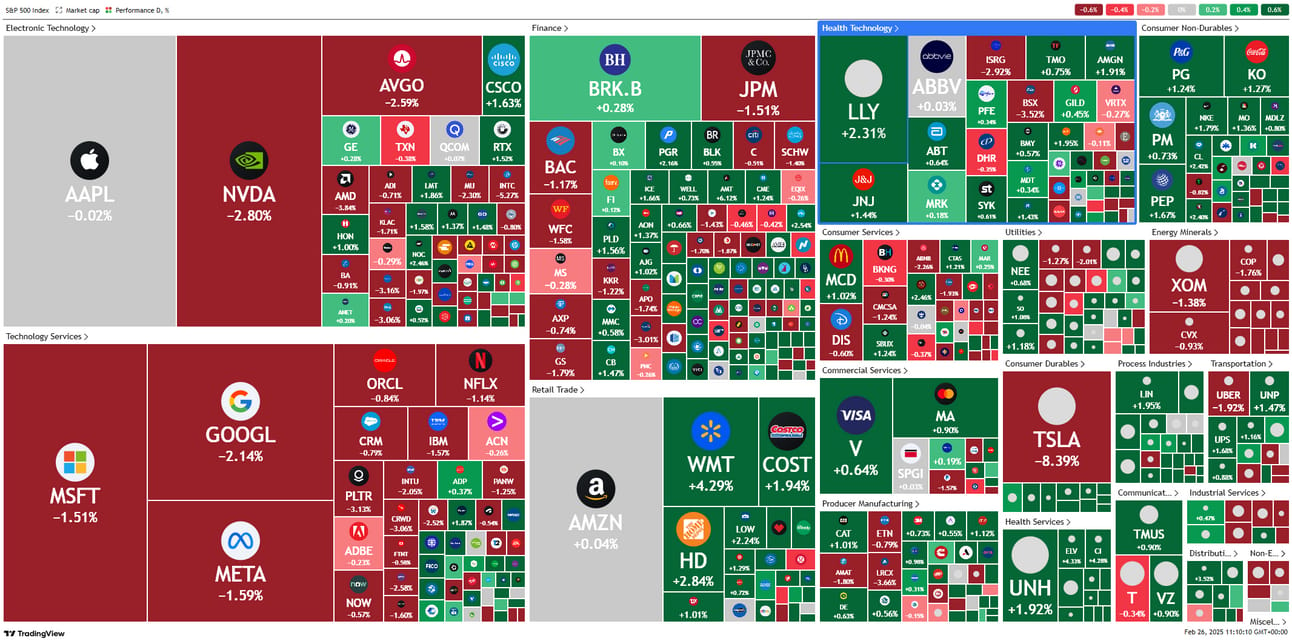

After yesterday's rollercoaster, U.S. stock futures are showing a modest uptick. As of 03:32 ET (08:32 GMT), Dow futures have risen by 62 points (0.2%), with S&P 500 and Nasdaq 100 futures each adding 12 and 40 points (0.2%), respectively. This comes on the heels of Thursday's sell-off, where the Dow dipped 0.5%, the S&P 500 slid 1.6%, and the Nasdaq took a 2.8% tumble. The tech sector, especially Nvidia, bore the brunt of the downturn.

Futures are on the uptick

📌 Key Points:

Nvidia's Impact: The chipmaker's shares plummeted 8.5%, erasing a staggering $274 billion from its market cap.

Awaiting PCE Data: Investors are on the edge of their seats for the upcoming Personal Consumption Expenditures (PCE) report, the Fed's favored inflation gauge. Projections suggest a 0.3% monthly rise and a 2.5% annual increase.

Tariff Tensions: President Trump's announcement of impending tariffs—25% on imports from Mexico and Canada starting March 4, plus an extra 10% on Chinese goods—has added a layer of uncertainty.

💻 Dell's Margin Squeeze Amid AI Ambitions

Despite forecasting a 53% surge in annual revenue from AI server shipments (hitting $15 billion), the tech giant anticipates a 100 basis point drop in its adjusted gross margin rate for fiscal year 2026. The culprit? Skyrocketing production costs for AI-driven servers. Shares dipped about 2% in extended trading, even as Dell unveiled a $10 billion boost to its share buyback plan.

📌 Highlights:

AI Server Demand: Annual revenue from AI servers expected to climb 53% to $15 billion.

Margin Pressure: Projected 100 basis point decline in adjusted gross margin rate due to higher production costs.

Shareholder Moves: Announced a $10 billion increase in share repurchase authorization.

💰 Bitcoin Dips Below $80K

Cryptocurrency enthusiasts, brace yourselves. Bitcoin has slipped below the $80,000 threshold, marking an 8.1% drop to $79,103.3 as of 03:33 ET. This downturn is poised to culminate in a 23% decline for February, influenced by tariff concerns and a shift away from speculative assets.

📌 Current Stats:

Price: $79,103.3

Monthly Decline: On track for a 23% drop in February.

Market Sentiment: Investors are skittish amid trade tensions and economic uncertainties.

🎢 The Takeaway: Brace for Volatility

As we wrap up the week, the markets are serving a cocktail of cautious optimism mixed with a dash of unpredictability. Between tariff announcements, corporate earnings surprises, and key economic indicators on the horizon, it's clear: volatility is the name of the game. Buckle up, stay informed, and as always, keep your investment strategies nimble.

Stay ahead, stay informed, and most importantly, stay profitable.

‘til next time,

TradingLab

*Disclosure: *This is a paid advertisement for Boxabl’s Regulation A offering. Please read the offering circular here. This is a message from Boxabl