Good Morning!

From the S&P 500’s latest slip to Nvidia’s monumental earnings, we’ve got the news that matters to your portfolio. And, we’re paying tribute to the legendary doge that left a paw print on the crypto world.

Today, we spotlight Nvidia’s jaw-dropping growth and strategic stock split designed to rope in even more investors.

And for the traders? We’ve got a killer strategy from our analyst Hayden on OP/USDT that’s lined with technical insights and clear entry points. It’s your roadmap to a lucrative trade.

Let’s get into it 👇

🌡 Market Temperature Check

📈 What’s Happening Today?

It’s Nvidia’s Market and We’re Just Living In It

Nvidia is making waves yet again, and it’s a sight to behold. The chip giant delivered another stellar earnings report, showing an astonishing 262% revenue growth year-over-year. Last quarter's growth of 265% was nearly matched, making it clear that Nvidia is on a rocket ship trajectory.

Revenue Growth: Nvidia's April-quarter sales hit $26 billion, smashing Wall Street’s expectations of $24.7 billion.

Data Center Business: The data center segment expanded by over 400% from the previous year, driven by insatiable demand for AI servers.

Future Projections: For the current quarter, Nvidia forecasts revenue of $28 billion, well above the $26.8 billion predicted by analysts.

These figures aren't just impressive; they're groundbreaking, showcasing Nvidia’s dominance in the AI and semiconductor industries.

The Big Split: Making Shares Affordable

In a strategic move to make its shares more accessible, Nvidia has announced a 10-for-1 stock split, set to take effect on June 7, 2024. This split comes on the heels of their blockbuster earnings report and marks a significant moment for potential investors.

Stock Split Details: Shareholders as of market close on June 6 will receive nine additional shares for each share they hold. Post-split trading will commence on June 10.

Accessibility: By lowering the stock price, Nvidia aims to attract a broader range of investors, making its stock more approachable for retail investors.

Historical Growth: Over the past five years, Nvidia's valuation has soared more than 25 times, turning a $1,000 investment into a staggering $25,000.

This split is not just a financial maneuver but a strategic effort to maintain and expand its investor base amid rapid growth.

The Market’s Reaction

Following these announcements, Nvidia’s stock has reacted predictably – by soaring. Shares jumped 6% in after-hours trading and are set to open above the $1,000 milestone. The market is buzzing, trying to determine Nvidia’s true worth in this new landscape.

Post-Earnings Surge: The impressive earnings and stock split news have catapulted Nvidia's stock into new heights.

Market Perception: Investors are more interested than ever in Nvidia, speculating on its potential and future growth.

Cash Dividend Increase: Nvidia has also increased its quarterly cash dividend by 150% to $0.01 per share on a post-split basis, further sweetening the deal for shareholders.

Nvidia’s latest moves are a masterclass in leveraging growth and market strategy. By making shares more affordable and continuing to deliver on performance, Nvidia is not just staying ahead of the game – it’s redefining it.

👾 What Are We Trading?

The Play

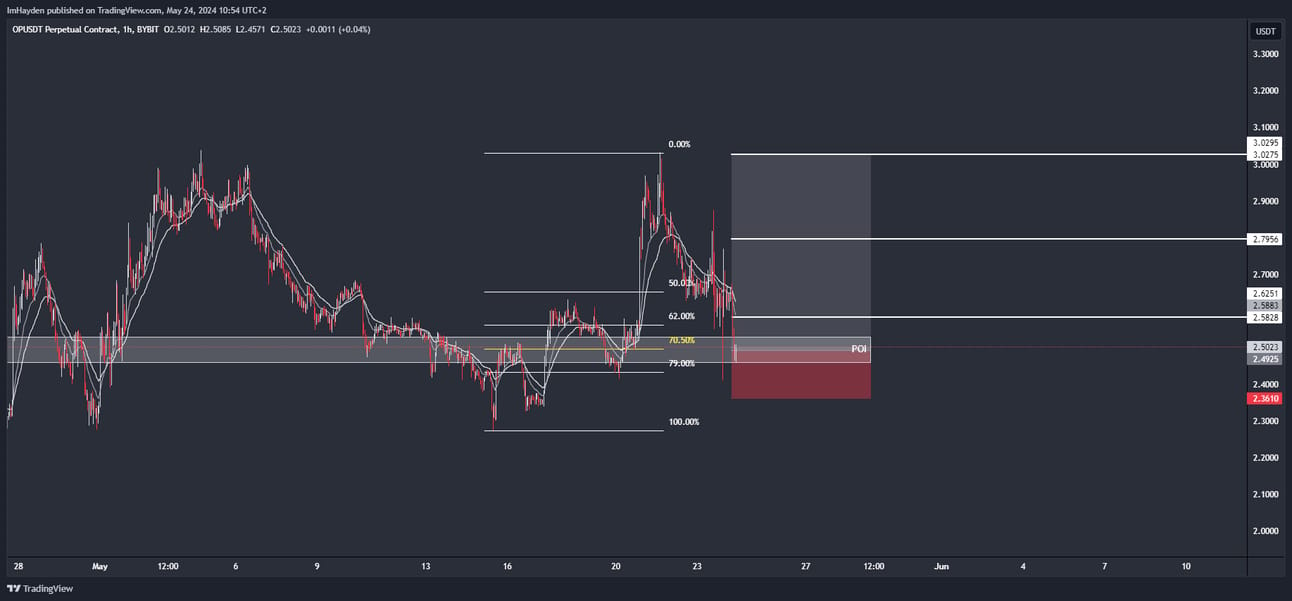

Our analyst, Hayden, has uncovered a golden opportunity with OP/USDT, and we’re here to break it down for you. This is a long play with clear-cut entries, exits, and a solid risk management strategy.

Entry: 2.459 - 2.531

Stop Loss: 2.361

Take Profit 1: 2.582

Take Profit 2: 2.795

Take Profit 3: 3.029

Leverage: 10x

Allocation: 2% of portfolio

Move Stop Loss to Entry after TP 1

The attached chart highlights some key technical levels. We've got strong support around the 70.50% Fibonacci retracement level, which aligns with our entry zone. The price action has been respecting these Fibonacci levels, bouncing off the 62.00% and aiming for higher targets.

The Catalyst

What’s driving this move? Recent news suggests an uptick in market confidence for OP, with new developments and partnerships announced. The crypto market is showing bullish signs, particularly for tokens with strong use cases and community support.

News Highlights:

Partnership Announcements: OP has secured partnerships with major DeFi platforms, boosting its utility and adoption.

Market Sentiment: Positive sentiment across the broader crypto market, with Bitcoin and Ethereum breaking key resistance levels, lifting altcoins along with them.

Technical Breakout: The recent price action indicates a breakout from a consolidation phase, backed by increased trading volumes.

Our Take

Why are we bullish on this trade? The combination of strong technical indicators and positive news makes this a compelling buy.

Technical Analysis: The chart shows a clear bullish trend with higher highs and higher lows. The 50.00% Fibonacci level provides a strong resistance-turned-support zone, reinforcing our confidence in the trade.

Risk Management: Tight stop loss at 2.361 minimizes risk, while moving the stop loss to entry after the first target locks in profits and mitigates potential losses.

Leverage: Using 10x leverage amplifies potential gains, but with a manageable risk due to our conservative allocation of only 2% of the portfolio.

Don’t miss out on this trade! Join our TradingLab community for more insights, expert analysis, and real-time trade alerts. We're here to help you navigate the crypto market with confidence and precision.

Ready to step up your trading game? 👇

Get smarter on AI in 5 minutes a day.

The world’s largest AI newsletter, read by over 600,000 AI professionals.

One free email every morning on what’s new in AI and gives you “the rundown” of the most important developments.

Allowing for readers to keep up with the insane pace of AI and why it actually matters

✍ TL;DR

Nvidia:

Earnings Report: Nvidia reports a massive 262% revenue growth year-over-year with $26 billion in sales for the April quarter.

Data Center Boom: Over 400% growth in the data center segment, driven by high demand for AI servers.

Future Outlook: Revenue projection for the current quarter is $28 billion, surpassing analyst expectations.

Stock Split: Nvidia announces a 10-for-1 stock split effective June 7, 2024, aiming to make shares more accessible to a broader range of investors.

Market Reaction: Post-earnings, Nvidia’s stock price jumped 6% in after-hours trading, with the stock opening above $1,000.

Dividend Increase: Quarterly cash dividend increased by 150% to $0.01 per share on a post-split basis.

OP/USDT Long Trade Setup:

Entry Points: Between 2.459 and 2.531.

Stop Loss: Set at 2.361.

Take Profit Levels: TP1 at 2.582, TP2 at 2.795, TP3 at 3.029.

Risk Management: Move Stop Loss to Entry after hitting TP1.

Leverage and Allocation: Using 10x leverage, with a 2% portfolio allocation.

Market Catalysts: Recent positive developments and partnerships in the DeFi space, enhancing OP’s market position.

Technical Analysis: Bullish trend confirmed by strong support at the 70.50% Fibonacci retracement level.

Stay ahead, stay informed, and most importantly, stay profitable.

‘til next time,

TradingLab