Good Morning!

While most traders are still chasing yesterday’s headlines, we’re already stacking tomorrow’s wins. At TradingLab, we don’t wait for confirmation - we create it. Every setup we share comes with tight risk, clean targets, and the kind of conviction you can’t fake.

If you’ve been watching from the sidelines wondering how we keep catching bottoms and fading tops, this is your sign.

Keep scrolling - today’s plays are hitting different. ⚡

🌡 TradingLab’s Headline Roundup

📈 Investing & Strategies

Proof of Wealth - On getting rich quickly and why keeping wealth requires sacrifice.

1 Glorious Growth Stock Down 74% to Buy on the Dip in September

All It Takes Is $27,000 Invested in These 2 High-Yield Dividend Stocks and ETF to Help Generate Over $1,000 in Passive Income Per Year

🏛 Stock Markets

$SPY ( ▲ 0.48% ) S&P 500 Books Back-to-Back Records as Oracle Makes History with $255 Billion Added

$ADBE ( ▼ 0.55% ) Adobe Stock Jumps 4% as Earnings Update Serves a Double Beat. Here Are the Numbers.

$NASDAQ ( 0.0% ) Nasdaq Composite Surges to Fresh Record on Inline Inflation, Upbeat Mood All Around

US CPI: Inflation for August Hits 2.9%, Inline with Consensus. Here’s to Interest Rate Cuts?

$KLAR ( ▼ 0.73% ) Klarna Stock Rises 15% in IPO as Traders Show Modest Appetite for Swedish Fintech

₿ Crypto

Metaverse ‘still has a heartbeat’ as NFT sales jump 27% in August

Albania’s AI virtual assistant Diella just got promoted to ‘minister’

DeFi Protocol Ondo Finance's Token Soars Amid Tokenization Hype

Coinbase Says SEC 'Destroyed' Gensler Texts, Demands Court Sanctions

Christie’s Closes Digital Art Department as NFT Market Stays Frozen

🔥 TradingLab Portfolio Update

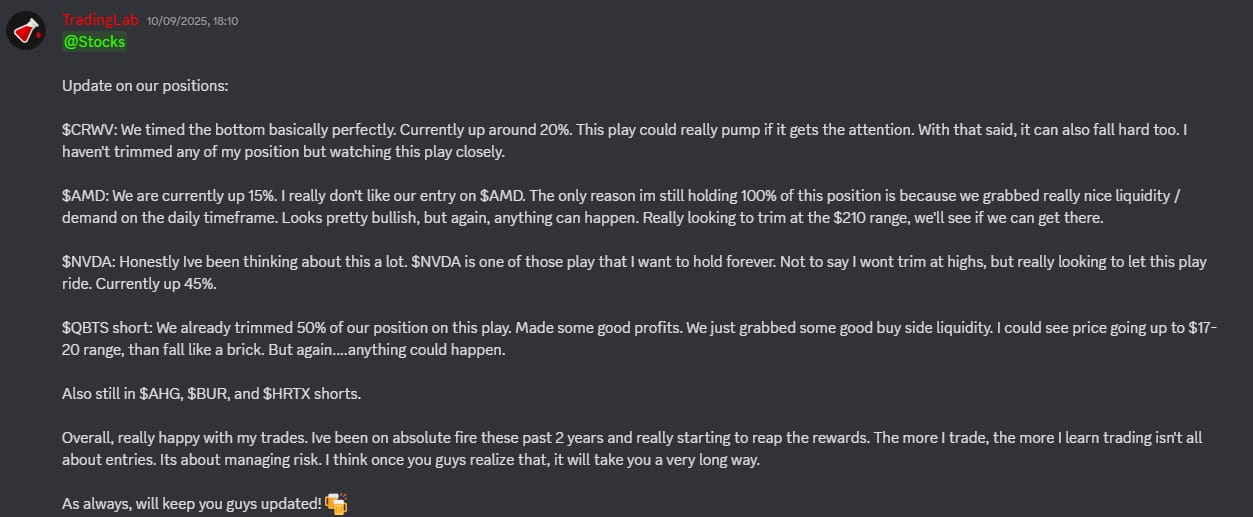

We’ve been cooking lately, and it’s time to give you a quick update on the positions we’ve been riding. Spoiler: it’s been a good week to be in the lab.

💰 The Play

$CRWV (Long)

• Entry near bottom (nailed it)

• Currently +20%

• Watching closely for momentum or rug risk$AMD (Long)

• Entry around key daily demand zone

• Currently +15%

• Targeting trims around the $210 level$NVDA (Long)

• Currently +45%

• Core long-term hold, will trim at euphoric highs$QBTS (Short)

• Already took 50% profits

• Expecting potential pop to $17–20 before next big leg downAlso holding shorts in: $AHG, $BUR, $HRTX

⚡ The Catalyst

Tech has been ripping off the back of fresh AI capital inflows and stronger-than-expected earnings.

$AMD and $NVDA continue to soak up demand from data center growth and GPU shortages.

$CRWV is a small-cap that could explode on volume if retail catches wind, pure sentiment rocket fuel.

$QBTS is trading on fumes with weak fundamentals, making it a perfect overextended short after any squeeze.

The market’s risk appetite is back on the menu, and we’re eating.

🧠 Our Take

We’re managing these positions like assassins, patiently waiting for levels, trimming on strength, and letting winners run.

$CRWV could go full face-melter if attention hits.

$AMD looks solid, but we’re eyeing that $210 zone to secure profits.

$NVDA? We want to be holding this name when people start calling it “over” again, because that’s when it goes parabolic.

And shorts like $QBTS? Easy money if you know when to hit the eject button.

The real edge isn’t just entries, it’s risk management. That’s what keeps us winning while everyone else blows up.

🚀 Don’t Just Watch, Trade With Us

We drop these plays daily before they move. If you’re reading this from the sidelines, you’re literally watching us print.

Join the TradingLab community now, or keep wondering how we caught the bottom again. 💸

🔥 These aren’t hindsight screenshots - they’re live calls with tight risk, clear targets, and the context you never get from random signal groups. If you’ve felt the frustration of missed moves, blown stops, or just gambling in the dark, this is your chance to trade with precision and confidence.

Inside TradingLab Premium, you’ll get daily plays like this one, risk-managed setups explained in plain English, and a community that actually has your back. Don’t just read about the wins - catch them while they’re happening.

Stay ahead, stay informed, and most importantly, stay profitable.

‘til next time,

TradingLab