Good Morning!

Markets didn’t tiptoe this month, they kicked the door in. From AI-fueled stock pops and face-plant earnings to crypto chaos that reads like a Netflix script, the tape has been loud, fast, and unforgiving. That’s exactly how we like it.

While headlines whipped traders around, TradingLab stayed locked in, executing, adapting, and stacking wins in conditions that exposed weak systems everywhere else. November wasn’t clean. It wasn’t easy. It was real market pressure, and real traders showed up.

Inside this issue, we break down what actually mattered, who moved the market, and why our best results came when volatility did its worst.

If you’re still watching from the sidelines, this is your cue.

Scroll on for the full market rundown, our headline hits, and a look inside what’s been working at TradingLab. The market’s warming up, don’t sit this one out.

Market Rundown

Markets are easing into the weekend on a tight leash. U.S. futures are hovering near flat after record closes, as traders weigh whether the Fed just greenlit a year-end rally or simply stopped glaring at equities.

Tech is driving the conversation, and the bill is coming due. Oracle rattled markets with a downbeat outlook, reviving concerns that the AI boom is heavy on spending and light on near-term payoff. Broadcom echoed the theme - strong results, massive backlog, but margin pressure as AI revenue proves expensive to scale.

On the consumer side, Costco delivered a clean beat, reinforcing that value retailers are still winning cautious shoppers who haven’t stopped spending, just gotten choosier.

Corporate drama added some spice: Lululemon popped after announcing its CEO’s departure and lifting guidance, with proxy-fight whispers lingering in the background.

Meanwhile, oil prices ticked higher on Venezuelan supply fears, though peace-talk optimism keeps a lid on the bigger move.

Bottom line: Stocks are calm, confidence is conditional, and AI remains the market’s favorite story - just one investors are starting to price more carefully.

3 Tricks Billionaires Use to Help Protect Wealth Through Shaky Markets

“If I hear bad news about the stock market one more time, I’m gonna be sick.”

We get it. Investors are rattled, costs keep rising, and the world keeps getting weirder.

So, who’s better at handling their money than the uber-rich?

Have 3 long-term investing tips UBS (Swiss bank) shared for shaky times:

Hold extra cash for expenses and buying cheap if markets fall.

Diversify outside stocks (Gold, real estate, etc.).

Hold a slice of wealth in alternatives that tend not to move with equities.

The catch? Most alternatives aren’t open to everyday investors

That’s why Masterworks exists: 70,000+ members invest in shares of something that’s appreciated more overall than the S&P 500 over 30 years without moving in lockstep with it.*

Contemporary and post war art by legends like Banksy, Basquiat, and more.

Sounds crazy, but it’s real. One way to help reclaim control this week:

*Past performance is not indicative of future returns. Investing involves risk. Reg A disclosures: masterworks.com/cd

🌡 TradingLab’s Headline Roundup

🏛 Stock Markets

$DIS ( ▼ 0.4% ) Disney Stock Pops 2.4% on OpenAI Deal to Bring Beloved Characters to AI Video App Sora

$DJI ( ▲ 0.47% ) Dow Jones Pulls Off 650-Point Rally on the Back of Surging Financial Stocks

Oracle Stock Plummets 12% as AI Spending Rises but Revenue Misses Target

₿ Crypto

Hollywood Director Guilty of Scamming Netflix out of $11M, Spending It on Crypto

Terraform's Do Kwon Sentenced to 15 Years in Prison for Fraud

Binance Overhauls Stablecoin Trading with Trump-Linked USD1

🚀 November Didn’t Play Around Inside TradingLab

If you were on the sidelines last month… yeah, you probably felt it.

Inside TradingLab, November delivered in a big way:

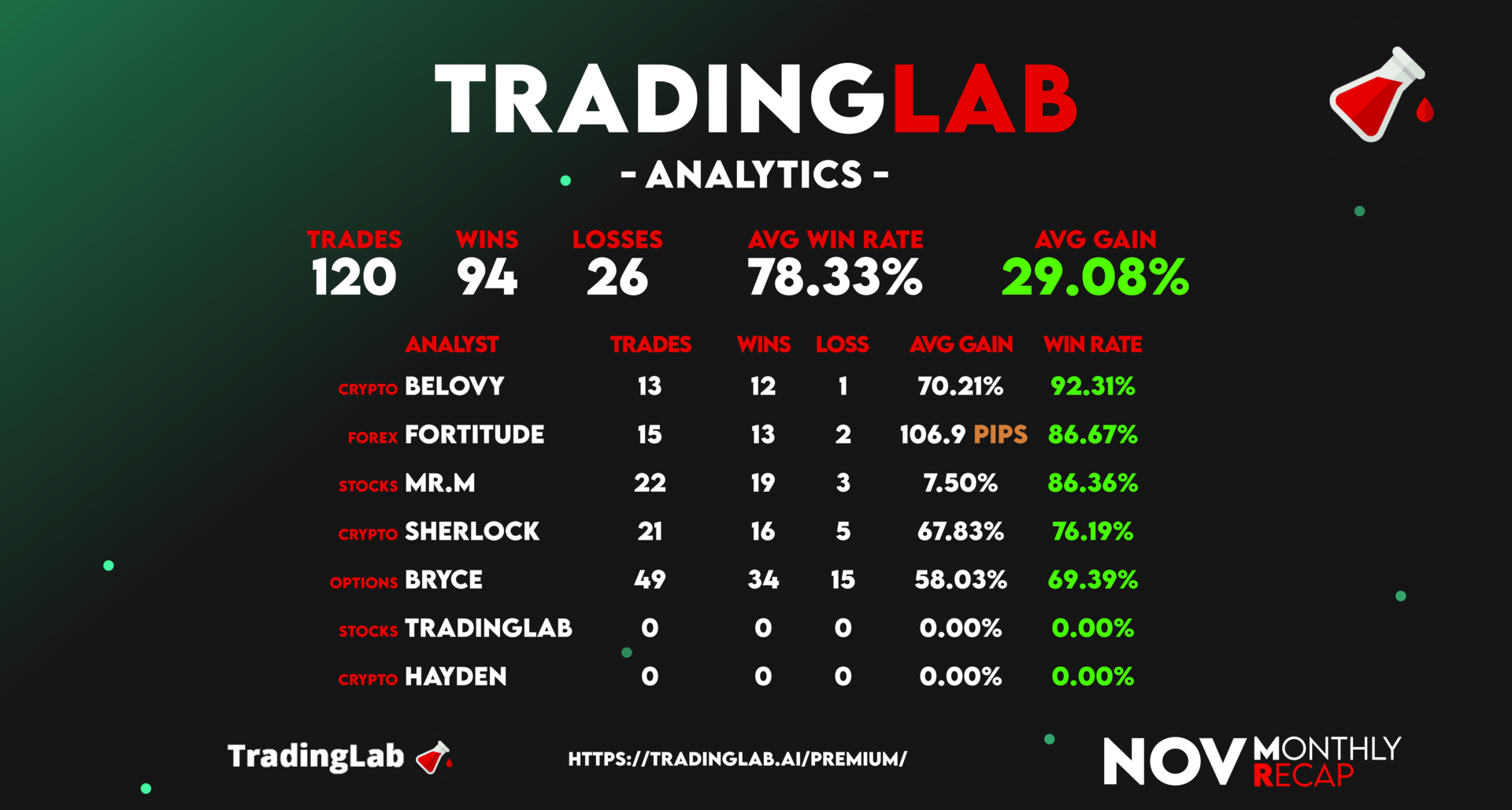

120 total trades

78.33% overall win rate

29.08% average gain

And that’s not even the full story.

Belovy closed November with a 92.31% win rate.

Fortitude averaged +106.9 pips.

Mr. M stayed locked in with an 86.36% win rate.

All of this happened during one of the choppiest, most unforgiving markets we’ve seen all year - and the team still executed. 🔥

🔥 Hard Markets Expose Weak Systems - Ours Held

When conditions get messy, luck disappears. What’s left is structure, discipline, and experience.

November proved one thing loud and clear:

Trading doesn’t reward guessing. It rewards preparation and teamwork.

That’s exactly why our traders weren’t scrambling - they were capitalizing.

📈 2026 Is Coming Fast - Don’t Be Late to the Party

Every month, more traders stop watching from the outside and start trading with us.

And if November was any indication, the next cycle is going to be wild.

You don’t want to be learning lessons late while others are already executing with confidence.

👉 Ready to Trade With a Real Team?

If you’re tired of trading blind and reacting instead of anticipating, it’s time to step inside.

Build consistency. Trade with clarity. Prepare before the next wave hits.

Stay ahead, stay informed, and most importantly, stay profitable.

‘til next time,

TradingLab