Good Morning!

November was busy. 120 trades. 78.33% win rate. +29.08% average gain. No hype, no fantasy P&Ls, just verified results and clean execution across crypto, stocks, forex, and options. While most traders were guessing, our members were following structured plans with clear risk and real data behind them.

Inside today’s newsletter, we break down the latest market moves, headline catalysts, and a free preview of a live trade idea our community saw in real time - before the move, not after.

Read on. The edge is below.

🚨 NEW TRADE RELEASED 🚨

📊 120 Trades Made in November | 78.33% Win Rate | +29.08% Avg Gain

Be among the traders getting access to our verified, transparent trade analytics - not hype, not “guru math.”

✔️ 94 winning trades vs. 26 losses

✔️ Crypto, stocks, forex & options signals

✔️ Top analysts hitting up to 92.31% win rates

✔️ Clear entries, exits & risk management , every trade

Our members don’t guess.

They follow data-backed signals inside a focused, private community.

Act fast , access is limited.

👉 Join TradingLab Premium today

🌡 TradingLab’s Headline Roundup

🏛 Stock Markets

$SPY ( ▲ 0.5% ) S&P 500 Posts Fourth Losing Day in a Row. Nasdaq Wipes Out 1.8%

$NKE ( ▲ 1.13% ) Nike Stock Crashes 10% Despite Revenue Beat. But China Sales Drop 17%.

$DXY ( 0.0% ) Dollar Gains Despite Bank of Japan Raising Rates to 30-Year High. What Happened?

₿ Crypto

Senate confirms Trump crypto-friendly nominees to take over CFTC, FDIC

How cheap power turned Libya into a Bitcoin mining hotspot

Crypto market cap falls to 8-month low, analysts see more pain ahead

IcomTech Crypto Ponzi Promoter Sentenced to Nearly Six Years in Prison

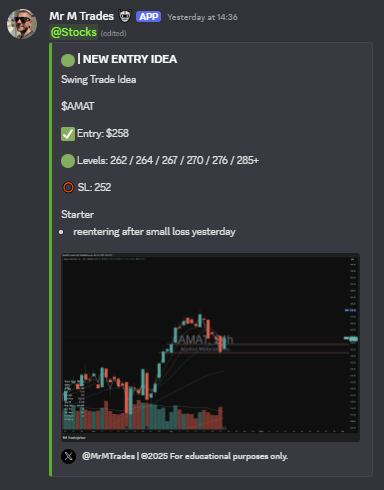

FREE PREVIEW: Sherlock Calls It Early - The $AMAT Swing Setup We’re Trading

The Play

Sherlock stepped up in the TradingLab community with a starter swing idea that had “too clean to ignore” written all over it.

$AMAT – Long

Entry: $258

Stop Loss: $252

Upside Targets:

$262

$264

$267

$270

$276

$285+

Simple structure. Defined risk. Plenty of room for expansion if momentum does its thing.

The Catalyst

Applied Materials sits right at the intersection of AI demand, semiconductor capex, and big-money institutional flows. Recent strength across the chip complex has kept AMAT firmly on radar, while continued optimism around advanced manufacturing and AI infrastructure spending provides a steady tailwind.

In short: money keeps flowing into this space, not out of it.

Our Take

This is the kind of trade we love, controlled risk with asymmetric upside. AMAT pulled back into a key support zone after a strong run, shaking out weak hands while maintaining its broader trend structure. That’s where pros step in… and that’s exactly what Sherlock spotted.

We’re not chasing highs. We’re positioning before the next leg. If AMAT clears nearby resistance levels, this trade has a very real shot at pressing into the higher targets.

And here’s the thing, this idea wasn’t posted after the move. It was shared live, in real time, with clear levels and a plan.

👉 Join TradingLab and get these trades daily, before they break out.

Because watching from the sidelines is way more expensive than being early.

👉 Ready to Trade With a Real Team?

If you’re tired of trading blind and reacting instead of anticipating, it’s time to step inside.

Build consistency. Trade with clarity. Prepare before the next wave hits.

Stay ahead, stay informed, and most importantly, stay profitable.

‘til next time,

TradingLab