Good Morning!

Markets are swinging, headlines are flying, and retail’s chasing ghosts again, meanwhile, we’re out here catching real moves before the crowd even knows what’s happening.

From billionaires reshuffling their portfolios to Bitcoin shaking out weak hands, there’s a ton of noise out there, but we cut through it, every single day.

This week, we’ll break down what’s moving, what’s next, and drop one of our latest plays that’s already heating up.

If you’re reading this, you’re already late. Want to see the trades as they happen, not after they’ve pumped? Stick around, or better yet, join TradingLab Premium and trade with us live.

Keep reading, it’s about to get good. ⚡

Market Rundown

Wall Street’s finally catching its breath after running on pure AI fumes all year. The S&P 500 logged its biggest drop in weeks as traders started side-eyeing those sky-high tech valuations. AMD’s “beat” didn’t impress anyone, stock dropped anyway, while Novo Nordisk trimmed its outlook and reminded everyone that even pharma kings bleed. Meanwhile, Bitcoin slipped under $100K for the first time in months, shaking out the leverage junkies. Bottom line? Sentiment’s cooling, but smart money’s not panicking, just reloading. When everyone’s crying “bubble,” that’s usually when we start shopping. 👀

$1K Could’ve Made $2.5M

In 1999, $1K in Nvidia’s IPO would be worth $2.5M today. Now another early-stage AI tech startup is breaking through—and it’s still early.

RAD Intel’s award-winning AI platform helps Fortune 1000 brands predict ad performance before they spend.

The company’s valuation has surged 4900% in four years* with over $50M raised.

Already trusted by a who’s-who roster of Fortune 1000 brands and leading global agencies. Recurring seven-figure partnerships in place and their Nasdaq ticker is reserved: $RADI.

Now open at $0.81/share, allocations limited – price moves on 11/20.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

🌡 TradingLab’s Headline Roundup

📈 Investing & Strategies

Billionaire Stanley Druckenmiller Dropped Nvidia and Palantir Stock and Is Piling into 2 Stocks Set to Win in One of the Decade's Hottest Growth Markets.

The Ultimate Growth Stock to Buy With $1,000 Right Now

🏛 Stock Markets

$SPY ( ▲ 0.16% ) S&P 500 Posts Biggest Loss in Weeks as Markets Question Lofty AI Valuations

$AMD ( ▼ 2.05% ) AMD Stock Tumbles 5% After Solid Double Beat. Blame Bad Timing and Sour Sentiment.

$XAUUSD ( 0.0% ) Gold Prices Drift Below $3,950 as Uncertainty Sweeps Global Markets

$AMZN ( ▲ 1.19% ) Amazon Stock Jumps 4% to Record High After $38 Billion Computing Deal with OpenAI

₿ Crypto

$BTC.X ( ▼ 0.69% ) Bitcoin Dives Under $100,000 as Crypto Traders Shed Risk

Animoca Brands' Public Market Ambition Aims at Providing Crypto Access to 'Billions'

Mamdani Wins NYC Mayor's Race: Here's What the Crypto Prediction Markets Foretold

🎯 Riding the HYPE Wave Before the Crowd

You’re Seeing This Late 👀

I called this one yesterday, so you’re already behind the move. If you want my trades as they happen, not after the fact, then you need to be in the room when we call them.

Join my trading community and get live plays, entries, and analyst calls in real time:

👉 Join TradingLab Premium

The Play

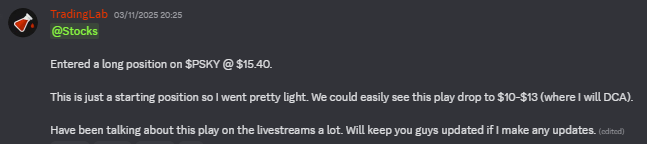

Ticker: $PSKY

Entry: $15.40

Plan: Starting light, will DCA between $10–$13 if we get a dip.

We opened a long on $PSKY as an early position. Nothing oversized yet, just enough skin in the game to ride the next leg up if momentum hits.

The Catalyst

$PSKY’s recent moves are catching attention across the sector. The company’s upcoming partnership announcement, rumored to involve a major blockchain infrastructure player, could be a serious inflection point. With sentiment swinging back toward mid-cap DeFi projects and liquidity creeping back into the market, $PSKY’s setup looks primed for a breakout once that news officially drops.

Our Take

We’re calling this a buy, but with patience. The chart still has room to breathe, and if we get that pullback into the $10–$13 zone, it’s an even better entry. The fundamentals are shaping up, the community buzz is real, and the risk/reward here looks filthy good if you’ve got the conviction to hold through the noise.

We’re already in, the question is, are you?

👉 Don’t just read about these plays after they happen, join TradingLab and catch them live, every day.

Want My Trades in Real Time?

Join TradingLab Premium, where me and my team of analysts share:

✅ Our daily trade alerts

✅ Real-time market breakdowns

✅ Exclusive strategies and entry levels

📈 Join us today and start trading smarter, not harder.

Stay ahead, stay informed, and most importantly, stay profitable.

‘til next time,

TradingLab