🚨 These trades delivered amazing 30%+ returns!!

Good Morning!

Let’s not sugarcoat it.

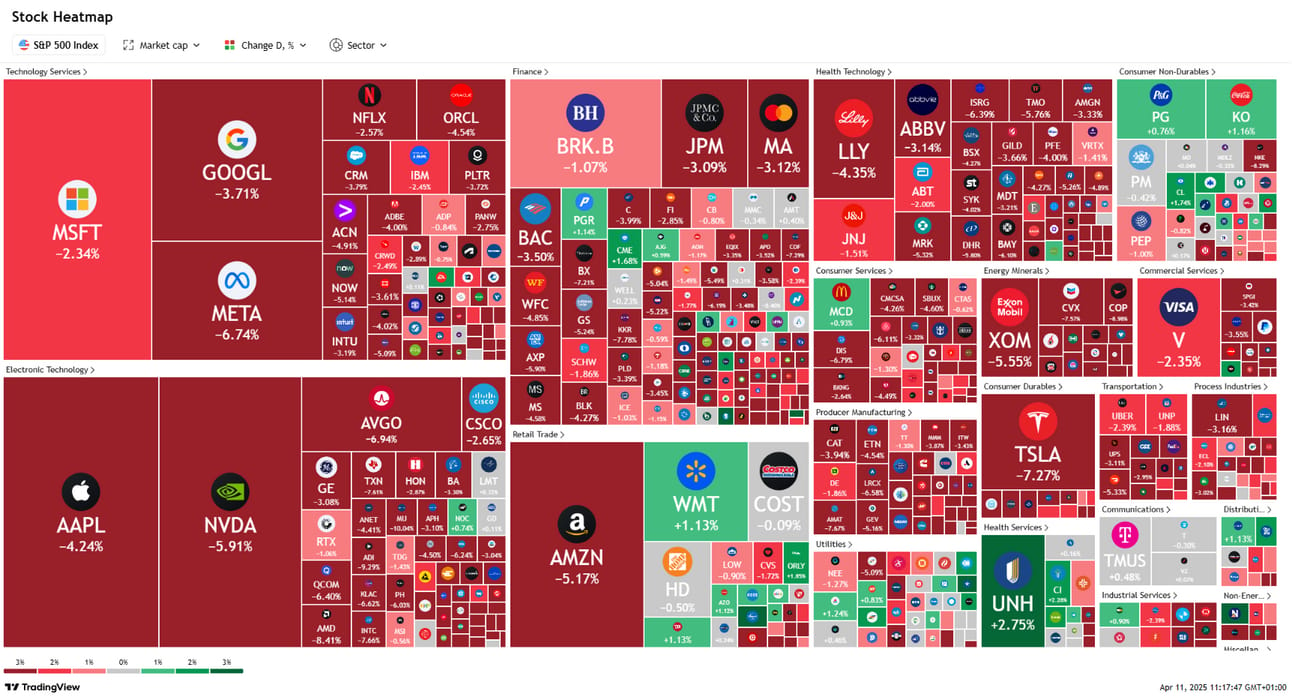

This market’s got more mood swings than a leveraged ETF on espresso. One minute we’re rallying, the next we’re staring down a tariff tantrum from Trump. The Nasdaq just tripped 4.3%, gold’s acting like it’s 2011 again, and bank CEOs are about to get grilled on whether the economy is “resilient” or just in denial.

Oh, and if you were hoping the crypto crowd would be the adults in the room… lol.

We’ve got the key moves, the big headlines, and the tea from Wall Street to DeFi, all in one place. Let’s dig in.

Read on. It’s spicy today. 🌶️

Let’s get into it 👇

🌡 TradingLab’s Headline Roundup

Stock Markets

11th April, 2025

🚨 BREAKING: Trump tariffs live updates: China raises retaliatory levies on U.S. goods to 125% as dollar sinks

Nasdaq Composite Dives 4.3% as Trump Has Traders Playing Red Light Green Light

Inflation for March Cools More Than Expected to 2.4%. Egg Inflation Hits 60%

Startup CEO Charged After 'AI' Turns Out to Be Humans in the Philippines

Crypto

Crypto gaming has mixed Q1 as deals jump, investment totals dip

President Trump Signs Resolution Erasing IRS Crypto Rule Targeting DeFi

World Liberty Says it Hasn't Sold Any Ether, Refutes Arkham Data

Crypto Competitors Grayscale and Osprey Settle Two-Year Tussle Over Bitcoin ETFs

Forex/Commodities

Euro Surges 4% to 3-Year High of $1.14. What’s Behind the Mighty Pop?

Japan Ready to Discuss Non-Tariff Issues With U.S. Including Forex, Economy Minister Says

Upcoming Earnings

via LevelFields

🕵️♂️ Pol Watch: Who’s Buying, Selling, and Hiding It

Another quiet week on the Hill… not a single trade reported from our usual suspects:

Brian Higgins, Susan Collins, Nancy Pelosi, Dan Crenshaw, David Rouzer, Roger Williams, Josh Gottheimer, Tommy Tuberville, Scott Franklin, or Markwayne Mullin.

Zero. Nada. Zilch.

Maybe they’re taking the “no trading” heat seriously… or maybe they’re just getting better at hiding it. Either way, no new filings this week, but you know we’ll be watching.

Stay tuned, the silence never lasts.

📈 What’s Moving Markets Today?

🔥 Futures Rebound, But the Vibes Are Still Off

After Thursday’s whiplash session, U.S. stock futures are tiptoeing higher this morning, trying to shake off the latest round of tariff drama like it’s just another day in the casino. The market’s been bouncing like a rookie trader on margin.

📌 What’s Moving:

Dow futures are up 0.3% (109 points), showing a pulse but not much more.

S&P 500 futures jumped 0.5%, and Nasdaq 100 futures rose 0.7%, because apparently hope springs eternal.

Thursday’s gains got wiped fast after Trump doubled down on his tariff game, clarifying that he’s not just raising tariffs to 125%, but that’s on top of a previous 20% hike. So yeah… math.

💣 Trump’s Trade War Is the Main Character Again

It’s official: the tariff tit-for-tat is back in the spotlight like it never left. President Trump’s decision to slap a total of 145% in tariffs on Chinese imports has the market looking queasy again.

📌 Key Fallout:

Wednesday’s “relief rally” is ancient history.

Trump’s aggressive stance is targeting China over fentanyl, but the markets don’t care why, it’s the size of the stick that matters.

Bonds sold off and volatility spiked, muting what could’ve been a solid day on the back of a better-than-expected March inflation report.

🏦 Big Banks Step Up to the Mic

If you’re looking for sanity, the banks might give us a glimpse. Earnings from JPMorgan, Wells Fargo, and Morgan Stanley hit today, and while Q1 numbers might not be disastrous, investors are listening more to the tone than the totals.

📌 What to Watch:

Don’t expect fireworks in the actual earnings, but every word from bank execs about the macro environment will be picked apart.

Analysts at Vital Knowledge expect a heavy dose of “resilience” spin, because that’s what you say when things aren’t actually great.

JPMorgan’s Jamie Dimon is already throwing shade on the tariffs, warning they could trigger a recession and borrower defaults. Yikes.

🧠 Consumer Confidence Test Incoming

The University of Michigan’s April consumer sentiment survey drops today. Last month’s report? A dumpster fire. People were stressed, confused, and seeing inflation monsters in their closets.

📌 Context:

March sentiment cratered as Americans freaked out over how Trump’s tariffs might hit their wallets.

Long-term inflation expectations spiked past 4%, which isn’t exactly what you want to see if you’re the Fed, or a grocery shopper.

This report will show whether people are actually adjusting their spending, or just doomscrolling.

✨ Gold Hits Record Highs Because Nobody Trusts Anything

While stocks flail around, gold just broke records, like a boomer yelling “told you so.” Spot prices hit $3,204.94/oz, while June futures cruised past $3,223.

📌 What’s Driving It:

A perfect cocktail of tariff fears + dollar weakness + general global anxiety.

Safe havens are in style again, and gold is getting the VIP treatment.

Even the yen’s having a glow-up. When people stop trusting the market, they start trusting shiny things.

🛢 Oil Rallies… But Still Set to Lose the Week

Oil prices popped today, but don’t let that fool you. Both Brent and WTI are heading for their second losing week in a row, thanks to the trade war shadow looming over everything.

📌 Reality Check:

Brent up 0.9% to $63.92

WTI up 1% to $60.69

Still, both benchmarks are down ~4% this week, following an 11% nosedive the week before.

China is the world’s #1 crude importer, so if their economy takes a hit, oil demand takes a nosedive too.

🎢 The Takeaway: Tariffs, Tension, and Tightropes

The market’s on edge, and for good reason. Tariff drama is back, bank earnings are a mixed bag, and gold’s rally is a flashing neon sign that says “TRUST ISSUES.”

If you’re trading this market, stay nimble, hedge smart, and don’t get cute. We’re in chop zone, and the bulls and bears are both exhausted.

Catch you after the dust settles.

Stay ahead, stay informed, and most importantly, stay profitable.

‘til next time,

TradingLab