Good Morning!

Bitcoin’s bouncing back after a tumultuous week sparked by the impending Mt. Gox repayments. Expect some turbulence as 140,000 BTC re-enter the market, but stay cool. The fundamentals are strong, and the long game looks solid.

Don't miss our latest video: it’s the ultimate trading indicator, reimagined. I’ve tweaked and perfected it, and it's ready to boost your trading strategy. Dive in, and let’s navigate these markets together.

Let’s get into it 👇

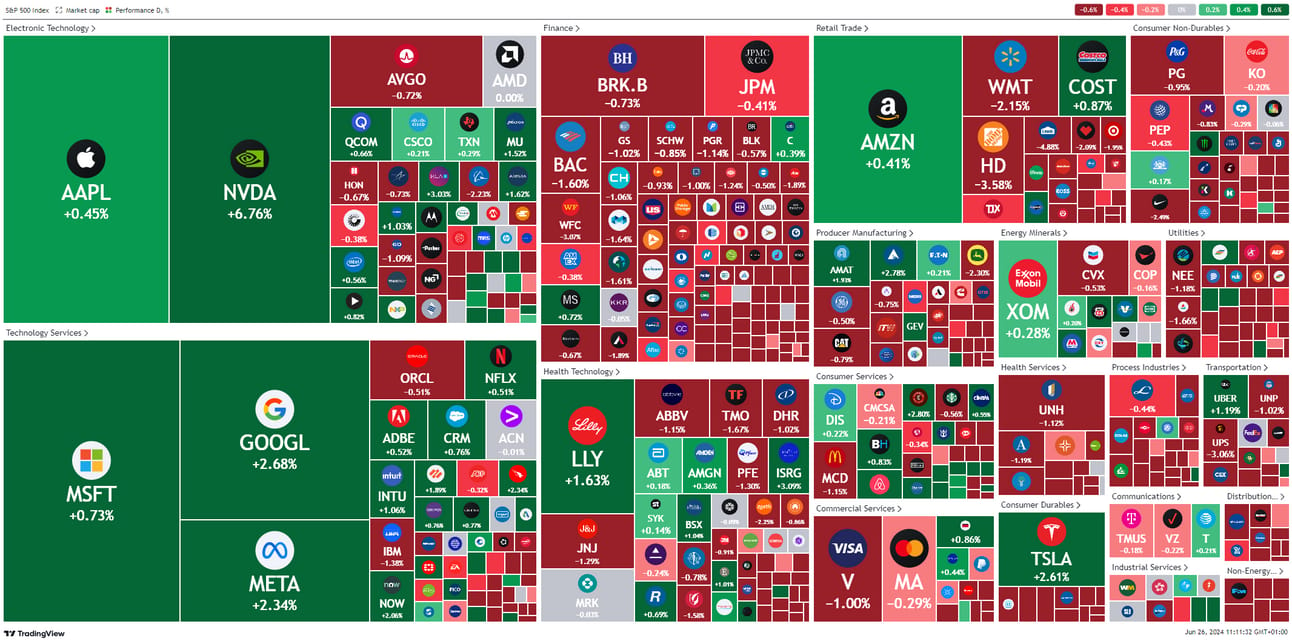

🌡 Market Temperature Check

📰 What’s Happening Today?

BTC Bounces back After Mt. Gox To Pay Back Billions

A creditor confronts Former Mt. Gox CEO Mark Karpeles / Via Coindesk

Buckle up, because Bitcoin has been on a wild ride this week. After taking a nosedive on Monday, the OG digital coin is making a comeback. Bitcoin prices plunged more than 7%, dropping from $63,000 to around $58,500. But guess what? It's already rebounded by 7%. So, what's the deal with all this volatility? Let’s dig in.

The Ghosts of Crypto Past

Remember Mt. Gox? If you’re new to the crypto world, here’s a quick history lesson:

Mt. Gox was the big cheese of Bitcoin exchanges, handling over 70% of all Bitcoin transactions back in the day.

In 2014, the exchange got hacked, losing a whopping 740,000 BTC, which would be worth about $15 billion today.

This catastrophe left a lot of folks hanging and led to years of legal battles.

Now, in a plot twist worthy of a Hollywood blockbuster, the trustee for Mt. Gox is set to return 140,000 BTC to creditors in July. Naturally, this has stirred up the crypto pot, with concerns that some of these early investors might decide to sell their precious Bitcoins, adding some selling pressure to the market.

The Roller Coaster Continues

When the news about the Mt. Gox repayments broke, Bitcoin prices took a hit, diving from $63,000 to $58,500. But before you could say "HODL," the market started to stabilize, with prices bouncing back by 7%. Here’s a snapshot of the mixed reactions:

Short-term jitters: The initial response was a bit of a freak-out, with fears of a Bitcoin sell-off looming large.

Long-term optimism: Some crypto sages believe that while we might see some short-term drama, the market will handle these new Bitcoins just fine in the long run.

Key Takeaways

So, what’s a smart investor like you supposed to do with all this chaos? Here are a few tips:

Brace for turbulence: With the return of Mt. Gox Bitcoins, expect some price swings. It's going to be a bumpy ride, so strap in!

Keep the faith: Despite the short-term noise, Bitcoin’s fundamentals are as strong as ever. Stay focused on the long game.

Stay cool: The crypto market has seen its fair share of storms and come out stronger. Don’t make rash decisions based on the daily ups and downs.

For those of you who love staying on top of things, keep an eye on the latest updates from Mt. Gox and the broader market trends. The crypto market’s resilience in the face of such news shows its growing maturity, even as it continues to keep us on our toes.

🚨 New Video Alert!

The Only Indicator You’ll Ever Need

Guess what? I just dropped a brand-new video on my YouTube channel, and it's packed with trading goodness - we unveil an indicator that's so accurate it's almost spooky.

Picture this: a gloomy day spent sifting through a mountain of trading indicators, each one more disappointing than the last. But then, just when all hope seemed lost, I found it. This indicator worked like a charm in trending markets, but it faltered during sideways movements.

I tinkered and tweaked it, adjusting the EMA baselines and pairing it with a stochastic momentum index. Voilà! Our indicator got a serious upgrade. In the video, I spill the beans on how you can make these magic adjustments yourself. 👇

I break down a super straightforward strategy using these indicators on higher timeframes, like the 4-hour chart. You'll learn how to jump into trades only when the stars (or, in this case, indicators) align. And wait for it—I even added a bonus indicator that helps you dodge those pesky consolidating markets.

I’ve backtested this bad boy, and it's looking pretty darn promising. I’m stoked about the potential here and think it could really amp up your trading game.

This is just one indicator, though. If you want access to ALL my indicators, as well as my real-time trade alerts and access to expert analysts, check out the TradingLab Premium on Discord - The largest & most profitable trading signals community.

✍ TL;DR

Mt. Gox

Mt. Gox Dominance: Once handled over 70% of all Bitcoin transactions.

2014 Hack: Lost 740,000 BTC (worth about $15 billion today).

Legal Battles: Led to years of litigation.

Repayment Plan: Trustee to return 140,000 BTC to creditors in July.

Market Impact: Initial Bitcoin price drop followed by a 7% rebound.

Investor Sentiment: Mixed reactions, with short-term jitters and long-term optimism.

Video Recap

New Indicator: Introduced a revamped trading indicator.

Problem Solved: Overcame issues with trending vs. sideways markets.

Upgrades: Enhanced with EMA baselines and stochastic momentum index.

Strategy Breakdown: Detailed 4-hour chart trading strategy.

Bonus Tip: Added an indicator to avoid consolidating markets.

Backtested Results: Promising performance, ready to boost your trading game.

Stay ahead, stay informed, and most importantly, stay profitable.

‘til next time,

TradingLab