Good Morning!

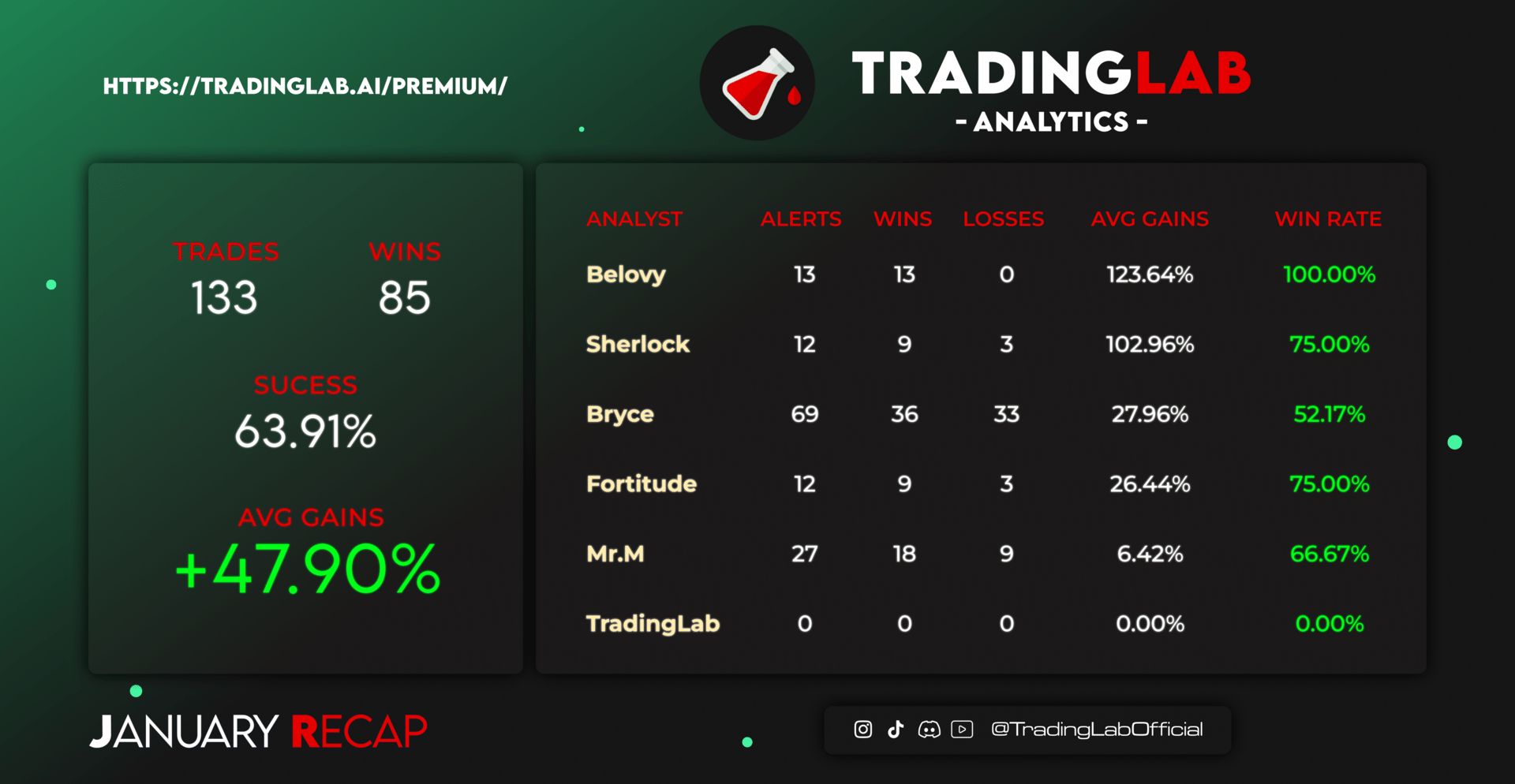

January recap is here!

Congrats to Belovy for having a perfect month 🔥

This January was filled with lots of uncertainty in the markets. Yet our analysts still came up on top.

These results reflect the continued discipline and precision of our analysts. This isn't luck. It's high-conviction, data-backed trading delivered in real time.

Let’s keep up the momentum moving into February! 💪📈

🌡 TradingLab’s Headline Roundup

Welcome to all the new faces joining us from the latest video 👋

If this is your first TradingLab newsletter, you’re in the right place. We break down what’s actually moving markets, cut through the noise, and - most importantly - show you how we’re trading it in real time.

Markets are back in “prove it” mode, with tech taking another hit as investors balk at eye-watering AI spend. Amazon $AMZN ( ▼ 2.62% ) is sliding after unveiling a $200bn capex splurge for 2026, adding fresh pressure to a Nasdaq already nursing its worst week since April. The hyperscaler arms race - Microsoft $MSFT ( ▼ 0.42% ) , Alphabet $GOOG ( ▼ 0.87% ) and Meta $META ( ▼ 2.38% ) included - isn’t slowing down, but traders are clearly questioning when all this infrastructure actually turns into returns.

Away from Big Tech, Stellantis $STLA ( ▼ 1.65% ) is ripping up its EV playbook with a hefty €22bn charge, crypto is firmly in the pain trade with Bitcoin $BTC ( ▼ 0.93% ) down heavily on the week, and oil $BZG23 ( 0.0% ) is drifting toward its first weekly loss in two months as U.S.–Iran talks chip away at geopolitical risk premium. Risk appetite isn’t gone - it’s just suddenly a lot more selective.

🏛 Stock Markets

$RDDT ( ▼ 3.43% ) Reddit Stock Pops 5% on Strong Earnings, Upbeat Guidance

$AMZN ( ▼ 2.62% ) Amazon Stock Tanks 12% as Spending Plans Knock Investors’ Confidence

$XAGUSD ( 0.0% ) Silver Plunges 18% in Fresh Rout. Is the Metal Now a Meme Trade?

$UBS ( ▼ 2.09% ) UBS Stock Drops Despite Swiss Bank Posting 53% Full-Year Profit Jump

₿ Crypto

$BTC ( ▼ 0.93% ) Bitcoin Goes Back to Pre-Election with Price Tumbling to $69,000

Bitcoin ETFs barely flinch as BTC slides 40%, Bloomberg’s Eric Balchunas says

$USDT ( ▼ 0.04% ) Tether makes $150M investment in Gold.com in latest gold play

🔓 FREE PREVIEW

My Portfolio Recap

The Play

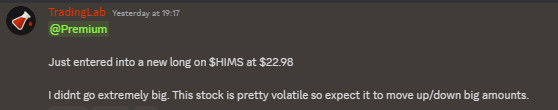

We entered a new long on $HIMS ( ▼ 0.88% ) at $22.98 - yesterday. Not this morning. Not “on the watchlist.” Entered.

Entry: $22.98

Position size: Moderate (this one swings hard, so we’re respecting the volatility)

Plan: Ride momentum and scale into strength if it confirms

Risk: Tight management - this name can move fast both ways

You’re reading this a day late. That’s fine. The community wasn’t.

The Catalyst

$HIMS has been quietly regaining momentum as growth names catch speculative flows again. The broader tape may be shaky, but high-beta consumer health plays are seeing renewed interest as traders rotate out of overcrowded mega-cap tech and into faster-moving mid-caps.

On top of that, sentiment around direct-to-consumer healthcare remains constructive - recurring revenue, expanding product lines, and sticky subscription models make it an attractive narrative when risk appetite firms up. When this one gets attention, it moves.

Our Take

This is a momentum long with teeth. $HIMS is volatile - which is exactly why we didn’t go oversized - but that volatility cuts both ways. If buyers step in, it doesn’t grind higher… it rips.

And let’s be clear: I entered this yesterday. You’re seeing it after the fact. Inside TradingLab, the alert went out the second I hit the button. I don’t enter a trade without calling it. Ever.

If you want these plays as they happen - not the morning after - you already know what to do. Join the community and get them in real time. The edge isn’t just what we trade. It’s when.

And if you’re reading this thinking, “I wish I caught that live,” that’s the point.

👉 Inside TradingLab, you get these trades in real time. entries, exits, updates, and profit protection included.

If you’re serious about catching moves like this before they rip, you know where to be.

Stay ahead, stay informed, and most importantly, stay profitable.

‘til next time,

TradingLab