Good Morning!

Another day, another market trying to pretend it knows what it’s doing. Luckily, you’ve got us to translate the chaos.

This week’s tape is giving “optimism with a side of anxiety”, rate-cut whispers, AI stocks catching their breath, crypto wobbling like it forgot how to walk, and oil doing its best impression of a slow-motion rug pull. In other words… a perfect playground for traders who actually know how to stay calm and play the long game.

We’ve got your market rundown, the biggest headlines you shouldn’t ignore, and a message that’ll probably save you a painful lesson down the road.

If you want the real insights, the ones that actually make you money, keep reading. The good stuff starts now.

Market Rundown

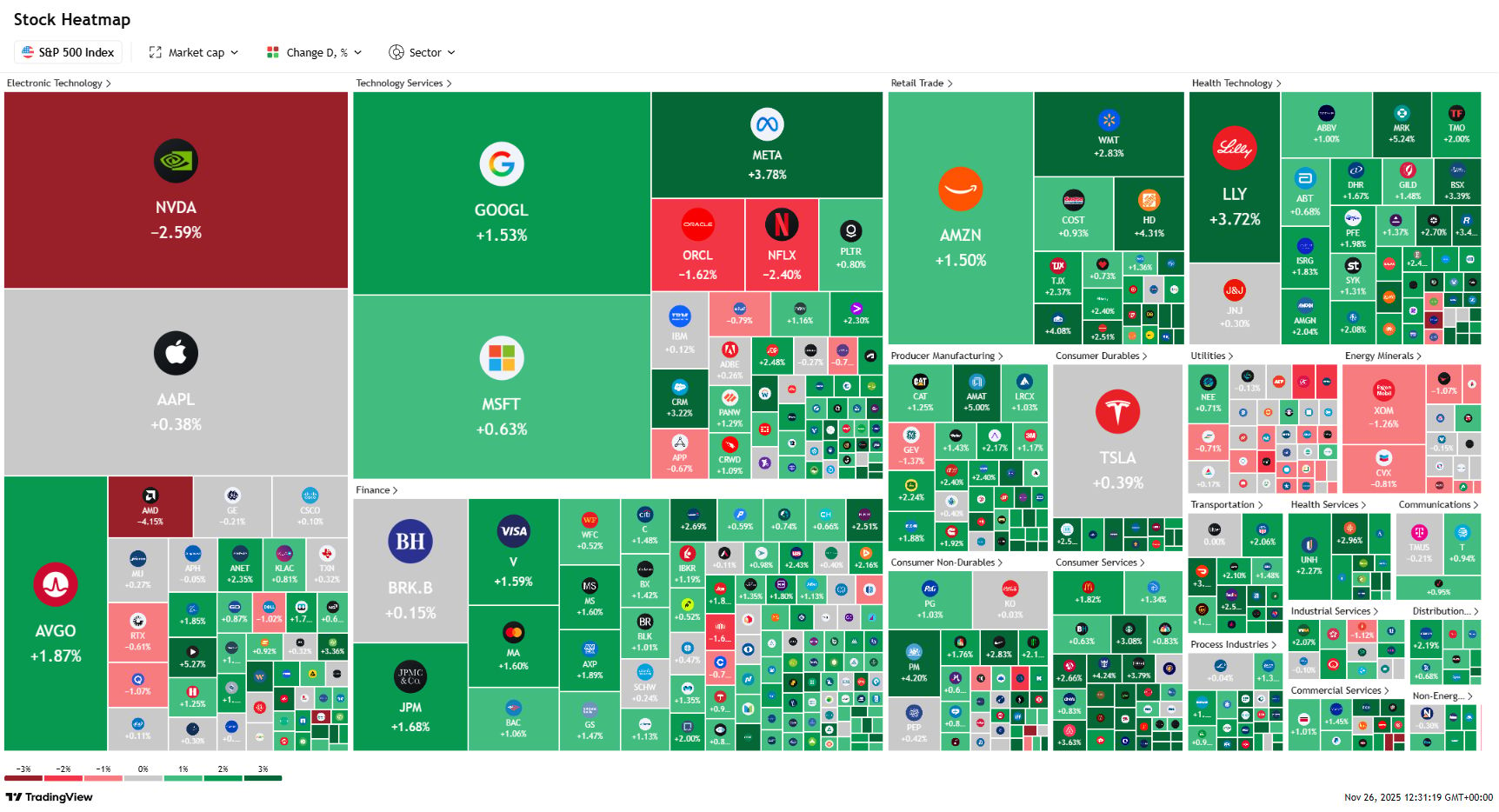

Futures are edging higher this morning as traders lean into rising expectations of a December Fed rate cut. Markets are now pricing in elevated odds of easing following weaker retail sales data and several Fed officials signaling support for cuts.

Tech looks mixed but calmer. Nvidia and other AI names are stabilizing after November’s volatility, while AMD continues to lag as investors reassess stretched chip valuations.

Crypto remains choppy. Bitcoin is fighting to stay above the mid-$80Ks after last week’s sharp selloff, with thin liquidity and ongoing outflows weighing on sentiment across the space.

Overseas, markets are watching Japan’s ¥21.3T stimulus package aimed at boosting competitiveness and AI investment. The yen has steadied slightly, but weakness still keeps BOJ intervention risk in play.

Energy continues to soften. Brent and WTI are drifting lower as traders digest reports of a possible U.S.–Russia peace framework that could ease supply disruptions and unwind geopolitical premiums.

Bottom line: Rate-cut optimism is helping markets stabilize, but crypto softness, falling crude, and geopolitical noise keep risk appetite fragile.

🌡 TradingLab’s Headline Roundup

📈 Investing & Strategies

5 Dividend Stocks to Hold for the Next 10 Years

How To Use TradingView For Beginners (My Secrets) 👇

🏛 Stock Markets

S&P 500 Pumps 1% as Traders Snap Up Shares of Just About Everything but Nvidia

Nasdaq Composite Shoots Up 2.7% as AI Trade Stages Big Rebound

Alphabet Stock Hits Record as Larry Page Becomes 2nd Wealthiest Person

Nvidia Drops 2.4% on Report Google Plans to Sell AI Chips to Meta. Now What?

₿ Crypto

Bitcoin Gains 10% from Lows to Stabilize Near $88,000. What to Watch Next.

Coinbase reveals 9 crypto ideas it wants to bankroll in 2026

DeFi is already 30% of the way to mass adoption: Chainlink founder

Altcoins HYPE, WLFI, and ENA are Soaring as Bitcoin Cools

The Vault Just Opened on a $2T Market Opportunity

Elf Labs owns 100+ priceless trademarks for icons like Cinderella & Snow White. They’ve already earned $15M+ in royalties, and are now using AI to turn these legends into living, interactive worlds for the next generation. With patented tech & a $2T market opportunity ahead, the next chapter of entertainment is being written in real time.

This is a paid advertisement for Elf Lab’s Regulation CF offering. Please read the offering circular at https://www.elflabs.com/

🤔 Stop Playing Hero, Start Playing Smart

Every once in a while, the market gives us a little reminder that it doesn’t care about your feelings, your hopes, or how badly you “need” a pump. And last night, I dropped a message inside the TradingLab community that a lot of people needed to hear, even if they didn’t want to.

Here’s the truth bomb:

If the market nukes 70% in the next six months and your portfolio or personal finances can’t survive it… you’re over-leveraged. Full stop.

Why a 70% Drop Is Actually a Gift

Most traders panic at the idea of a huge market flush. Meanwhile, seasoned operators get a little grin, crack their knuckles, and prepare the shopping list.

If the market melts down, yep, it’s opportunity. But you only get to take advantage of it if you’ve got free capital, not if you’re all-in praying your bags come back.

This is why having dry powder matters. Not just emotionally… mathematically.

Your Bills Don’t Care About Your Bags

If you’ve got 100% of your money tied up in your positions, who exactly is paying your rent? Your car payment? Your “I can’t believe eggs cost this much” grocery bill?

When real life starts knocking, people don’t hold, they break. And once you’re trading with panic instead of strategy, the game is already over.

How the Portfolio Is Positioned

Here’s exactly how my portfolio is structured right now:

30% bonds

30% free cash

40% equities

That means 60% of my net worth stays flexible no matter what happens. Could I be making more in a raging bull market? Of course.

But I don’t play for the next pump, I play for the next decade.

And that’s why I can survive anything… and capitalize when everyone else is crying into their keyboard.

The Slow Route Is the Rich Route

Everybody wants the overnight millionaire story.

Everybody wants the 100x moonshot.

Everybody wants to skip the grind.

And that’s exactly why most people lose.

Real wealth comes from discipline, patience, and positioning, not blind optimism and 5-second attention spans.

Simple advice… but it’ll save you a fortune in the future.

Want This Level of Insight Daily?

If you’re reading this thinking, “Damn… I needed that,” then imagine getting this kind of guidance every single day, plus real-time plays, breakdowns, and strategy sessions from traders who actually walk the walk.

The doors to TradingLab are open, but not for long.

If you want to stop guessing and start trading like someone who’s here to stay, then you need to get inside.

If you want plays like this as they happen - not summarized the next day - you know where to be.

You’re reading this after the community already got the breakdown.

They saw the chart, the levels, the thesis, hours before this hit your inbox.

If you’re tired of reacting late, tired of trading yesterday's setups, and tired of watching our members catch moves while you catch up…

Stay ahead, stay informed, and most importantly, stay profitable.

‘til next time,

TradingLab