Good Morning!

Another Fed day, another market pretending it has it all figured out. Futures are flat, traders are edgy, and everyone’s convinced this rate cut will be different (it always is… until it isn’t). Tech is still flexing, crypto’s finding its footing, and macro signals are just messy enough to keep the pros guessing and the tourists confused.

That’s where we come in.

Below, we break down what actually matters, the setups, the narratives moving price, and where traders are positioning before the headlines hit. No fluff, no fear-mongering, just clean reads in a noisy tape.

Scroll on for the full market rundown, our headline hits, and a look inside what’s been working at TradingLab. The market’s warming up, don’t sit this one out.

Market Rundown

Markets are doing that pre-Fed meditation pose, calm on the surface, mildly unhinged underneath. U.S. futures are hovering just above flat as traders count down to today’s Federal Reserve decision, where a long-anticipated hawkish cut is the base case. According to CME FedWatch, odds of a quarter-point trim are sitting around 88%, with rate markets already flirting with the idea of more easing in 2026. Hope springs eternal.

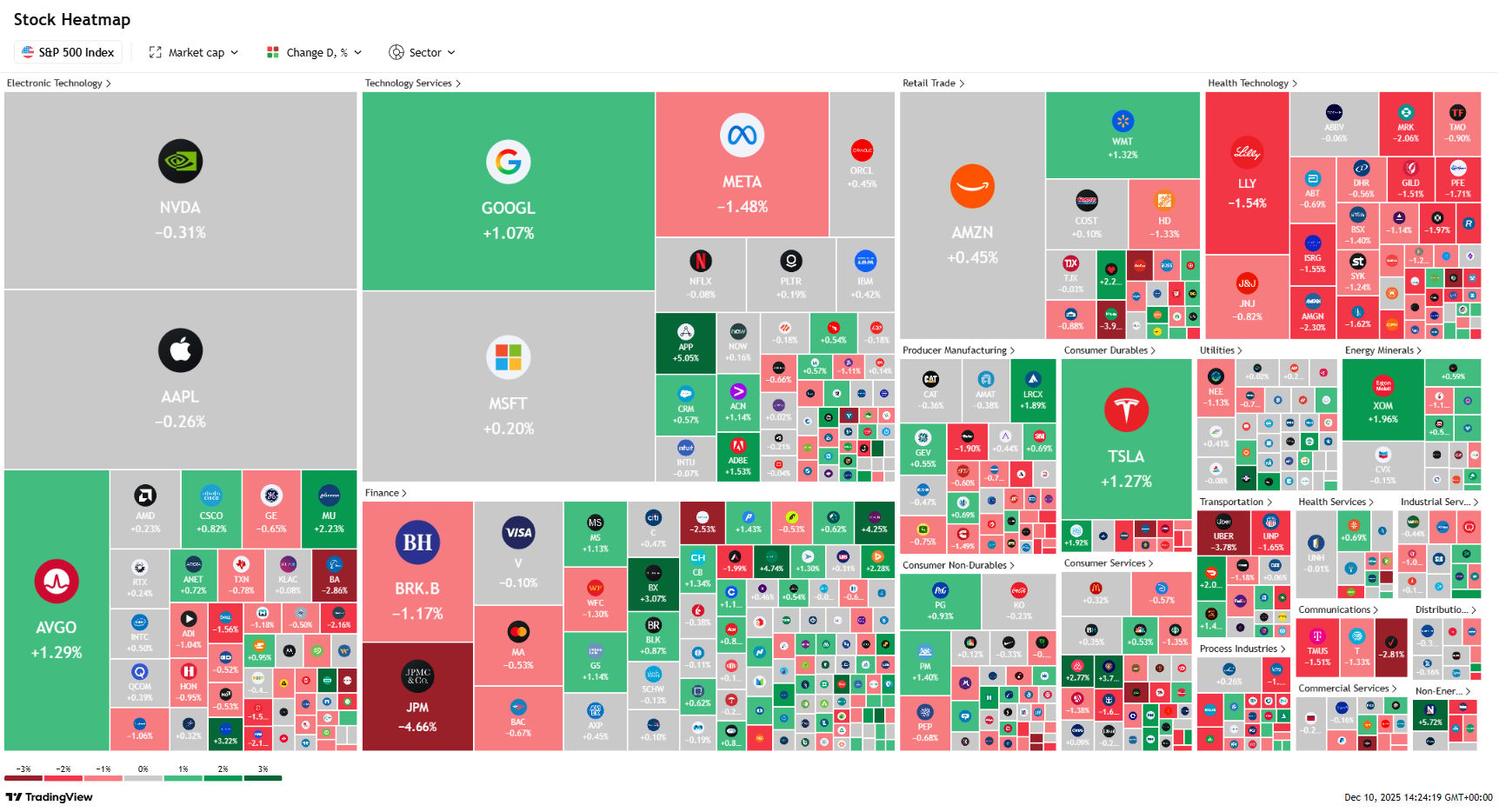

Tech is keeping the pulse alive. Oracle reports after the bell, and the market wants proof that its AI-fueled cloud renaissance isn’t just vibes and capex. Adobe follows, still wrestling with investor anxiety that generative AI eats seats faster than it creates them. Nasdaq’s relative strength suggests traders are still buying the future, just with a tighter stop.

On the macro side, fresh labor data showed job openings ticking higher, but hiring and quits staying sluggish, the kind of mixed signal that keeps Powell up at night and strategists employed. Layer in political spice with reports that Trump is beginning final interviews for the next Fed Chair (WSJ via Reuters), and suddenly rates traders are pricing policy and personalities.

Bottom line: The market smells a rate cut and refuses to ignore it, but nobody fully trusts the Fed to keep the easing party going. Stocks are steady, tech’s still strutting, and Powell’s about to decide whether this rally gets dessert or the check.

A New way to Earn Income from Real Estate

Commercial property prices are down as much as 40%, and AARE is buying income-producing buildings at rare discounts. Their new REIT lets everyday investors in on the opportunity, paying out at least 90% of its income through dividends. You can even get up to 15% bonus stock in AARE.

This is a paid advertisement for AARE Regulation CF offering. Please read the offering circular at https://invest.aare.com/

🌡 TradingLab’s Headline Roundup

🏛 Stock Markets

$DJI ( ▲ 0.63% ) Dow Jones Leads Decline with 200-Point Washout as Traders Brace for Rate Call

$GME ( ▲ 1.89% ) GameStop Stock Sheds 6% on Sliding Revenue. Bitcoin Stash Is Intact.

$DXY ( 0.0% ) US Dollar Steady Against Rivals as FX Traders Await Key Fed Decision

$TSLA ( ▲ 1.96% ) Tesla Stock Powers Up as Traders Hope for Powerful Santa Claus Rally

₿ Crypto

$BTC ( ▲ 2.98% ) Bitcoin Holds Near $92K as Selling Cools, but Demand Still Lags

$XRP ( ▲ 3.24% ) XRP price may grow ‘from $2 to $10’ in less than a year: Analyst

$ARK ( ▲ 1.18% ) Ark Invest’s Cathie Wood: Bitcoin’s Four-Year Cycle Will Be ‘Disrupted’

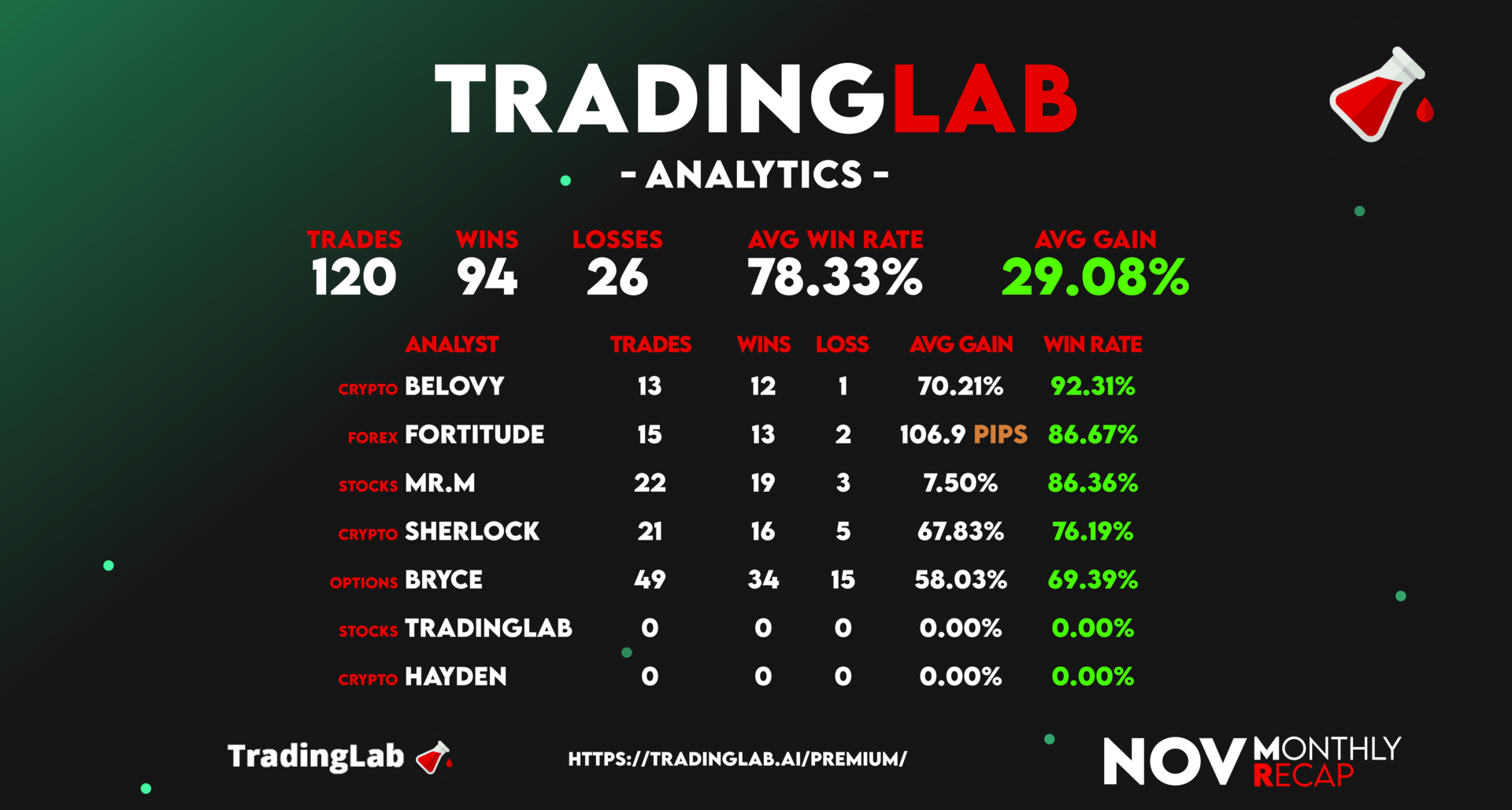

🚀 November Was a Monster Month Inside TradingLab

If you missed November… you felt it.

Here’s what went down inside the Lab:

120 trades

78.33% win rate

29.08% avg gain

Belovy: 92.31% win rate

Fortitude: +106.9 pips avg

Mr. M: 86.36% win rate

All in one of the weirdest, choppiest markets we’ve seen all year, and our team still crushed.

🔥 2026 Will Be Insane… Don’t Wait Until You’re Playing Catch-Up

Every month more traders are joining us and riding these wins with us… not watching from the outside.

If November proved anything, it’s this:

👉 You don’t rise in tough markets alone.

👉 You rise with a team, a system, and real traders who actually know what they’re doing.

2026 is going to be wild. Mark my words.

📈 Ready to Trade With Us?

Come inside the Lab and stop trading blind.

Let’s build your consistency before the next wave hits.

Stay ahead, stay informed, and most importantly, stay profitable.

‘til next time,

TradingLab