Good Morning!

Welcome back to TradingLab - where we don’t just watch markets move, we make moves while everyone else is still rubbing the sleep out of their eyes.

This week’s tape is serving up a little bit of everything: rate-cut hopium, crypto whiplash, AI megadeals, and energy markets acting like they drank two Red Bulls and a mystery potion. Perfect conditions for traders who know how to play it — and as usual, our community’s been feasting while the rest of the market tries to figure out what’s happening.

We’ve got the full breakdown below: what’s moving, why it matters, and how we’re positioning around it.

If you want the edge, you’re in the right place.

If you want the plays before they show up in your inbox… well, you already know where to find us.

Read on — it’s a good one.

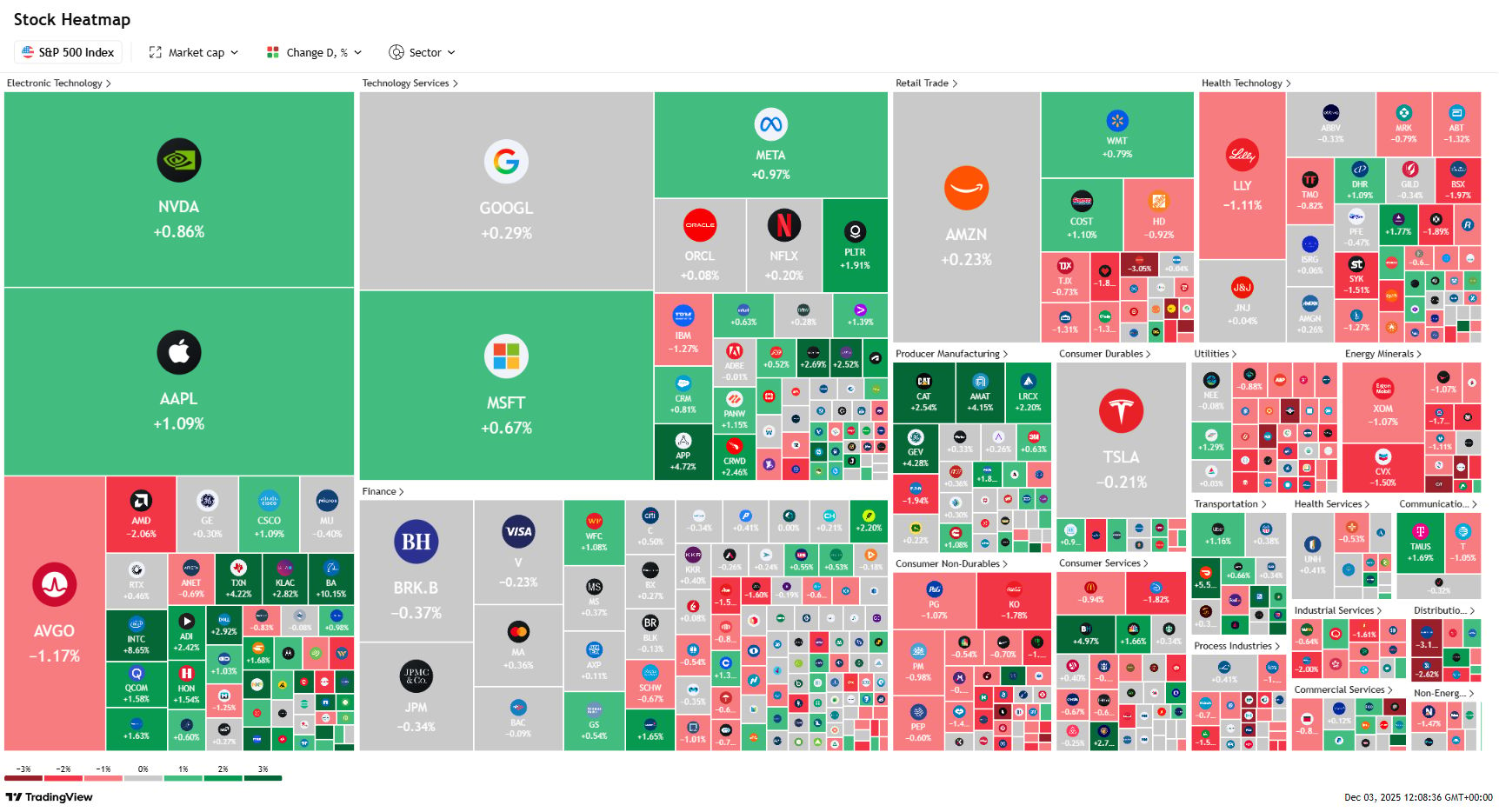

Market Rundown

Futures are creeping higher this morning as traders lean into growing confidence that the Fed will finally deliver a December rate cut. Odds of a quarter-point trim are sitting near 87%, according to CME FedWatch, with investors betting policymakers will prioritize a cooling labor market even as pockets of inflation remain annoyingly sticky.

Crypto is helping boost risk appetite too. Bitcoin snapped back above the mid-$90Ks, reversing the early-week washout and giving beaten-up crypto-linked names some breathing room. The rebound has added a bit of spark back into tech as well, helping support a broader recovery after Monday’s wobble.

Tech headlines are lively: Marvell confirmed a $3.25B deal to acquire Celestial AI, a move that plugs them directly into the photonics race — connecting AI and memory chips using light instead of electrical signals. Revenue impact won’t hit until late FY2028, but the market loves any narrative tied to expanding AI compute. Earnings from Pure Storage, CrowdStrike, and Okta are also in focus after solid reports Tuesday evening.

Energy is firmer, with Brent and WTI up more than 1% as talks between the U.S. and Russia failed to produce any breakthrough on a Ukraine peace framework. With no immediate deal in sight, supply risk remains elevated. Meanwhile, U.S. crude inventories continue climbing — the API reported a +2.48M barrel build — muddying the picture ahead of official EIA data later today.

Bottom line: Rate-cut optimism is steadying markets, crypto’s rebound is helping risk sentiment, and AI continues to dominate the headlines. But geopolitical uncertainty and rising U.S. crude stockpiles keep things a bit twitchy heading into the back half of the week.

🌡 TradingLab’s Headline Roundup

📈 Investing & Strategies

Billionaire Ken Griffin Buys an Index Fund That's Crushing Bitcoin, Nvidia, and the S&P 500 in 2025

How To Use TradingView For Beginners (My Secrets) 👇

🏛 Stock Markets

$DJI ( ▲ 0.1% ) Dow Jones Ekes Out Tiny Gain as Traders Look on the Bright Side in Holiday Month

$AAPL ( ▼ 2.27% ) Apple Stock Hits Record High, Reaching $4.2 Trillion in Value. What’s Behind the Rise?

$BTC.X ( ▼ 1.79% ) Bitcoin Hoarder Strategy Raises $1.44 Billion to Survive Steep Market Drop

$XAGUSD ( 0.0% ) Silver Hits All-Time High Above $58, Taking 2025 Gains to 100%. Take That, Gold.

$NASDAQ ( 0.0% ) Nasdaq Composite Dives 0.4% as Traders Kick Off December with No Enthusiasm

₿ Crypto

Crypto treasuries lead recovery after shaky start to December

CNN to Use Kalshi Prediction Markets Across Its News Coverage

Grayscale Launches First US Chainlink ETF on NYSE Arca

Gunmen Steal $85,800 in Trinidad Crypto Ambush as Attacks on Holders Rise

🤔 Stop Playing Hero, Start Playing Smart

The Play

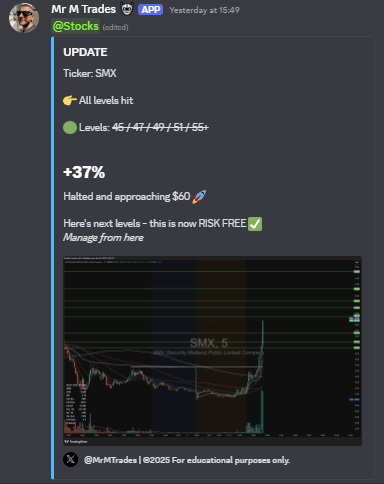

Mr. M walked in yesterday, dropped an $SMX ( ▼ 21.6% ) idea with zero hesitation, and the thing detonated exactly the way we like it.

Entry: $43.50 (break + VWAP reclaim)

Targets: 45 / 47 / 49 / 51 / 55+

Stop: 38.70

Outcome: Every. Single. Level. Hit.

Final Move: +37% and halted on the way toward $60. Risk-free, cruise control.

If you were in the community callout channel, you watched this one go from “nice setup” to “holy hell” in real time.

The Catalyst

SMX had all the ingredients for a face-melter: low float, surging volume, and a clean reclaim of VWAP right into a pivot break. Add in market-wide momentum and you've got the perfect recipe for a parabolic run.

The moment it cleared the pivot with conviction, the bids stacked, volume exploded, and the breakout became a runway. Halts, level smashes, everything you want from a momentum name when it decides to go full rocket mode.

Our Take

This was a textbook buy-the-break-and-ride-the-momo trade, and Mr. M executed it flawlessly. Simple trigger, disciplined stop, clean targets — and then the market did the rest.

To our members who caught it: congratulations.

If you grabbed the Black Friday 40% off deal? This single trade probably already paid for your entire membership.

If you missed the sale… yeah, that’s rough. But missing trades like this? That’s even rougher.

🔥 Stop watching from the outside. Join TradingLab and get these setups in real time, every day.

If you want plays like this as they happen - not summarized the next day - you know where to be.

You’re reading this after the community already got the breakdown.

They saw the chart, the levels, the thesis, hours before this hit your inbox.

If you’re tired of reacting late, tired of trading yesterday's setups, and tired of watching our members catch moves while you catch up…

Stay ahead, stay informed, and most importantly, stay profitable.

‘til next time,

TradingLab