Good Morning!

Ethereum just rocked the scene with a staggering 22% surge, driven by rumors of the SEC approving spot Ether ETFs. This massive $70 billion gain has everyone talking, with political drama adding to the excitement.

On the flip side, Cardano (ADA) is struggling to break the $0.500 resistance. Thanks to Hayden's timely call, our premium members are already enjoying a 52% profit from this ADA short. If you're still in the trade, keep an eye on those stop losses.

Let’s get into it 👇

🌡 Market Temperature Check

Investors are buzzing as chipmaking titan Nvidia is set to release its quarterly figures after the bell. The Nasdaq Composite soared to a new all-time high on Tuesday, with tech shares, especially Nvidia, driving the surge, fueled by a powerful rally in AI. The AI infrastructure and data centers are hot commodities, with all the big tech players wanting a piece of the action.

Meanwhile, the S&P 500 hit a record high, adding 0.25% for a year-to-date increase of over 12%, and the Dow Jones inched up 0.17%. However, the banking sector felt a bit heavy after JPMorgan's Jamie Dimon hinted at his upcoming retirement.

🚀 Elevate Your Trading Game with TradingLab Premium!

🔥 Are you ready to see real profits? 🔥

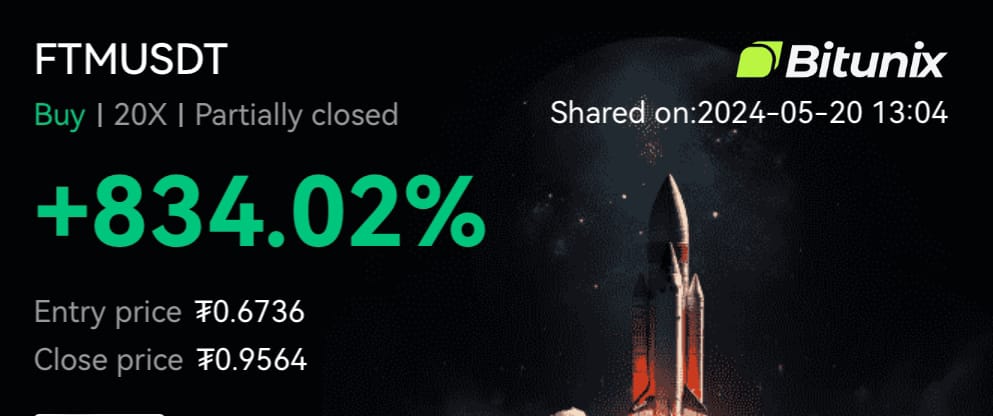

Imagine a trading day where 834.02% on FTMUSDT and 655.97% on DOGEUSDT are part of your portfolio. That’s the reality for our premium members at TradingLab, where profits are just another day at the office! 📈

Dive into a community fueled by exclusive insights, real-time signals, and revolutionary strategies that transform average traders into market conquerors. At TradingLab, we don’t just trade; we dominate the charts.

Why settle for less when you can trade alongside the best? Enhance your skills with personalized mentorship, detailed analysis, and a network of driven traders, propelling you to heights you've only imagined.

📈 Market Update

Ether Skyrockets: A $70 Billion Day for ETH

Ethereum just gave the market a shockwave. On Monday, the price of ether surged over 19%, adding a whopping $70 billion to its market cap, pushing it to $439 billion. To put that into perspective, this gain is nearly equivalent to 90% of Solana's entire market value.

Key Driver: The main catalyst behind this explosive growth was renewed optimism around the approval of a spot ether exchange-traded fund (ETF) in the U.S. This optimism came after the SEC made significant strides in the approval process.

SEC's Abrupt Pivot on Ether ETF Approval

The SEC’s sudden progress on the ether ETF approval has left many in the market stunned. CoinDesk reported that by the close of the U.S. business day on Monday, the SEC had asked exchanges to update their 19b-4 filings for ether ETFs.

Market Reaction: A Polymarket contract predicting the approval of an ether ETF by May 31 saw its price skyrocket from 10 cents to 55 cents, indicating a 55% chance of approval by the end of the month.

Implications: This development has fueled speculation and significantly increased market confidence in the imminent approval of an ether ETF, further propelling ETH prices upward.

Political Underpinnings and SEC Coordination Woes

However, the SEC's sudden change of heart hasn't come without controversy. According to The Block, this shift appears to be politically motivated.

Internal Confusion: Sources revealed a lack of coordination within the SEC, with the division of trading and markets pushing for approval while the division of corporation finance seemed out of sync.

Political Angle: As elections loom, some believe the SEC's move could be influenced by political pressures. Notably, former President Donald Trump has recently made pro-crypto statements, suggesting that crypto supporters should vote for him, contrasting President Joe Biden’s perceived lack of understanding of the industry.

The unexpected progress in the ether ETF approval process, the internal disarray within the SEC, and the potential political motivations behind these moves add layers of intrigue and uncertainty to the market. Keep your eyes peeled, traders – the next few weeks could be pivotal for ETH.

👾 Crypto Catalyst

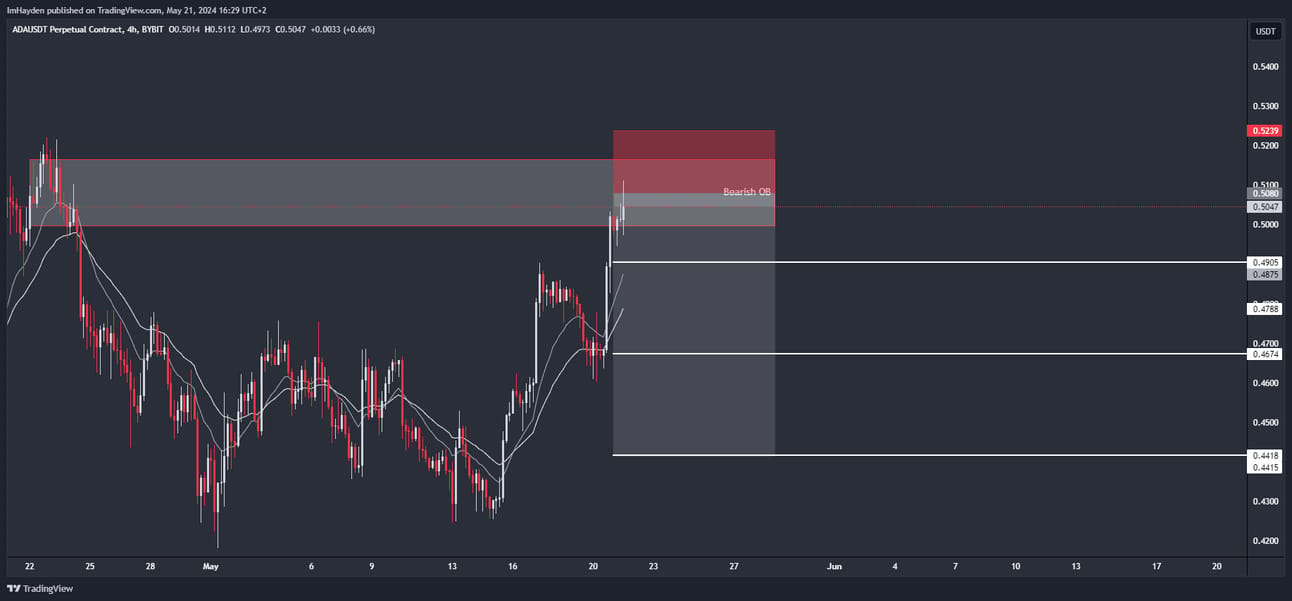

ADA/USDT Short 📉

Our original trade on this was yesterday, premium members are already sitting pretty at 52% profit on this move!

Entry: 0.4998 - 0.5166

Stoploss: 0.5239

TP 1: 0.4905

TP 2: 0.4674

TP 3: 0.4418

Leverage: 15x

Portfolio Allocation: 2%

Update as of 22/05/2024:

TP 1 hit on ADA +52% 🚀

Moved SL to Entry

The Catalyst

Cardano (ADA) has been unable to break above the critical $0.500 resistance zone, signaling weakness. Technical analysis shows strong support around $0.480, but indicators are pointing towards a bearish trend with continued selling pressure. The current price hovers around $0.49, reinforcing a cautious approach. This setup is ideal for those who acted on Hayden's timely advice, reaping initial profits as TP1 has been achieved.

Our Take

Why is this a sell? Simple. Cardano's struggle to break the $0.500 resistance is a clear indicator of its current bearish momentum. The market is not favoring an upward movement, and the selling pressure remains strong. By moving the stop loss to entry after TP1, our members are locking in profits while minimizing risk.

This play was a textbook example of how technical analysis and strategic trading can lead to significant gains. If you’re still in the trade, keep a close watch and adjust your stops accordingly. This is how you trade smart with TradingLab – solid analysis and precise execution.

Looking for visuals and charts, rather than words, to understand the daily news?

Bay Area Times is a visual-based newsletter on business and tech, with 250,000+ subscribers.

✍ TL;DR

Ethereum (ETH) Surge:

Massive Gain: ETH surged 22%, adding $70 billion to its market cap.

Catalyst: Optimism around SEC potentially approving spot Ether ETFs.

Market Reaction: Polymarket contracts predicting ETF approval rose from 10 cents to 55 cents.

Political Angle: Possible political motivations and internal SEC coordination issues.

Cardano (ADA) Short:

Initial Trade: Shorted at 0.4998 - 0.5166 with a 15x leverage.

Current Status: TP1 hit with a 52% profit.

Key Insight: ADA is struggling to break the $0.500 resistance, signaling bearish momentum.

Strategy: Move stop loss to entry to lock in profits and minimize risk.

Stay ahead, stay informed, and most importantly, stay profitable.

‘til next time,

TradingLab