Good Morning!

First up, despite solid earnings, Arm's stock took a dive—a stark reminder that markets always have the last word. In a different corner, Cathie Wood isn't shying away from deals, snatching up 3 bargain stocks that are setting the scene for a strategic comeback.

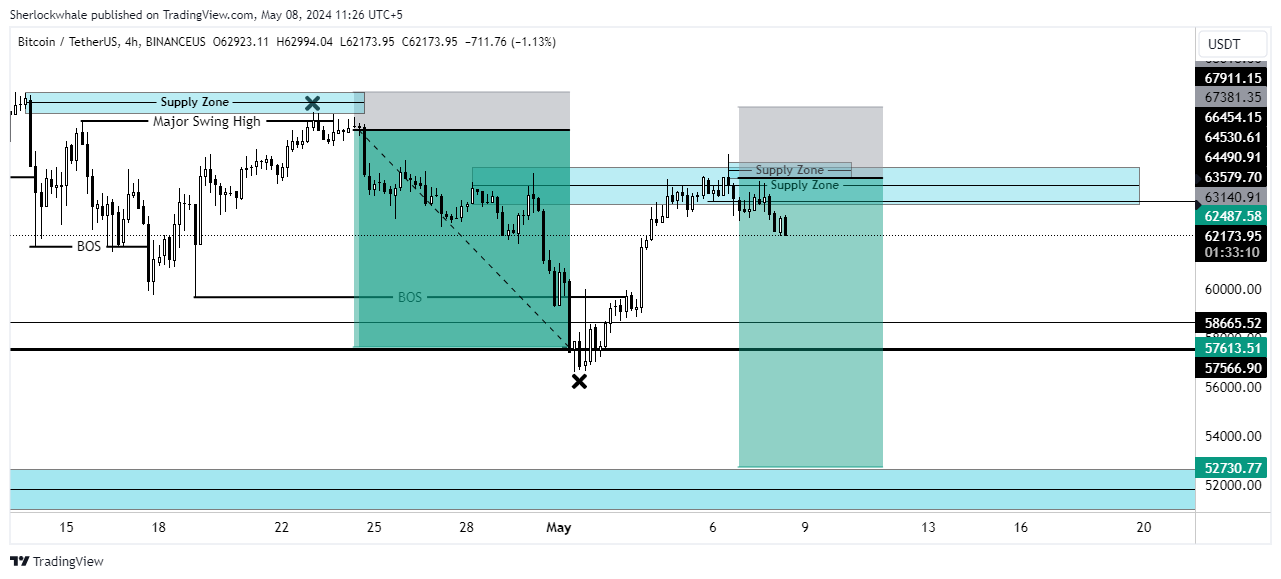

Dive deeper into our handpicked stock watchlist, primed for today’s trading turbulence. Plus, don't miss our crucial crypto segment, where Sherlock dissects $BTC's near miss at $64,500, offering insights that could redefine your strategy.

As the crypto world twitches with every tick, understand how recent network strains might shape Bitcoin's journey. Sherlock's sharp analysis highlights why staying prepared for potential retests and price adjustments is your best defense in this high-stakes market.

Don't miss the chance to be part of something big. Our sponsor, Ryse, is offering you the opportunity to invest in their public offering of shares.

Let’s get into it 👇

🌡 Market Temperature Check

Missed out on Ring and Nest? Don’t let RYSE slip away!

Ring 一 Acquired by Amazon for $1.2B

Nest 一 Acquired by Google for $3.2B

If you missed out on these spectacular early investments in the Smart Home space, here’s your chance to grab hold of the next one.

RYSE is a tech firm poised to dominate the Smart Shades market (growing at an astonishing 55% annually), and their public offering of shares priced at just $1.50 has opened.

They have generated over 20X growth in share price for early shareholders, with significant upside remaining as they just launched in over 100 Best Buy stores.

Retail distribution was the main driver behind the acquisitions of both Ring and Nest, and their exclusive deal with Best Buy puts them in pole position to dominate this burgeoning industry.

👾 Crypto Catalyst

Bearish $BTC Update From Sherlock

As our trusted analyst Sherlock observed, the Bitcoin scene remains a game of patience and precision. Despite a tantalizing near-miss—$BTC stopping just short of the critical $64,500 mark—our strategy stays unwavering. The price peaked at $64,300, slightly shy of triggering our desired trades, but as seasoned market navigators, we understand that the dance with digits is all about timing.

Sherlock's latest analysis highlights the significant role of the H4 supply level, which is currently dictating the tempo of Bitcoin’s price movements. While some may get distracted by the surrounding market noise, Sherlock advises maintaining focus on the bearish structure that’s emerging right before our eyes. Our game plan? Stay prepared for a potential retest of $64,500, which, if unsuccessful, could propel $BTC downwards to find balance at $60,500 before potentially plunging to the $57,000 territory.

Network Strains Amidst Trading Strains

While Bitcoin remains loftily perched above $60,000, the underlying network fundamentals narrate a story of strain. Recent data from Cointelegraph Markets Pro and TradingView has traced Bitcoin as it subtly descends, undoing the gains of the previous week. This slow erosion in value, compounded by a lack of significant bullish momentum, leaves traders like us watching the market’s every pivot.

Network Strain via BTC.com

Amidst these trading challenges, Bitcoin’s mining difficulty is poised for a notable decrease of 5.5%—marking the most considerable single downward adjustment since the tail end of the 2022 bear market—this change signals shifting dynamics within the network itself. The difficulty currently stands at a record high of 83.23 trillion, yet the price maneuvers under much different conditions compared to when BTC/USD hovered around $20,000.

TradingLab's Takeaway

In this complex tapestry of high stakes and higher algorithms, Sherlock reminds us to cut through the clamor and capitalize on the clarity of the charts. As we navigate these turbulent waters, our community's strength lies in our collective resilience and the sharp insights of analysts like Sherlock. Keep your eyes on the prize and your strategy tight—more opportunities for bearish bets may be on the horizon, and readiness is our most valuable asset.

In TradingLab, we don't just follow trends—we anticipate them.

Tap below to get VIP Access to the largest & most profitable trading signals community 👇

✍ TL;DR

$BTC Price Action: Peaked at $64,300, just shy of the significant $64,500 level, with our strategy remaining focused on patience and precision.

Key Levels: Sherlock emphasizes the H4 supply's crucial role, pointing to a bearish structure. Watching for a potential retest at $64,500, possibly dropping to $60,500 and down to $57,000.

Network Strain: Bitcoin network shows signs of strain as mining difficulty is set to decrease by 5.5%, the largest drop since late 2022.

Trading Strategy: Maintain focus on emerging bearish patterns, with readiness to capitalize on potential declines.

Market Insight: Continue to observe and adapt to Bitcoin’s subtle value shifts and network changes.

TradingLab Advice: Stay alert, focus on the charts for trading opportunities, and prepare for bearish bets.

Stay ahead, stay informed, and most importantly, stay profitable.

‘til next time,

TradingLab