Good Morning!

First up, we're tackling Tesla's unexpected nosedive – a nearly 5% plunge that's got everyone talking. What's behind this slump? We've got the inside track. Then, there's Bitcoin, showing signs of fatigue after a stellar rally. Is this the calm before another storm, or a signal to rethink your strategy?

Plus, we're demystifying market movements with our latest video on avoiding false breakouts. It’s not just about knowing the traps; it’s about turning them to your advantage with liquidity strategies. And for the crypto enthusiasts, we're spotlighting a golden opportunity: CFX/USDT. Our breakdown includes specific strategies, entry points, and risk management to help you seize this moment with confidence.

Let’s get into it 👇

🔥 March Profit Report: Just the Beginning

Let's cut to the chase – our March numbers are not just good; they're off-the-charts exceptional. Bryce on options? Dominating with an 82.14% win rate. Mr. M on stocks? He's the sniper with a 97.62% accuracy. And crypto with Reynard? We're talking a 121.76% average gain.

What’s so special about TradingLab?

✨ Precision Calls: Our analysts don’t just predict; they deliver. You're not following trades; you're joining a proven history of big wins.

💥 Unmatched Expertise: You want professionals? We've got the pros that others wish they could be.

🎯 Exclusive Tools: Premium members get the key to our TradingLab indicator – and it's on us.

With our private trading community, you're not just trading; you're rewriting your financial story. And that proprietary indicator everyone's whispering about? Consider it yours when you go premium.

It's not about joining a signals group; it's about joining the winning team. It's about turning the markets into your playground.

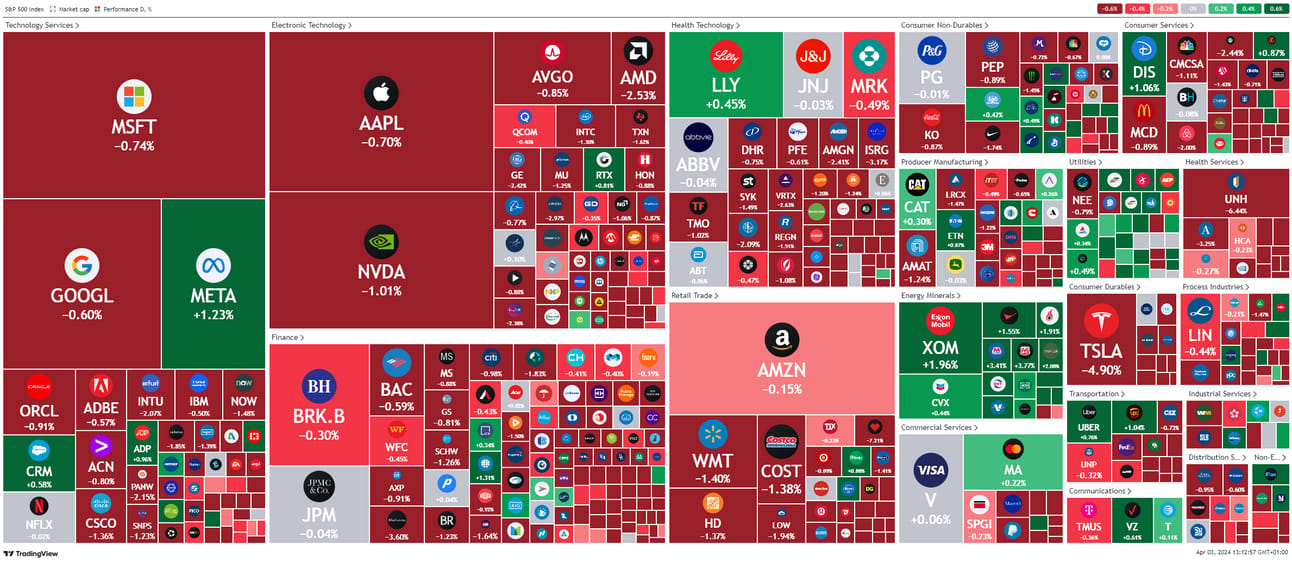

🌡 Market Temperature Check

📽 How I Avoid False Breakouts (New Technique)

New Video Alert!

Have you ever been caught in the classic chart setup, where a promising breakout turns into a wallet-draining false breakout?

The video starts with a familiar scenario: you spot a potential breakout, volume is surging, and you're ready to jump in, dreaming of huge gains. But then, the market pulls a fast one on you – a false breakout, leaving your account in shambles. Sounds familiar?

But what if there's a strategy to not just avoid these traps but also capitalize on them? The answer lies in understanding market liquidity. It's the fuel that drives market movements. I’m talking about how big players exploit common stop-loss areas to create liquidity for their entries, leading to false breakouts.

The real kicker? You can use this knowledge to your advantage. The strategy involves identifying points of liquidity (disguised as support or resistance) and fair value gaps, which are imbalances in the market. By understanding how price targets these areas, you can anticipate moves and make smarter trades.

Don't just take my word for it; the video dives deep into the mechanics of this strategy with practical examples. It's not just theory – this is actionable intelligence that could revolutionize your trading approach.

Don’t miss it! 👇

👾 Crypto Catalyst

Our CFX/USDT Long Play

The Play:

Entry Points: 0.36008 - 0.37437

Stop-Loss: 0.33985

Take Profits:

TP1: 0.39416

TP2: 0.44231

TP3: 0.51509

Strategy: Using 2% of your portfolio with 10x leverage.

Risk Management: Move Stop-Loss to Entry after reaching TP1.

Hayden’s Call

The Catalyst:

China's grand entrance into the blockchain arena comes with the introduction of a new public blockchain infrastructure platform, led by none other than the Conflux Network (CFX). This isn't just any initiative; it's the "Ultra-Large Scale Blockchain Infrastructure Platform for the Belt and Road Initiative." Think of it as a digital Silk Road, laying down the tracks for cross-border applications on a public blockchain. This isn't just a step forward; it's a leap into the future of international trade and digital collaboration, with CFX at the helm.

Our Take:

Here's the deal: when a major global player like China throws its weight behind a blockchain project, you don't just sit on the sidelines. You jump in. And that's exactly why we're eyeing CFX/USDT as a buy.

Why Buy? It's not every day that a blockchain project gets the nod from a powerhouse like China. This backing isn't just a vote of confidence; it's a catalyst for potential exponential growth. Conflux Network is no longer just another player in the crypto game; they're now a front-runner in an international initiative.

The Strategy: Leveraging 2% of your portfolio with 10x leverage might sound bold, but bold moves are what separate the traders from the onlookers. With carefully placed entry and exit points, and a strategy to move the Stop-Loss post-TP1, we're playing it smart yet aggressive.

The Potential: With targets set at TP1 (0.39416), TP2 (0.44231), and TP3 (0.51509), we're not just dipping our toes – we're diving in for potentially significant returns.

Ready to jump into the fray? Join the TradingLab community. Stay ahead of the curve with insights like Hayden's, and join a community that's as invested in your success as you are.

✍ TL;DR

Avoiding False Breakouts

Reveals strategies to identify and exploit false breakouts.

Focuses on understanding market liquidity and its impact on price movements.

Highlights the tactics used by big players to manipulate common stop-loss areas.

Explains how to spot points of liquidity and fair value gaps as trading opportunities.

Provides practical, actionable examples to enhance trading decisions.

CFX/USDT Long Play:

Play based on China's endorsement of the Conflux Network (CFX) for its blockchain initiative.

Suggested Entry Points: Between 0.36008 and 0.37437.

Stop-Loss: Set at 0.33985 to manage risk.

Take Profit Targets: TP1 at 0.39416, TP2 at 0.44231, TP3 at 0.51509.

Strategy involves using 2% of your portfolio with 10x leverage.

Risk Management Tip: Adjust the Stop-Loss to the entry point after reaching TP1.

Stay ahead, stay informed, and most importantly, stay profitable.

‘til next time,

TradingLab