Good Morning!

Another day, another market shake-up. Tariffs, jobs data, Powell’s next move, and even a U.S. Bitcoin reserve—there’s no shortage of action, and as always, we’re ahead of the curve.

While Wall Street tries to make sense of Trump’s on-again, off-again trade policies, we’re focused on what actually matters: staying profitable no matter the chaos. Futures are rebounding, the Fed’s on deck, and Bitcoin just got a government-backed plot twist—all the makings of another wild session.

We’re breaking it all down so you can trade smarter, not harder.

Let’s get into it 👇

🔥 February Recap – Another Huge Month! 🔥

February was yet another massively profitable month for TradingLab! Our analysts crushed it, delivering a 78.79% win rate and an average gain of 18.61%! 📈💰

🚀 Standout Performances:

Bryce (Options): 76% win rate with a 41.88% avg gain 🔥

Mr. M (Stocks): 88.89% win rate and 13.16% avg gain 💎

Sherlock (Crypto): Insane 191.63% avg gain with an 89.47% win rate 🚀

Eve (Crypto): 71.43% win rate with 32.87% avg gain! 💰

I personally didn’t close any trades this month because there was too much uncertainty in the markets. In trading, it’s better to be out of the market wishing you were in, than in the market wishing you were out.

Even in volatile markets, our analysts continue to deliver consistent profits. If you’re following along, you already know why this is the best trading community out there. If you’re new here, it’s time to lock in and level up. 🔒📊

Let’s keep up the momentum into March! 💪📈

🌡 TradingLab’s Headline Roundup

Stock Markets

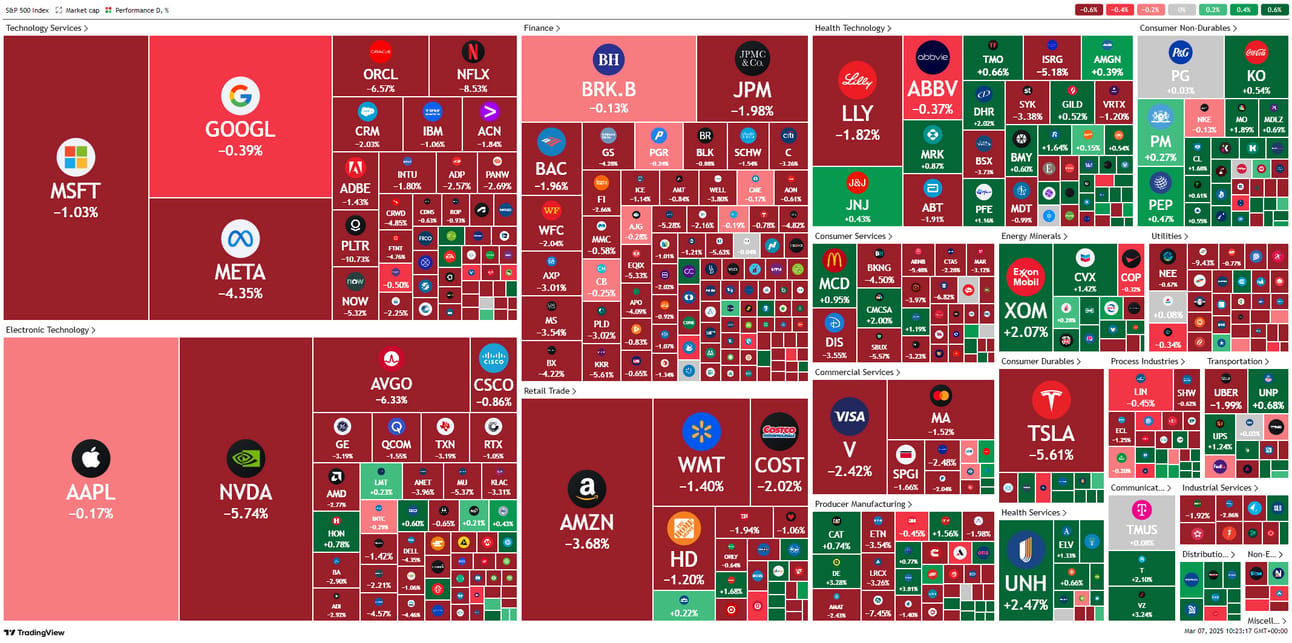

7th March, 2025

S&P 500 Stages Comeback After Trump Delays Auto Tariffs by One Month

Intuitive Machines Stock Craters 50% in Less than 24 Hours on Moon Troubles

Foot Locker Pops 5% Despite Missing Sales Estimates. It’s in the Guidance.

Crypto

Bitcoin Turns Up to Regain $93,000 as Traders Hope for Broad Tariff Reprieve

NFT trading volume has tumbled 63% since December

Trump Orders ‘Fort Knox’ Bitcoin Reserve and Digital Assets Stockpile

Tariffs Surge — This Tech Disruptor Moves Faster Than Global Shifts

Consumer electronics may have dodged the tariff bullet, but one smart home disruptor isn’t waiting for luck.

They’ve strategically secured production outside China, staying ahead of the global manufacturing shift.

That’s exactly how this company has hit 200% year-over-year growth while expanding into over 120 major retail locations.

Their smart shade technology is reshaping home automation, protected by patents and backed by powerful retail partnerships.

Smart investors spot the pattern: companies that turn global challenges into strategic wins often deliver the biggest returns.

At just $1.90 per share, you’re looking at a company that’s not just prepared for supply chain shifts — it’s already capitalizing on them.

Past performance is not indicative of future results. Email may contain forward-looking statements. See US Offering for details. Informational purposes only.

Upcoming Earnings

📅 Friday, 8th March

No Notable Earnings

📈 What’s Moving Markets Today?

🔄 Futures Attempt a Comeback Amid Tariff Turbulence

After yesterday's nosedive, U.S. stock futures are showing signs of life. As of 03:41 ET (08:41 GMT), Dow futures edged up 82 points (0.2%), S&P 500 futures rose 20 points (0.3%), and Nasdaq 100 futures climbed 100 points (0.5%). Investors are cautiously optimistic, keeping a close eye on President Trump's ever-evolving tariff strategy and the upcoming jobs report.

📌 Key Points:

Dow Futures: Up 0.2%

S&P 500 Futures: Gained 0.3%

Nasdaq 100 Futures: Increased by 0.5%

President Trump’s decision to delay tariffs on many goods failed to quell a stock market sell-off

🛑 Tariff Tango: Trump's On-Again, Off-Again Trade Moves

In a classic display of unpredictability, President Trump temporarily suspended tariffs on Canada and Mexico until April 2, reversing a decision made just days earlier. This whiplash has left investors scratching their heads, trying to decipher the administration's next move.

Trump insists that these decisions have "nothing to do with the market," but Wall Street isn’t so sure. The uncertainty has added fuel to market volatility, with investors struggling to make sense of an erratic trade policy.

📌 Highlights:

Tariff Suspension: Temporary halt on levies for Canada and Mexico until April 2

Market Reaction: Increased volatility and investor uncertainty

Presidential Stance: Trump insists his tariff decisions are independent of stock market movements

💼 Jobs Report on the Horizon: What to Expect

All eyes are on the upcoming U.S. jobs report, which is expected to show an increase of 156,000 nonfarm payrolls in February, up from 143,000 in January. Meanwhile, the unemployment rate is expected to hold steady at 4.0%.

These numbers could play a pivotal role in shaping the Federal Reserve's next move, especially as economic growth shows signs of cooling. A big miss could fuel speculation that the Fed might resume rate cuts later this year.

📌 Anticipated Figures:

Nonfarm Payrolls: Expected 156,000 increase

Unemployment Rate: Steady at 4.0%

Average Hourly Earnings: Growth expected at 0.3% month-over-month

🏦 Powell's Perspective: Fed Chair to Speak Post-Jobs Report

Right after the jobs report drops, Fed Chair Jerome Powell is set to speak, and you can bet Wall Street will be hanging onto every word. Powell’s take on the labor market and inflation could offer hints about future interest rate moves.

📌 What to Watch:

Monetary Policy Insights: Will Powell signal more rate cuts ahead?

Economic Outlook: Does the Fed still believe in a soft landing?

Inflation Considerations: Any concerns about wage growth stalling?

💰 Bitcoin Goes Mainstream: U.S. Establishes Crypto Reserve

In a move that’s sure to shake up the crypto world, President Trump signed an executive order establishing a U.S. Bitcoin reserve. This "digital Fort Knox" will be funded by Bitcoin seized in criminal and civil asset forfeitures, rather than taxpayer dollars.

The order also directs federal agencies to develop "budget-neutral" strategies to increase Bitcoin holdings. Whether this is a pro-crypto move or just another Trump flex remains to be seen, but Bitcoin markets reacted with cautious optimism.

📌 Crypto Highlights:

Reserve Composition: Funded with seized Bitcoin assets (roughly 200,000 BTC)

Government Stance: Major step toward mainstream acceptance of crypto

Market Reaction: Bitcoin saw slight fluctuations following the announcement

via @CGasparino on X

🎢 The Takeaway: Hold On Tight

Between tariff teeter-totters, pivotal economic data releases, and groundbreaking moves in the crypto space, the markets are anything but predictable. As always, stay informed, keep a diversified portfolio, and be prepared for the unexpected. Because in the world of investing, the only constant is change.

Stay ahead, stay informed, and most importantly, stay profitable.

‘til next time,

TradingLab