Good Morning!

Markets are treading water, waiting for today’s jobs report to dictate the Fed’s next move, but that’s not stopping the drama. Amazon just wiped out $90 billion in market cap after investors got cold feet over its cloud growth and AI spending. Meanwhile, Bitcoin is stuck, trade war fears are creeping back, and oil prices are wobbling.

It’s a market caught in limbo, but we’re here to make sense of it. Will the jobs report shake things up? Is Amazon’s AI binge worth the hype? Stick with us – we’ve got the breakdown you actually need.

Let’s get into it 👇

🌡 TradingLab’s Headline Roundup

Stock Markets

31st January, 2025

Amazon Stock Drops as Cloud Revenue, Low-Bar Guidance Weigh on Sentiment

Ralph Lauren Stock Back in Fashion as Luxury Brand’s Revenue Soars 11%

Trade War Between U.S. And China Could Weaken Eurozone Economy

Crypto

Stablecoin and memecoin frenzy drive Tron’s adoption

Sony's Soneium Releases First Music NFT Collection With Coop Records’ NUU$HI Drop

Solana’s SOL Could Hit $520 by 2025-End, VanEck Says

Phishing attackers target Phantom wallet users with fake update pop-ups

Commodities/Forex

Euro Consolidates Near $1.04 Ahead of Friday’s Nonfarm Payrolls. What’s Next?

USD/CAD to trend higher on the current situation

Gold prices ahead of NFP: Key factors driving market sentiment

Upcoming Earnings

📅 13 January

UnitedHealth Group Inc (UNH)

BlackRock Inc (BLK)

📅 14 January

Games Workshop Group PLC (GAW.L)

📅 15 January

Bank of New York Mellon Corp (BK)

Wells Fargo & Co (WFC)

JPMorgan Chase & Co (JPM)

Goldman Sachs Group Inc (GS)

Citigroup Inc (C)

📈 What’s Moving The Markets?

😐 Futures Are Flat – Investors Playing the Waiting Game

Wall Street futures barely budged this morning as traders braced for what could be a market-moving jobs report. Here’s where things stood pre-market:

Dow futures: Flat.

S&P 500 futures: Down 0.1%.

Nasdaq 100 futures: Also down 0.1%.

Why the lack of excitement? Simple. The jobs report is one of the biggest pieces of data the Federal Reserve watches when deciding whether to cut rates. A hotter-than-expected number could push rate cuts further down the road, while a weak number might give the Fed a reason to loosen policy sooner rather than later.

Meanwhile, stock-specific action kept things lively:

Eli Lilly (NYSE: LLY) flexed as demand for its weight-loss drugs stayed strong.

Tapestry (NYSE: TPR), the parent of Coach, soared 12% after raising its profit outlook.

Honeywell (NASDAQ: HON), however, got slapped, falling after announcing a corporate breakup that left investors scratching their heads.

👀 All Eyes on Jobs Report – Will the Fed Blink?

Traders are fixated on one thing today: the January jobs report. Here’s what economists are expecting:

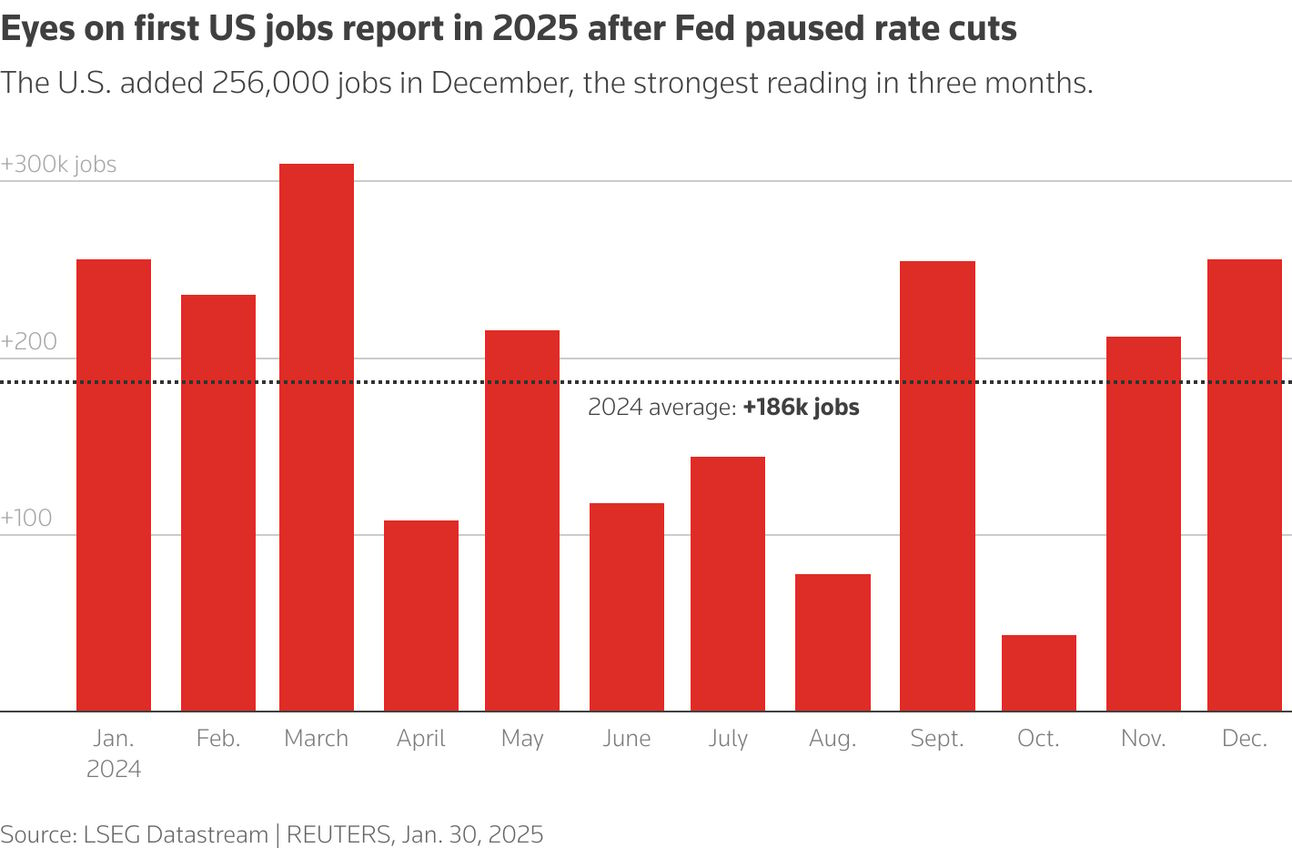

169,000 new jobs added (down from 256,000 in December).

Unemployment rate holding steady at 4.1%.

Wage growth slowing slightly to 0.3% month-over-month.

Why does this matter? The Fed has made it clear: if the labor market stays hot, don’t expect rate cuts anytime soon. But if hiring slows, markets could get the green light for lower rates sooner rather than later. Earlier data this week showed private payrolls growing but job openings slipping, suggesting a gradual cooling in the labor market rather than a hard stop.

Bottom line? A weak report could send stocks higher, while a strong report might slam the brakes on the recent rally.

🚨 Amazon’s Cloud Problem – Investors Hit the Sell Button

Amazon (NASDAQ: AMZN) saw its stock take a 5% dive in after-hours trading, erasing a cool $90 billion in market value. What went wrong?

Amazon Web Services (AWS) revenue grew 19% to $28.79 billion, slightly below expectations ($28.87 billion).

Q1 sales forecast of $151B-$155B came in weaker than analysts' $158B estimate.

AI spending is through the roof, with Amazon planning to drop over $100 billion on AI infrastructure this year, up from $78 billion last year.

This continues a broader AI spending arms race in Big Tech, and investors are starting to wonder: are these massive investments actually going to pay off? Especially with Chinese startups like DeepSeek rolling out low-cost AI models, the race to dominate AI might not be as easy (or profitable) as once thought.

💰 Bitcoin Slips as Risk Appetite Cools

Bitcoin has been stuck in a rut lately, and today’s 1.3% dip to $96,933 isn’t helping the case for a breakout.

What’s going on?

Global trade tensions are heating up, with President Trump announcing new tariffs.

Investors are playing defense, waiting for clearer signals on Fed policy and economic growth.

Bitcoin’s been trading in a tight range, meaning there’s no strong momentum in either direction.

For now, crypto bulls are waiting for a catalyst, whether it’s a dovish Fed or a regulatory breakthrough. Until then, expect more sideways action.

🚀 Final Thoughts – Waiting for a Catalyst

The market’s in limbo right now, waiting for the next big move. Today’s jobs report could be the trigger, but investors are also dealing with Big Tech drama, trade war headlines, and a murky Fed outlook.

For now, keep an eye on:

The jobs report reaction – Will the Fed shift its stance?

Amazon’s stock move – Will it drag tech lower?

Bitcoin’s next move – Can it break out or will it keep grinding sideways?

Oil price swings – Will trade war fears push it lower?

Whatever happens next, one thing’s for sure: volatility isn’t dead yet.

Stay ahead, stay informed, and most importantly, stay profitable.

‘til next time,

TradingLab