Good Morning!

Welcome to today’s edition. We’re diving into the latest market moves, from Nvidia’s big moment and LEGO’s surprise profit surge, to Tesla’s ongoing debate. Plus, Sherlock’s making a bold play on Bitcoin, which you’ll want to check out.

Let’s get into it 👇

More than 300 million people use AI, but less than 0.03% use it to build investing strategies. And you are probably one of them.

It’s high time we change that. And you have nothing to lose – not even a single $$

Rated at 9.8/10, this masterclass will teach how you to:

Do market trend analysis & projections with AI in seconds

Solve complex problems, research 10x faster & make your simpler & easier

Generate intensive financial reports with AI in less than 5 minutes

Build AI assistants & custom bots in minutes

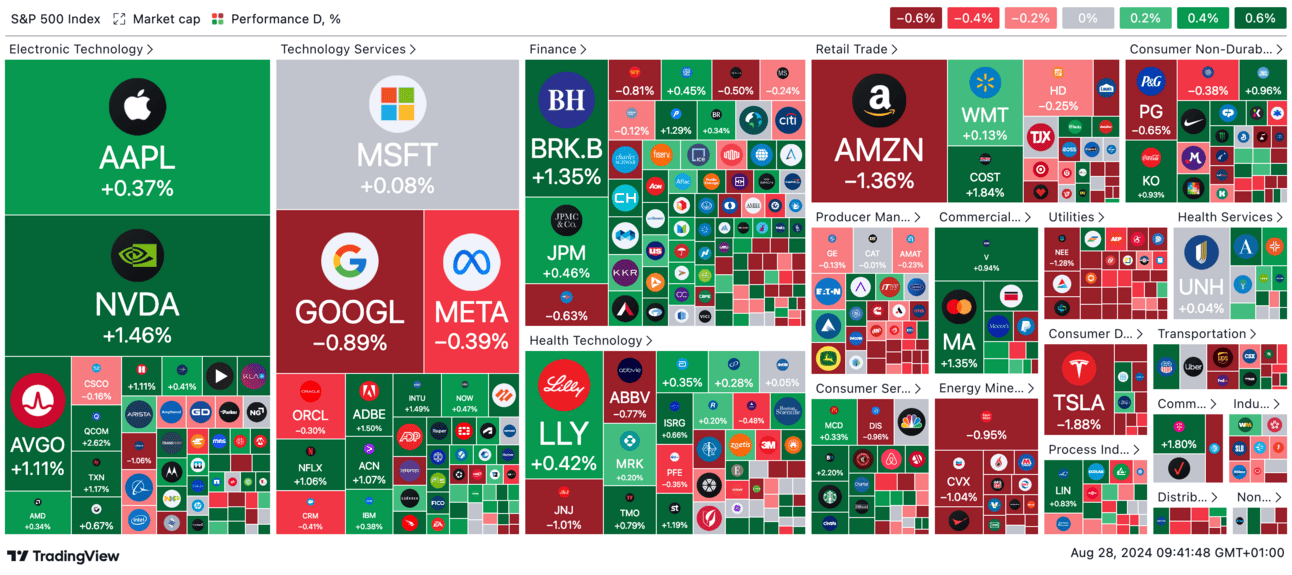

🌡 Market Temperature Check

📈 US Markets lifted by Nvidia shares

The S&P 500 inched up on Tuesday as all eyes turned to Nvidia's upcoming earnings report. Nvidia, a major player in AI, saw its shares rise 1.5% ahead of the report, signaling its crucial role in tech market trends. Baird analyst Ross Mayfield noted that the market is in a "wait-and-see" mode, with Nvidia potentially influencing a shift back to tech.

Quick Links

🤖 Nvidia has become world’s ‘most important stock’

Nvidia investors have enjoyed a wild ride, but recent volatility has them on edge as the company prepares to report earnings Wednesday. Wall Street is closely watching for any signs of waning AI demand or spending cuts from major cloud customers, which could hit revenue hard.

🧱 LEGO sales and profits skyrocket in the first half of 2024

LEGO Group's sales and profits soared in the first half of 2024, far surpassing its performance from the same period in 2023, sending the stock higher.

🔋 Tesla: Buy, Sell, or Hold?

Tesla's stock, down 10% this year, remains a hot topic among investors. Here are three key factors to consider before deciding whether to buy, sell, or hold.

💰 Why you shouldn't invest like a billionaire

Many firms promise middle-class investors access to ultra-wealthy strategies, but here's the catch: these strategies are terrible for normal investors.

📈 What I’m Trading

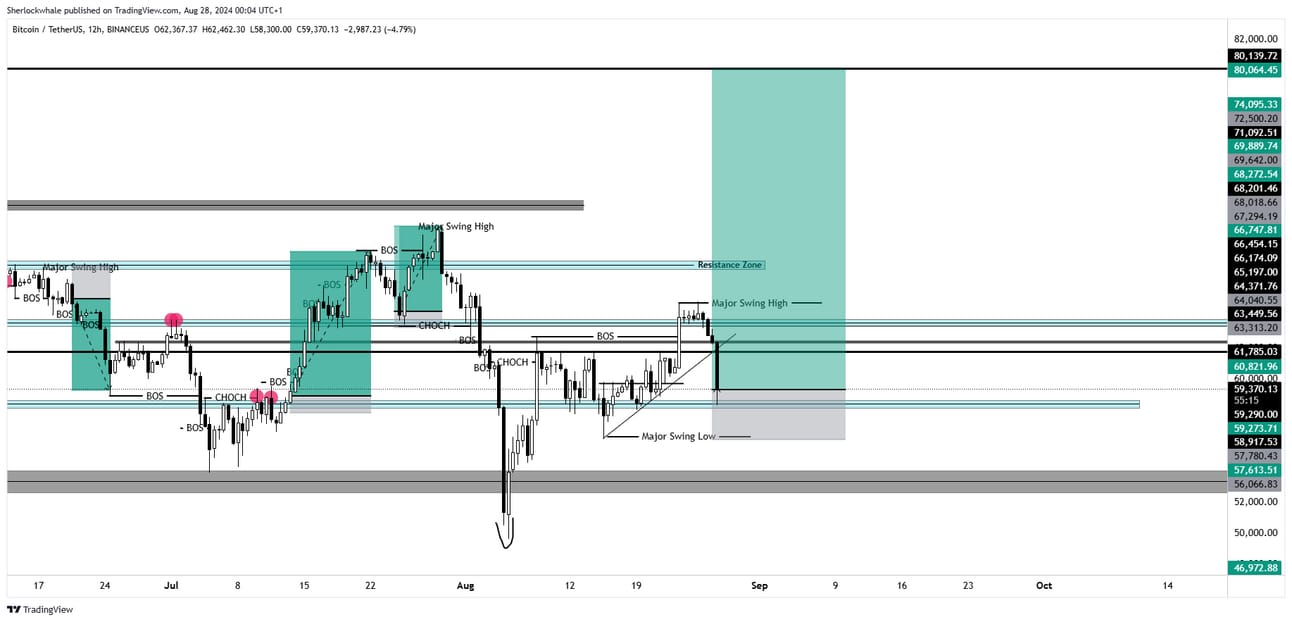

The Play: $BTC Long (Risky)

Sherlock has been ringing alarm bells in our TradingLab community about not buying Bitcoin just yet, and good job to those who listened, because yesterday Crypto prices dropped sharply.

Now he's finally making a move. The plan is simple, but it’s not for the faint-hearted. Here’s how he’s playing it:

Entries: Market (59,260) - $58,000 - $56,900

Stoploss: 1D Close Below $56,000

Targets: $62,000 - $65,000 - $67,500 - $70,000 - $73,000 - $77,000

Sherlock is eyeing a high-risk, high-reward scenario. It’s a knife-catching manoeuvre, But if this thing moves, it's going to fly. You might miss out on what could be a rare and explosive opportunity.

The Catalyst: Bitcoin’s Sharp Dive

August hasn’t been kind to Bitcoin. After starting the month at $65,000, it’s now limping around $59,000, dragging its tail between its legs with a 9% loss. And it’s not alone—Ethereum’s taking even more heat with a 10% drop, barely hanging onto $2,500. The crypto market is in a rough patch, with Bitcoin erasing monthly gains and adding to its string of volatile swings.

Sherlock isn’t waiting for lower timeframe confirmation. Why? Because this could be one of those rare chances where you catch the bottom of the dip before everyone else realizes what’s happening. The trendline’s been breached, and the market’s in panic mode, but that’s exactly where the opportunity lies.

Our Take:

So why are we backing this risky move? Simple: the trendline break has flushed out the weak hands, and now the market is ripe for a bounce. The TA on the chart shows strong historical support around $56,000-$58,000, which aligns with Sherlock’s entry zones. If Bitcoin bounces here, the upside is huge, and we’re targeting as high as $77,000.

Yes, it’s risky. Yes, it’s bold. But that’s how you play the game if you want to win big. Missing this could mean missing out on the next leg up, and no one wants to be the one who hesitated when the opportunity was right in front of them.

Sherlock’s got his eye on the charts, ready to adjust his position as the market evolves. If you want to stay in the loop and catch these moves as they happen, check out our community.

‘til next time,

TradingLab