Good Morning!

From Reddit's stock soaring 38% to an unexpected surge in Dogecoin's price, we're covering the big plays and the even bigger players. And let's not forget Apple's recent antitrust turmoil wiping out over $100 billion in value.

In this edition, we're zeroing in on two explosive opportunities: our bet on $VIRTUAL, a crypto game-changer in the AI and gaming arena, and the remarkable dividend rise of Blue Owl Capital ($OWL). Think high risk, high reward, and even higher excitement.

Strap in and keep your eyes peeled; you're about to discover why these aren't your average market plays.

Let’s get into it 👇

🌡 Market Temperature Check

👾 Crypto Catalyst

Betting on AI and Gaming

The Play:

Recently, I made a bold move, scooping up $15,000 worth of $VIRTUAL at $0.0061 per coin. Before you raise your eyebrows, let me tell you, this is not your ordinary, run-of-the-mill play. We're talking about a somewhat risky but potentially high-reward, long-term investment. $VIRTUAL isn't just any coin; it's a rising star in the gaming and AI sector, a niche that's been on fire lately. And guess what? They're not playing small; they're already cozying up with tech giants like Nvidia and have bagged a cool $6.5 million in funding. Keep your eyes peeled; we might just witness this coin do a spectacular 10-20x leap.

VIRTUAL/WETH on dexscreener.com

The Catalyst:

Why $VIRTUAL, you ask? The Virtual protocol is a groundbreaking decentralized hub for creating versatile AI entities. These aren't your average bots; they're designed for text, voice, and motion responses, perfectly fitting into various virtual environments like games or online platforms. The real kicker? Their main goal is to churn out and market these AI personas in ways that benefit everyone. Imagine AI sales agents with a jaw-dropping 90% success rate in closing deals! This isn't just a run-of-the-mill coin; it's poised to be a revolution in the AI and gaming industry.

Our Take:

Now, let's cut to the chase. Why am I betting on $VIRTUAL? Simply put, it's the perfect blend of innovation, partnership potential, and market trend alignment. Partnering with big names like Nvidia isn't just a vanity metric; it's a testament to their technological prowess and industry recognition. Plus, with the AI market booming, particularly in gaming and interactive environments, $VIRTUAL is strategically positioned to reap the benefits.

But, let's not sugarcoat it – this is a high-risk play. That's why it's crucial to invest only what you can afford to lose. Ready to take the plunge? Here's how:

Transfer some ETH into your wallet (I used Coinbase for this), head to Uniswap on your computer or through the Coinbase wallet's browser, and swap your ETH for $VIRTUAL. When it's time to cash out, just reverse the process. Simple!

If you don't want to miss out on real-time updates like this one as soon as they’re announced, make sure to join our private Discord server 👇.

Oh Sh*t You’re a Grown Up

Life comes at you fast. Suddenly you’re being quizzed on things like 529 plans and backdoor Roth IRAs. It’s time to step up and be responsible with your money and financial goals. But unlike 2 AM feeds - you don’t have to be in this alone.

Advisor.com lets you compare expert financial advisors and select a vetted fiduciary to handle your investing. They evaluate credentials, client reviews, and an advisor’s overall experience to make sure you are in good hands.

📈 Stock Catalyst

Blue Owl Capital's Dividend Surge

The Play:

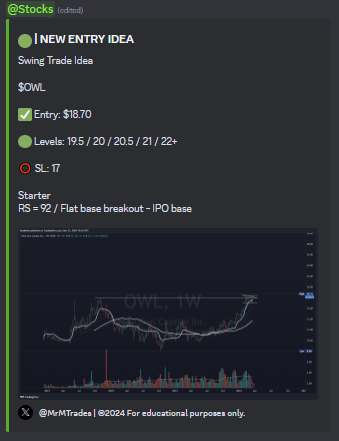

Blue Owl Capital ($OWL):

Entry Point: $18.70

Profit Levels: $19.50, $20.00, $20.50, $21.00, $22.00+

Stop Loss: $17.00

Technical Indicator: RS (Relative Strength) at 92, indicating a flat base breakout.

Mr M’s call in our exclusive trading community 🤫

The Catalyst:

Blue Owl Capital ($OWL), a juggernaut in asset management with a whopping $165.7 billion in assets, just threw a curveball that's got the market listening.

Since its inception in May 2021, Blue Owl has been on a tear, beefing up its portfolio through savvy acquisitions. But here's the kicker: they've announced a dividend hike that's nothing short of impressive. In 2023, they cranked up their annual dividend by a hefty 22% to 56 cents. Not resting on their laurels, they're ramping it up even further with a 29% increase to 72 cents for 2024. And for those who like to look ahead, they're eyeing a $1 dividend by 2025. Talk about putting your money where your mouth is!

Our Take:

At TradingLab, we don't just throw darts at a board and hope for the best. We crunch the numbers, read the tea leaves, and listen to the whispers of the market. And right now, those whispers are all about $OWL. Mr. M's play isn't just a random pick; it's a calculated move on a stock that's showing all the signs of a bull ready to charge. The dividend boost isn't just good news; it's a neon sign pointing to a company that's not only growing but is confident about its future. That's why we're tagging this as a solid buy.

In the wild world of trading, there's never a guarantee. But with an RS of 92 and a textbook flat base breakout, $OWL isn't just knocking; it's kicking down the door. The entry point and profit levels outlined by Mr. M are your road map to potential gains.

A texbook breakout setup

Not part of the TradingLab community yet? Don't just watch from the sidelines. Join the action and get insights like this daily. Remember, in the market, fortune favors the bold - and the informed. Let's trade smart.

✍ TL;DR

Brief TL;DR of the newsletter, plays and market news.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Stay ahead, stay informed, and most importantly, stay profitable.

‘til next time,

TradingLab