Good Morning!

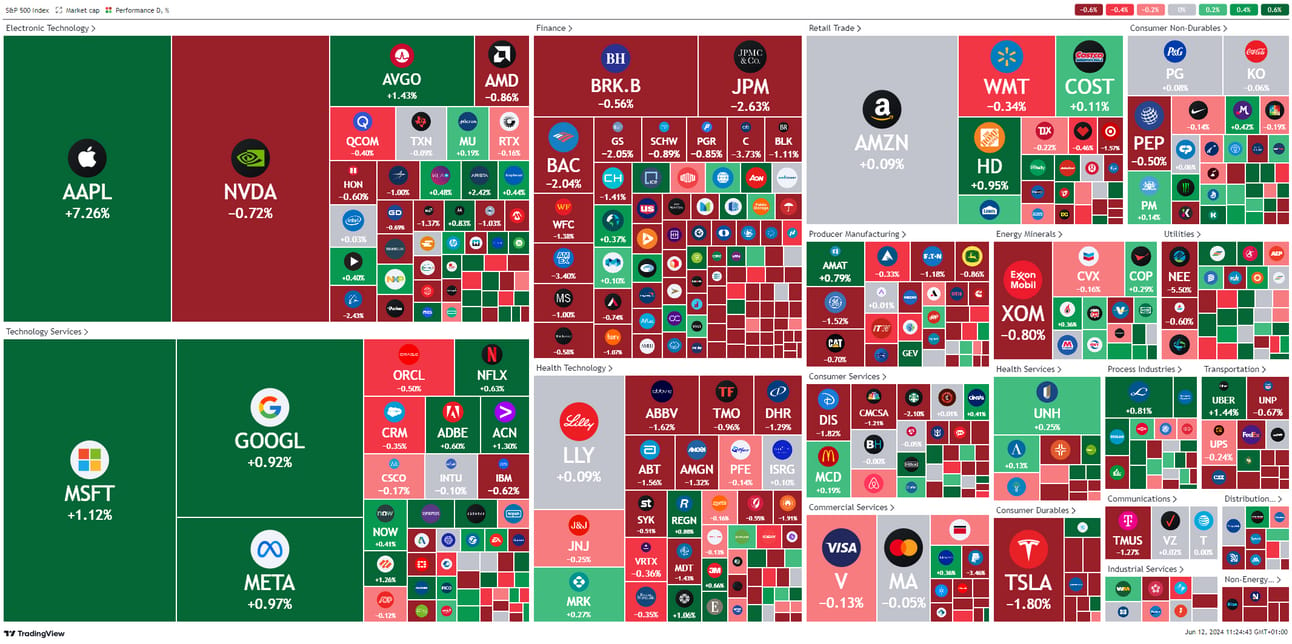

The S&P 500 and Nasdaq are hitting new heights, a crypto downturn has wiped out $190M in leveraged positions, and the EU has slapped up to 38% tariffs on Chinese EVs, setting the stage for market volatility. Meanwhile, Apple's latest AI push sent its shares to a record $207.15. With smarter Siri, productivity tools, and fun emojis, Apple's innovation is driving a wave of device upgrades, marking a strategic play with potentially huge market implications.

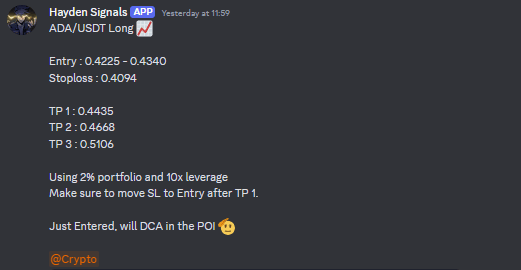

Our analyst Hayden has spotted a golden opportunity in Cardano's ADA/USDT pair, poised for gains with the upcoming Voltaire upgrade. With a strong support base and upcoming governance enhancements, this trade is set to capitalize on Cardano's technological advancements.

Let’s get into it 👇

🌡 Market Temperature Check

📰 What’s Happening Today?

Apple’s AI Power Move

Apple just dropped a bombshell in the tech world, and the market is buzzing. At its annual developer conference, the tech giant finally unveiled its long-awaited push into artificial intelligence (AI). The move sent Apple’s shares soaring to a new record high, closing at $207.15 on Tuesday. This article dives into what this means for investors and why you should care.

The AI Unveil: What’s New?

Apple didn’t hold back during its reveal, showcasing a range of AI features that promise to revolutionize user experience:

Overhaul of Siri: The voice assistant is getting smarter, more intuitive, and deeply integrated with OpenAI’s ChatGPT, making it more conversational and helpful.

Writing Assistance Tools: New tools aimed at enhancing productivity, perfect for drafting emails, documents, and more with ease.

Customizable Emojis: Adding a fun, personal touch to messaging, making communication more expressive.

These tools are pitched as AI for the average person, but there's a catch—users will need to upgrade to newer models to access these features. This strategic move is expected to drive a significant wave of device upgrades, boosting Apple’s hardware sales.

Market Reaction: Stocks Soar

Apple’s stock didn’t just rise; it skyrocketed. Here’s a quick rundown of the market impact:

Shares hit an all-time high: Apple closed at $207.15 per share, up 7% on the day of the announcement. You can read more about this in Apple's official preview.

Best-performing stock: It outperformed all other stocks on the major market indexes, popping about 6% and surpassing the $200 per share mark. CNBC covered this surge in detail here.

Record-breaking: The new share price bested Apple’s previous high from December 14, marking a historic moment for the company and its investors. For more insights, check out the QZ article.

Investors had been eagerly waiting for Apple to make its mark in the AI boom, and the company’s comprehensive AI strategy has clearly resonated with the market.

Privacy First: Apple’s Commitment

While diving headfirst into AI, Apple CEO Tim Cook made it clear that the company is not compromising on user privacy. This stance comes at a crucial time when OpenAI has faced criticism for not adequately protecting user data. Apple’s approach ensures that their AI tools are both cutting-edge and secure, a dual promise that reassures users and investors alike.

Privacy assurance: Apple’s AI tools are designed with user privacy in mind, setting them apart from competitors.

Market confidence: This commitment to privacy likely contributed to the positive market response, as investors trust Apple to handle sensitive data responsibly.

Apple’s innovation engine seems like it’s running at full throttle, and there’s plenty of potential for future growth.

📈 What I’m Trading

Why Cardano's Voltaire Upgrade Makes ADA/USDT a Must-Trade

The Play

Hayden, one of our ace analysts at TradingLab, has just unveiled a promising trade in the ADA/USDT pair. Here's the scoop on his move:

Entry: 0.4225 - 0.4340

Stoploss: 0.4094

Take Profit 1 (TP1): 0.4435

Take Profit 2 (TP2): 0.4668

Take Profit 3 (TP3): 0.5106

Leverage: 10x

Portfolio Allocation: 2%

Hayden advises entering the trade now and DCA (Dollar Cost Averaging) into an entry. Remember to shift your stop loss to the entry point after hitting the first take profit target to lock in those gains.

The Catalyst

Cardano is gearing up for a significant upgrade. According to co-founder Charles Hoskinson, the network is on track for its Voltaire upgrade this month. The much-anticipated Chang fork is ready, and the team is awaiting 70% of the operators to install the new node.

This upgrade is expected to bring enhanced governance features to the Cardano network, positioning it for greater decentralization and operational efficiency. The market is likely to react positively as these developments unfold, providing the perfect backdrop for Sherlock's ADA/USDT long trade.

Our Take

Why is this trade a buy? Let's break it down with some technical analysis on his chart.

The ADA/USDT pair has been consolidating around the support zone of 0.4225 - 0.4340, making it an ideal entry point. The price is hovering above a critical support level, indicating a strong base. The POI marks a potential accumulation zone where buying pressure might intensify, driving the price upward.

Hayden’s first take profit at 0.4435 is a conservative target, just above recent resistance levels. The subsequent targets at 0.4668 and 0.5106 are positioned at significant resistance levels, indicating potential breakout points if bullish momentum sustains.

Considering the upcoming Voltaire upgrade, market sentiment is poised to turn bullish, aligning perfectly with our technical setup. This trade is set up to capitalize on the anticipated price surge due to Cardano's technological advancements.

✍ TL;DR

Apple AI Story:

AI Unveil: Apple launches new AI features, boosting productivity and user experience.

Market Reaction: Shares hit a record $207.15, soaring 7% post-announcement.

Privacy Focus: Apple's AI tools prioritize user privacy, enhancing market confidence.

ADA/USDT Trade:

Trade Details:

Entry: 0.4225 - 0.4340

Stoploss: 0.4094

Take Profits: 0.4435, 0.4668, 0.5106

Leverage: 10x

Portfolio Allocation: 2%

Catalyst: Cardano’s upcoming Voltaire upgrade promises enhanced governance and operational efficiency.

Technical Analysis: Strong support base and bullish sentiment align for potential gains.

Stay ahead, stay informed, and most importantly, stay profitable.

‘til next time,

TradingLab